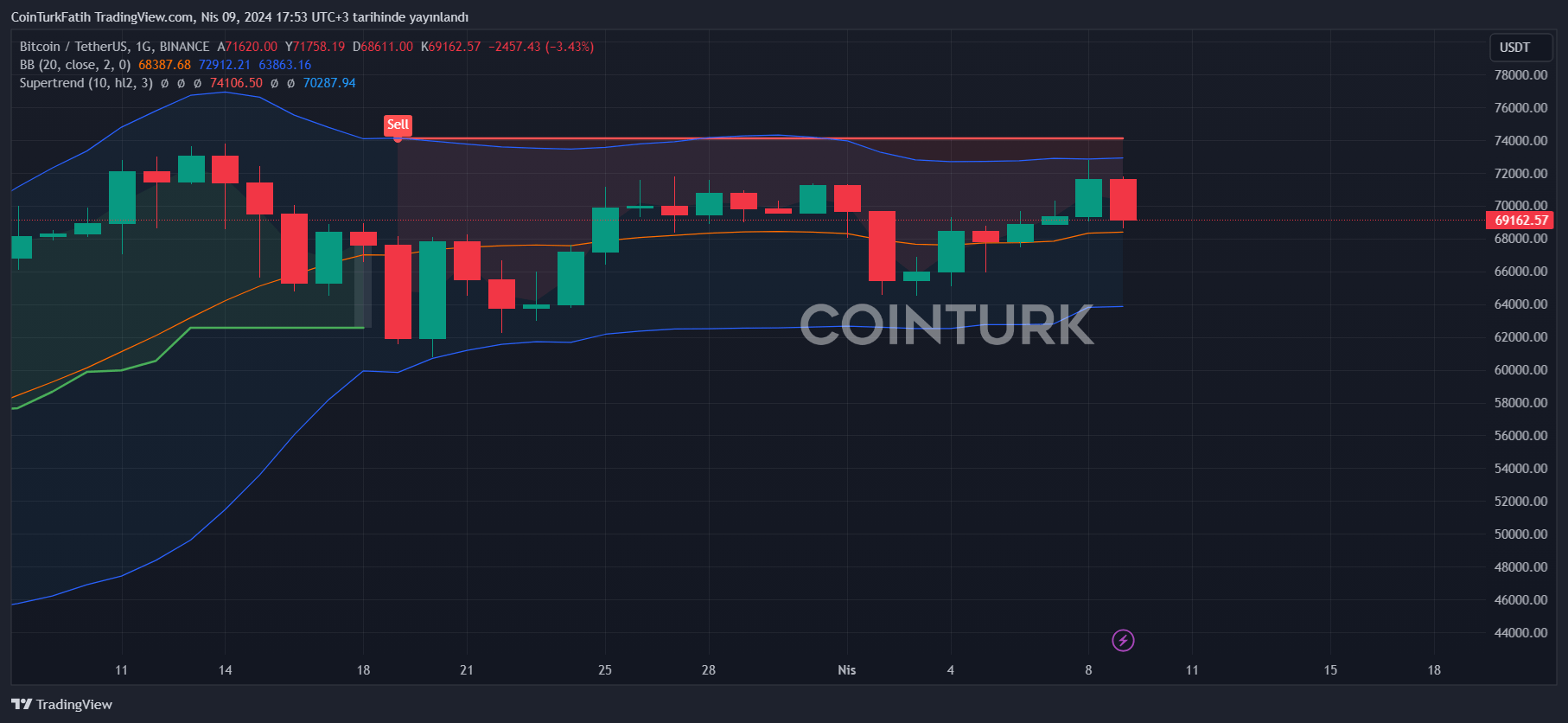

Following developments 12 hours ago, the Bitcoin price logically had to retreat to these levels. The crypto market is full of surprises, but it also makes logical moves in line with expectations. Indeed, the ongoing decline was the result of a warning we issued more than 12 hours ago.

Why Is Bitcoin Declining?

The Bitcoin price is falling due to a significant net outflow from spot Bitcoin ETFs on April 8. The size of the net outflow was the largest since the daily outflow on March 20. During those days, we saw major losses in the ETF channel, and concurrently, the BTC price also plummeted. Moreover, concerns about tomorrow’s US inflation data continue.

US inflation has been coming in poorly for two months. Even though Federal Reserve members may not pay much attention, a 75 basis point rate cut this year could be a difficult scenario. Leading indicators are not optimistic about inflation. Housing inflation is strong, and there is no easing on the employment front. Wage inflation is not weakening. While all this is happening, it doesn’t seem logical for the Fed to achieve its 2% inflation target.

Therefore, the days when Bitcoin could be shaken by the possibility of interest rates being cut below 75 basis points in 2024, or even by some members’ statements against rate cuts, may be approaching. Even if that’s not the case, we might see the market’s anxiety about this in the next 24 hours.

Türkçe

Türkçe Español

Español