The price of Bitcoin is currently at $27,400. On October 5, the price exceeded $28,000 but then dropped again. Despite this volatility, investors have not completely lost hope. So why can’t the BTC price continue to rise?

Why Are Cryptocurrencies Not Rising?

At the beginning of the week, the BTC price climbed to $28,600 with an increase of over 5%. However, when the Ether Futures ETF closed with a laughable $2 million volume on its launch day, sentiment reversed. This actually showed how weak risk appetite is in the markets. Could the same thing happen if the BTC ETF is approved? Investors are starting to ask this question.

There are three main reasons why prices are struggling to recover.

Macroeconomy

Barr from the Fed stated on October 2 that he expected a slowdown in the economy due to high interest rates. He also emphasized that the effects of the current policy have not yet been fully felt.

Following the statements of many other members, the expectation of a lower interest rate increase on November 1 surged rapidly. On October 3, the real yield of US 10-year Treasury bonds adjusted for inflation reached approximately 15-year high at 2.47%. This development led to the US Dollar Index (DXY) reaching its highest level in 10 months.

Volumes

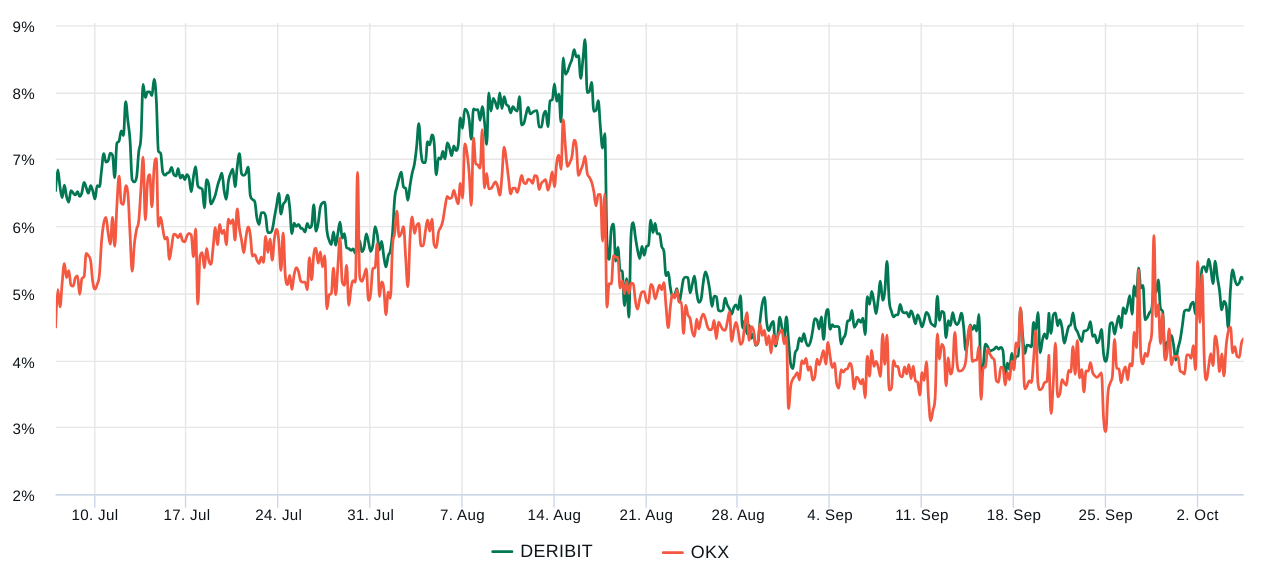

Monthly Bitcoin futures contracts usually trade at a slight premium compared to spot markets, indicating that sellers ask for more money to delay settlement. As a result, BTC futures contracts typically trade with an annual premium of 5-10%. This situation is true for other markets as well and is known as contango.

The BTC futures premium continues to trade below the 5% neutral threshold and is trending towards a decline. This situation indicates a lack of demand in the futures market.

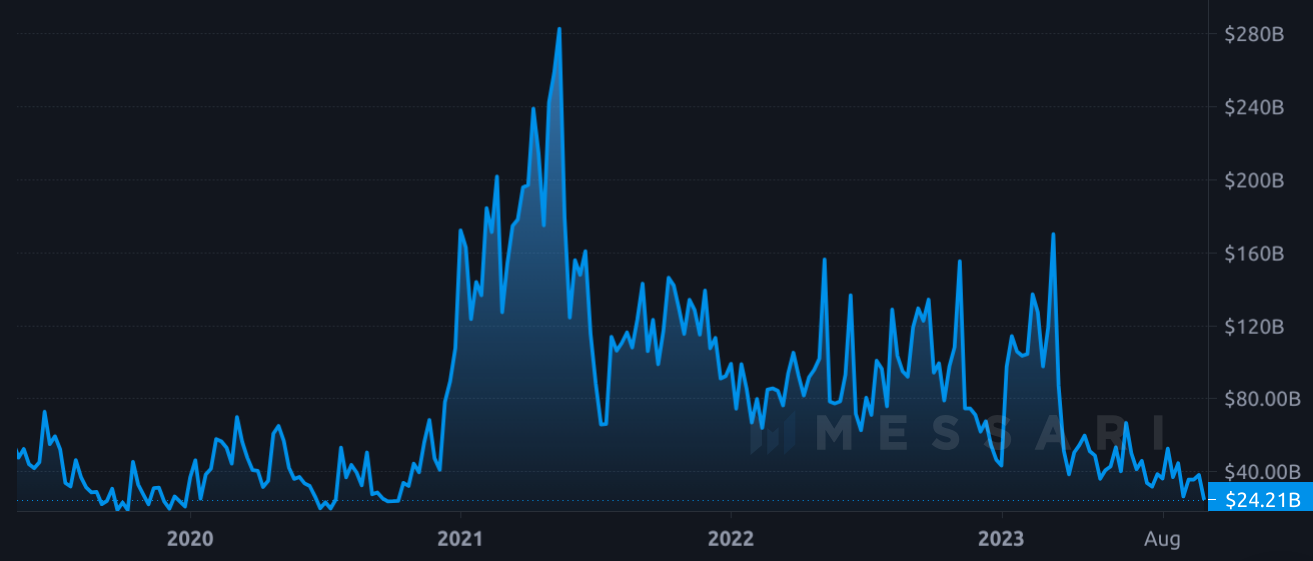

On the other hand, spot market volumes have declined to 2020 lows. US-based major market makers like Jane Street Group and Jump Trading started to exit the market before May, causing volumes to shrink. When you look at the monthly chart and examine the volume power, you can clearly see this.

Market makers have stated that they have withdrawn from the market due to regulatory uncertainty, but rumors about Jump being involved in some shady deals have been circulating on social media for a long time.

Spot Bitcoin ETF

One of the factors supporting Bitcoin’s 68% gain in 2023 was the expectation that a spot Bitcoin ETF would be approved by the US Securities and Exchange Commission. However, with the recent delays, the idea that spot ETF approval will not be given in 2023 has gained acceptance.

On the other hand, the volumes of ETH ETF were a complete disappointment on Monday. From a broader perspective, this indifference can continue even if the Spot BTC ETF is approved.

Furthermore, despite a positive court decision for the conversion of Grayscale Bitcoin Trust to a spot Bitcoin ETF, the negative premium stands at 19%. If investors were hopeful for the GBTC conversion, they would quickly buy in to bring the negative premium to a neutral level, knowing that they would gain more than 19% with the conversion.

October 10 is the last day for the SEC to appeal the GBTC decision, and so far they have not appealed. They said they are still reviewing the decision. If they can’t find another excuse, they may approve the conversion.

In conclusion, due to these short-term negative factors, the Bitcoin price may not be able to sustain above the $28,500 resistance area.

If the Fed sees that it will mess things up in the near future and starts easing early, if the SEC gives up its stubbornness, if the market regains its trust and institutional/individual investors return, we may see the painful bear markets come to an end. Unfortunately, for now, this is the situation.

Türkçe

Türkçe Español

Español