Cryptocurrency investors have been trying to make sense of the anomaly in the price of Bitcoin, especially in the last few weeks. The rise that started in the first months of the year was undermined by sudden drops. Now we are seeing a steady decline in the price. Why is the Bitcoin price, which started to rise in January with volume buying, falling despite the positive data?

Bitcoin (BTC) 2023 Commentary

After the collapse in November, the king cryptocurrency had a good start to January and rose quite fast. It was great, all of a sudden the price was going up by a few thousand dollars, which excited investors. And the volumes started to increase. But in the last 2 months we’ve been seeing particularly sharp declines. The sales in March, the fall in April, the sales that accelerated in the second week of this month. All of these are happening despite positive macroeconomic data.

So what do we mean by positive data?

– US inflation fell again in April.

– The Fed gave the first official signal that they are about to reach the interest rate ceiling.

– Today’s PPI data suggested that the decline in inflation would continue.

– The effects of the credit tightening brought about by the banking crisis are starting to be seen clearly. Considering that the ceiling is targeted at 5.75% (the most exaggerated Fed member forecasts), the message “we have reached the interest rate ceiling” can be given in June with the 25-50bp effect of credit tightening.

All this indicated that the Fed-induced market crash of 2022 was about to reverse.

Reason for Bitcoin Price Decline

So why have we seen the Bitcoin price fail to maintain $30,000? There are basically two reasons. First, the big market makers are not as active on centralized exchanges as they were in January. So they withdrew from the market. There is a serious market depth problem, especially in the US-based exchanges, and we can see this clearly in the $500-plus spreads in the Bitcoin price. June and Jump Crypto have not been providing liquidity to the market for several months due to the risk of the regulatory environment in the US.

So the order books are now predominantly filled by traders. This means that even a sudden sell-off of a few million dollars can drop the price by 100-130 dollars.

So, if we go back to the January rise we described above, what happened to the volume buyers? Where are the investors who bought close to $3 billion in a few hours?

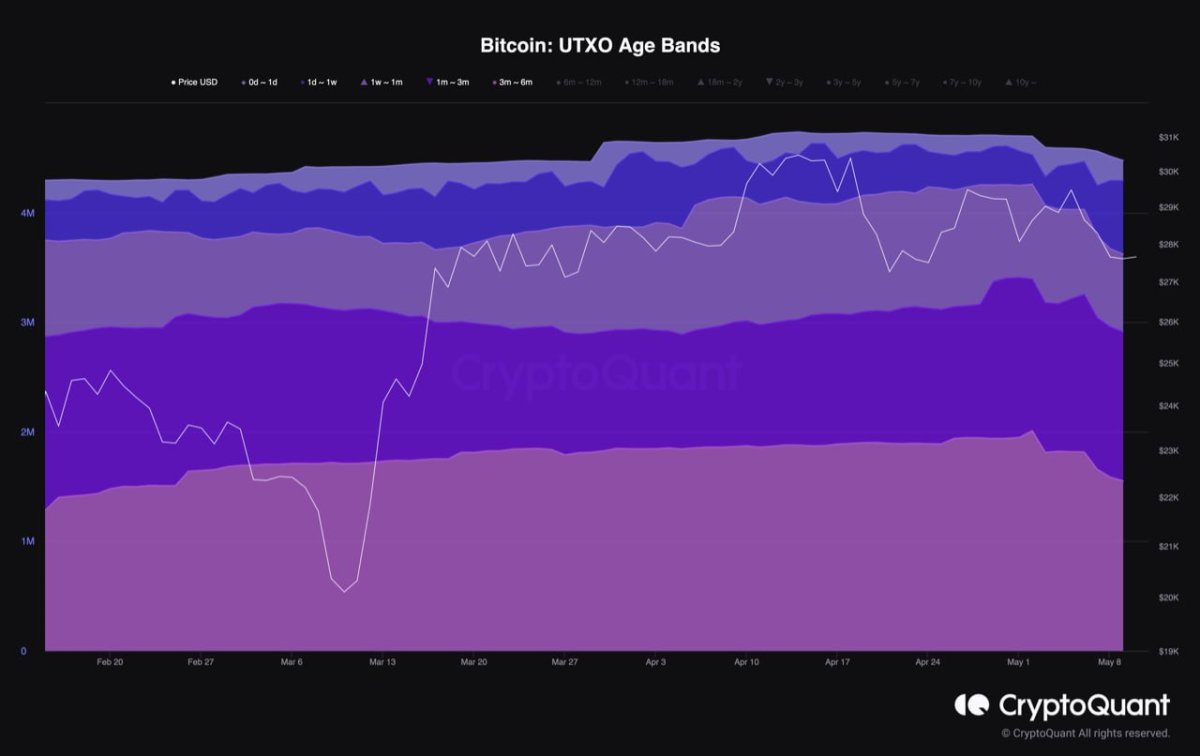

The UTXO Age Bands analysis compiled by Cryptoquant provides the answer. The analysis shows that a significant portion of UTXOs have fallen into short-term holder age bands, specifically the 3-month to 6-month UTXO Age Band.

This observation is supported by a drop of 266,000 UTXO in this age band during this month. This drop was triggered by the sale of about 266,000 BTC acquired between November and January until May 1.

Around 266,000 BTC acquired between November 22 and January 23 were sold at the same pace. The selling by buyers that triggered the recent rally and the selling by short-term traders in the face of a liquidity shortage have kept the price of Bitcoin at these levels today. So why are they selling?

– They may be worried about the exponential increase in US regulatory pressure.

– They may be anticipating that the Fed will continue to raise interest rates for a while.

– They may think that the recession experienced during Fed rate cuts will cause destruction in cryptocurrencies.

– They may believe that market makers withdrawing from the market will cause a bearish market without volume in the medium term.

And there may be many more reasons. The selling by short-term investors also tells us that the bottom may be near. If we see a sustained decline down to the $25,000 level, and if that price level is attractive to them, the demand for a rebound could be there.