Today was one of the most important days of the month for cryptocurrency investors. The US inflation data has finally been announced. Bitcoin price and cryptocurrencies in general have been closely following the decisions of the Fed since the beginning of 2022. The period of tight monetary policy implemented has shaken the risk markets since last year.

In this article, we will discuss why Fed decisions are important for cryptocurrencies and the impact of inflation data on Fed decisions. However, before examining the recently released inflation data, we will delve into the details of the June inflation report. All of this is important for us to understand the Fed’s roadmap on September 20th and beyond.

Why are Fed Decisions Important for Cryptocurrencies?

Fed’s policies are divided into expansionary and tight. What we have experienced for the past 1.5 years has been the tightening of monetary policy with interest rate hikes. The aid distributed during the pandemic and the printed piles of dollars have triggered a significant period of inflation, so the Fed started raising interest rates.

Interest rate hikes restrict access to cash, thus curbing demand inflation. At the same time, the end of the era of abundant money also led to US citizens’ escape from high-risk assets. This was the reason for the decline in the stock market and cryptocurrencies. Apart from the unique problems of cryptocurrencies, interest rate hikes are the fundamental trigger of bear markets.

Now, the Fed has brought interest rates to a “tightening” point. Further increases of 25bp can be made in the future, but the current situation with an interest rate well above inflation will make it possible to achieve the 2% inflation target in the long run.

Since Fed policies directly affect the money supply for cryptocurrencies, Fed decisions have a direct impact on cryptocurrencies. Therefore, Fed is extremely important for cryptocurrencies.

July Inflation Report

Before delving into the expectations regarding the interest rate decision that the Fed will make on September 20th and the details of the recently announced July inflation data, we should look at something else. Of course, the first thing we will focus on is the inflation data from last month, June. Every month, the data for the previous month is announced, and the situation of inflation is reported with a delay.

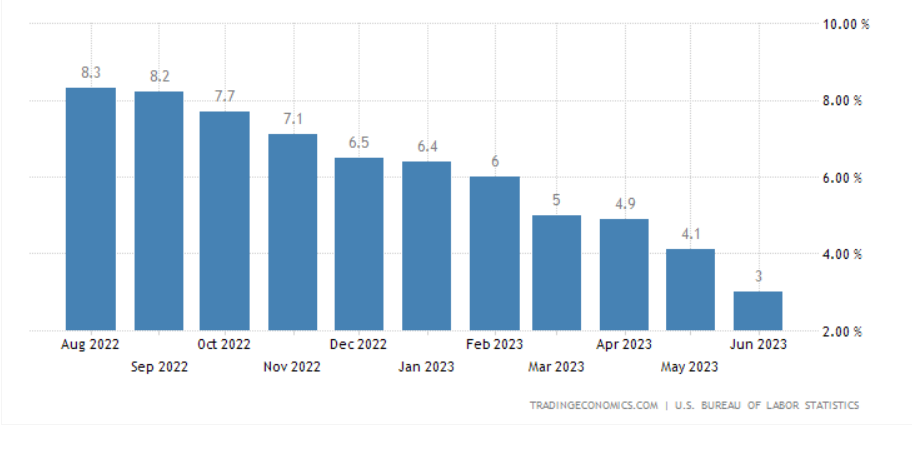

In the June report, the US inflation increased by 3% (annual). The housing index made the biggest contribution to the increase in all items on a monthly basis. The increase in motor vehicle insurance index represented a significant share of the total inflation increase. While the in-home food index remained unchanged throughout the month, the out-of-home food index increased.

The index for all items excluding food and energy showed the lowest increase in the last month with 0.2%. It was the lowest increase since August 2021. Among the indexes that increased in June, housing, motor vehicle insurance, clothing, entertainment, and personal care expenses were at the forefront. On the other hand, communication, used cars and trucks, and household goods were among the items supporting the decline.

After a 3.6% decrease in the energy index in May, it increased by 0.6% in June. In June, the 1.0% increase was remarkable after a 5.6% decrease in the previous month.

US Inflation Data

The data was just announced, and we were expecting to see the first increase in the inflation data. The inflation rate was 3.3% compared to the expected 3% we mentioned earlier. This situation also worried cryptocurrency investors, and we saw that prices started to decline as of yesterday.

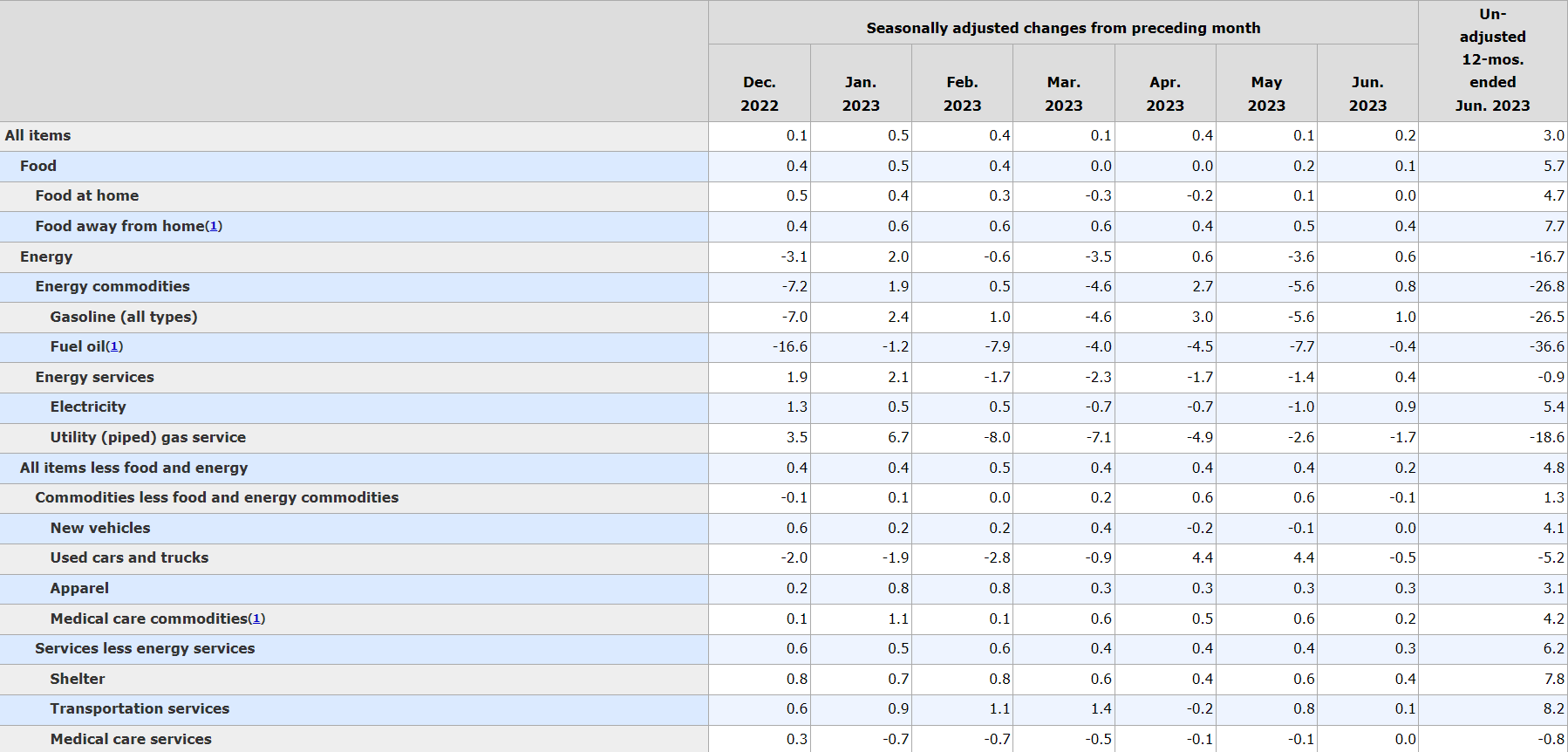

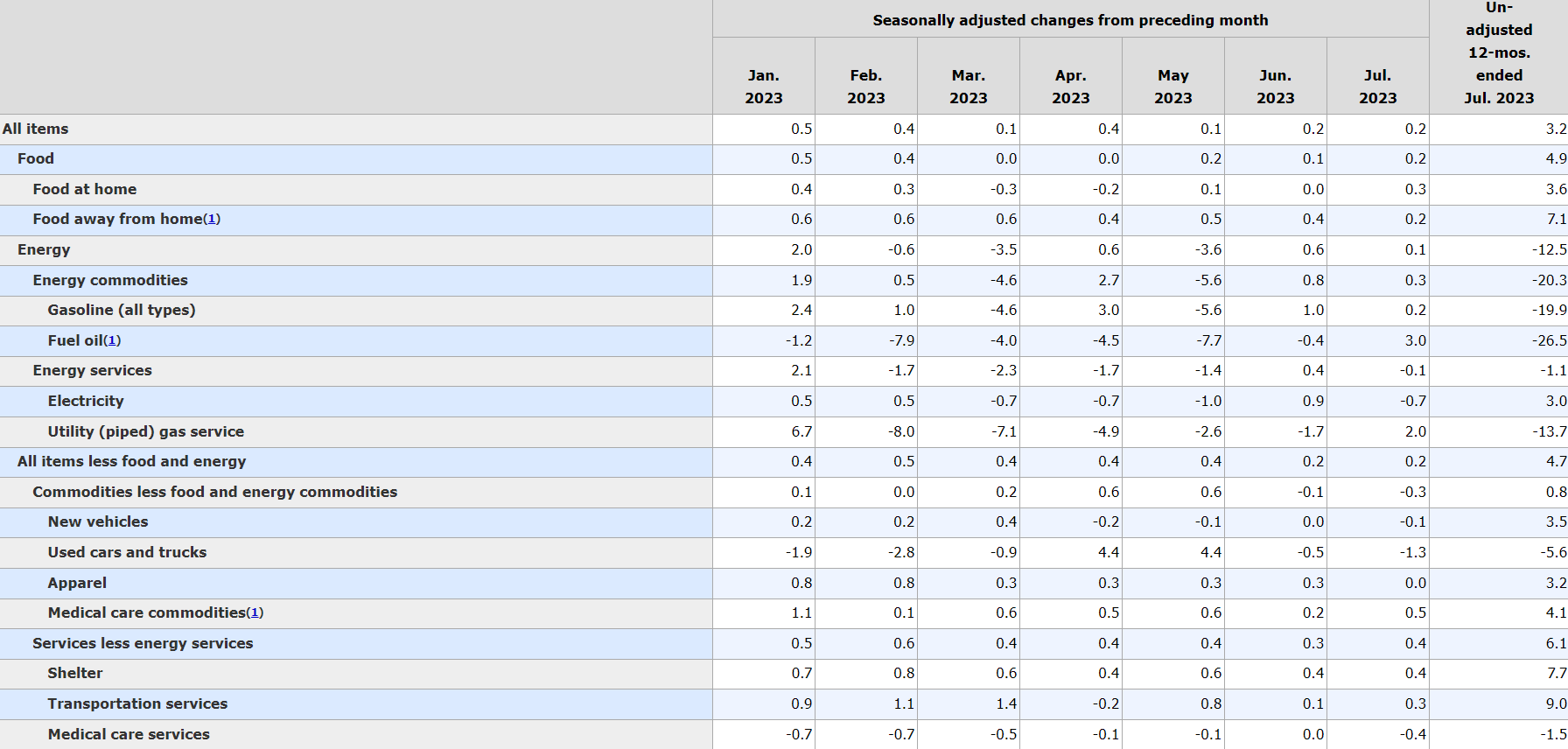

The inflation data was reported as 3.2% annually. The core CPI was 4.7%. The initial claims data came in at 231K, almost in line with expectations. The housing index was the item that made the biggest contribution to the increase in all items on a monthly basis, accounting for over 90% of the increase, and the motor vehicle insurance index also supported the increase, just like last month.

While the in-home food index increased by 0.3% compared to the previous month, the out-of-home food index increased by 0.2% in July. The energy index increased by 0.1% in July due to the impact of the main energy sectors.

As you can see from the table above, fuel prices reversed their long-standing decline. Fuel prices increased by 3%, and they have fallen by a total of 26.5% in the past 12 months. Used cars and trucks have been supporting the decline for two months and have decreased by 5.6% in the past 12 months.

September 20th Fed Interest Rate Decision

There will be no Fed meeting in August. Although the Jackson Hole meeting at the end of the month is critical, the next Fed meeting will be on September 20th. The recent data was not surprising due to the ongoing increase in energy prices. However, it is also likely that the Fed will comment on the “temporary” increase in the latest inflation data. Naturally, the Fed will not consider a 50bp increase based on this inflation data. The hawkish members’ view is towards a 25bp increase, despite the risk of excessive tightening, to ensure that inflation is definitively brought under control.

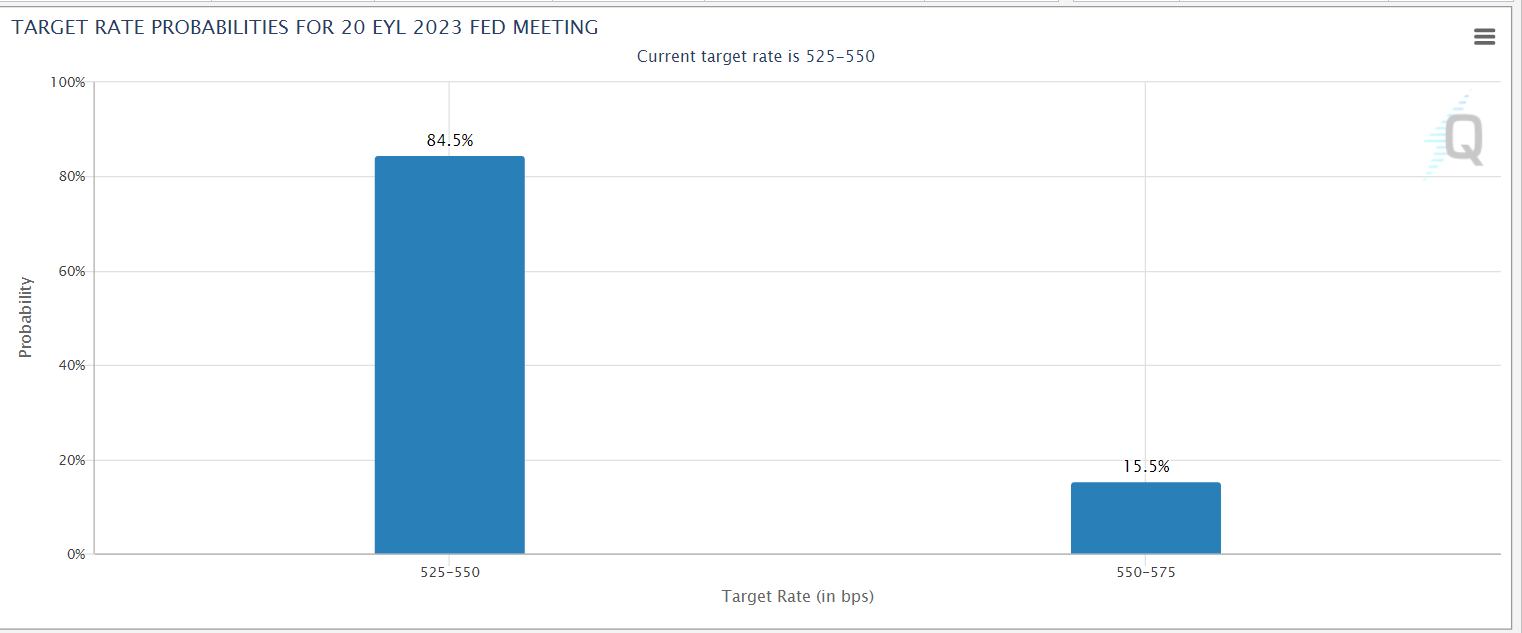

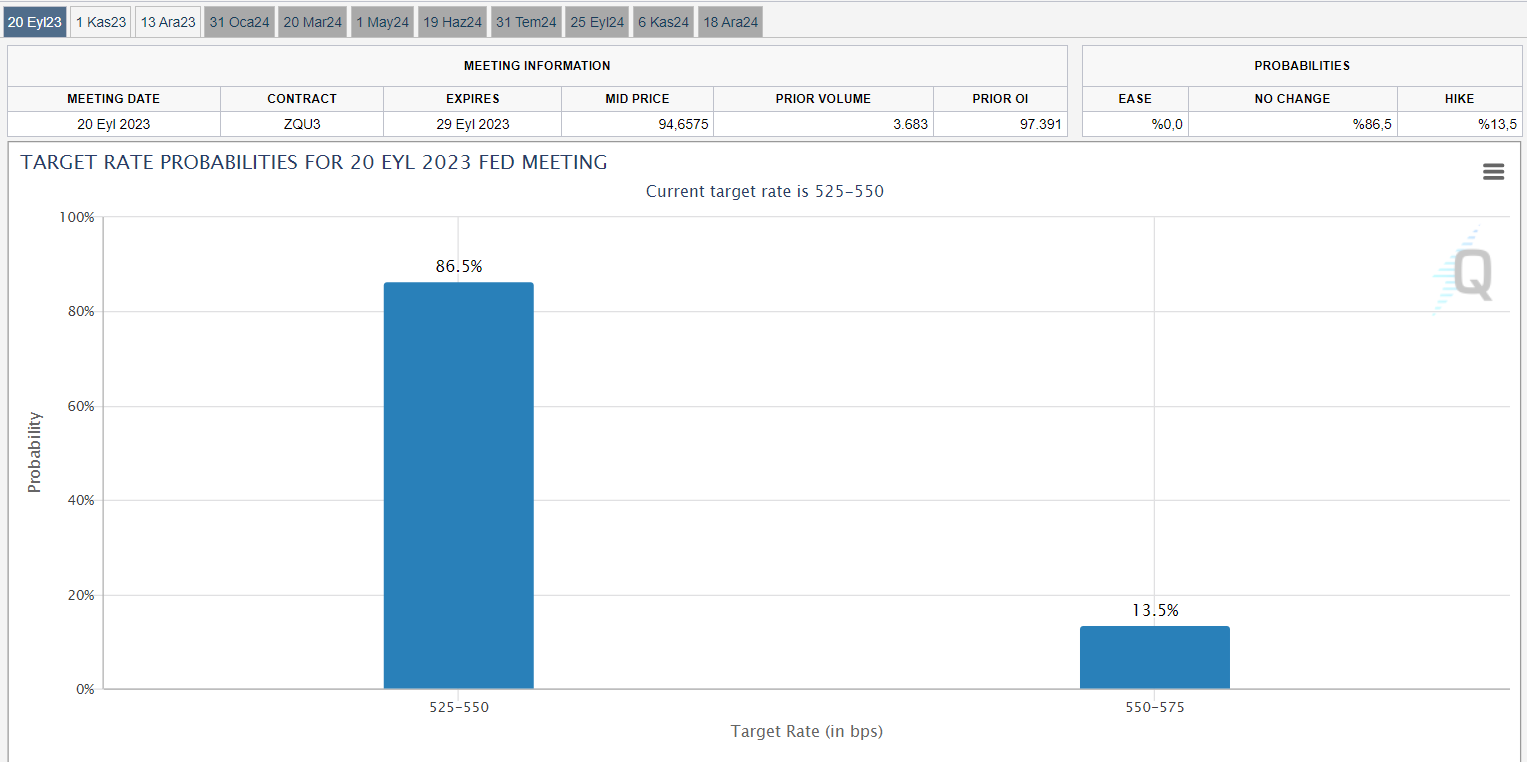

Half an hour before the inflation data, FedWatch said that there was an 84.5% chance that interest rates would remain unchanged at the September meeting.

After the inflation data was announced, it became as follows.

According to this, the probability of interest rates remaining unchanged has increased with the latest data. The Fed may mention the transitory nature of the inflation rise supported by the increase in fuel prices. If they do not expect a medium-term decrease in energy prices, a 25bp increase may cause larger losses for cryptocurrencies. The comments that Fed members will make in the coming days regarding the latest data have the power to increase volatility in both directions in the cryptocurrency markets.

If the Bitcoin price cannot reclaim the critical threshold of $29,952 permanently, there is a possibility of a further decline to $28,500.