The leading cryptocurrency is finding buyers at $61,500 as this article is being prepared. These numbers, easily pronounced, were a dream last year. In 2022, some investors made sales around $15,500, never considering such a possibility. Each bear market has most investors believing it’s over, but Bitcoin says “no, I am here”.

Why is Bitcoin Rising?

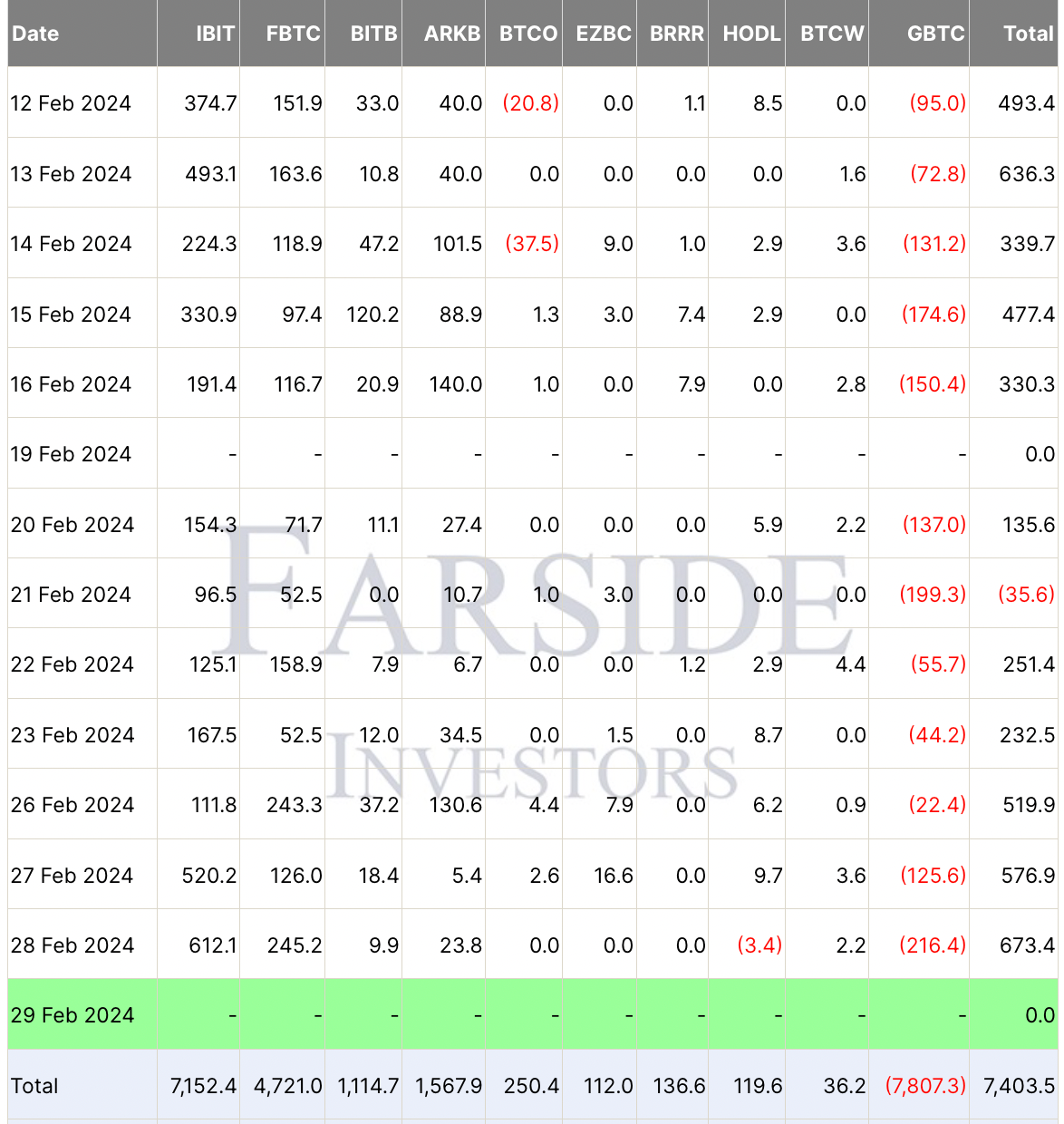

There is fundamentally one reason for the rise in Bitcoin prices. The latest rally led to a 93% increase in BTC‘s daily trading volume, reaching $90.2 billion. The trigger for this rally was the massive record volumes in Spot Bitcoin ETFs. On February 28th, a record net inflow of $673 million was seen, surpassing the previous peak of $655.2 million set on January 11th.

According to data from Farside Investors, BlackRock’s spot Bitcoin ETF, IBIT, saw the highest inflow to date.

Data provided by BitMEX indicates that nine new Bitcoin ETFs have seen an inflow of $7.4 billion for the first time since their launch. ETF analyst Eric Balchunas wrote;

“Only one or two ETFs on the planet are pulling in cash as quickly as $IBIT right now. It will probably reach $10 billion tomorrow. To better understand what I’m saying, it took GLD over two years and VOO more than three years to reach $10 billion.”

Will Bitcoin Rise Tomorrow?

Despite yesterday’s extreme buying, swelling volume, and half a billion in individual transactions, BTC fell today. There are two reasons for this; the first is the monthly close, and we generally do not see such long green candles in Bitcoin, and an upper wick should form. The second is that as of this writing, BlackRock has reached a volume of around $1.3 billion, so it won’t come close to yesterday’s record.

As volumes return to normal, market enthusiasm will wane, and investors will likely position themselves in preparation for the weekend’s anticipated profit-taking. The scenario I mentioned is probably what anyone who has spent enough time in the industry and analyzes recent developments well would say. So, the market might just trigger rallies in altcoins to catch these predictions off guard and, after seeing historic liquidations for short positions, we might witness the start of real profit-taking.

In crypto, certainty is never an option. We can only create scenarios based on what might happen and what is happening.