Bitcoin (BTC), on April 30, dropped nearly 10% from its local high level. At the time of writing, it was trading just below $57,000, well outside the previous demand zone between $59,200 and $61,000.

Buying Zone in Bitcoin

BTC experienced a drop of over 3.5% in just the last hour alone. However, according to cryptocurrency analyst Rekt Capital, Bitcoin is not yet out of the danger zone. The analyst compared the current Bitcoin price movement to what happened immediately after the halvings in 2020 and 2016. RektCapital suggested that the post-halving price movement in 2024 resembles that of 2016 more than 2020. At that time, an 11% drop occurred 21 days after the halving.

Experts suggest that if the same scenario repeats, BTC prices could drop to $52,000. The $60,000 zone has been a technically solid support area for the last two months. However, each retest of the support could weaken it. Buyers might consider buying from the bottom until this happens.

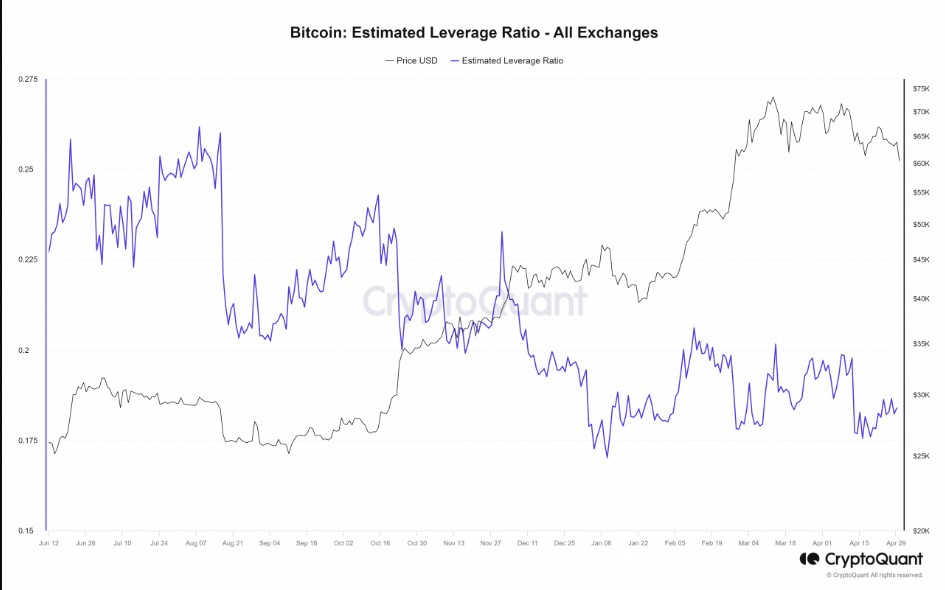

Technical Data on Bitcoin

The Spot CVD has been on a downtrend since mid-March and fell below the support level that extended until the end of February. This confirmed the bearish trend in HTF and reduced the likelihood of another bounce from the $60,000 demand zone. Open positions were also declining, reflecting the downtrend. The adjusted output profit ratio (aSOPR) saw a significant rise to 1.1 a month ago but dropped to 1.029 at the time of writing. Similar scenarios occurred in May and August 2020.

After overly eager bulls were forced to reduce leverage, the market saw a more sustainable rise supported by spot demand. The estimated leverage ratio exceeded 0.18 several times in 2024 but had to pull back. This indicates that most of the over-leveraged positions were wiped out with the last drop. However, this could mean that BTC might see a positive price reaction. A move below the $59,400 level could likely lead to prices falling to the $55,000 and $52,000 support zones.

Türkçe

Türkçe Español

Español