Bitcoin broke the $37,000 level for the first time in 18 months, but investors continue to have different opinions on BTC‘s price movement. Bitcoin continues to steadily progress towards the $40,000 level during this period. Data obtained from TradingView shows that the BTC/USD pair surpassed the $37,000 level for the first time before the Wall Street opening.

Why is Bitcoin Rising?

Bitcoin, which experienced a 6.6% increase in the first days of November, continues to surprise some market participants by gaining approximately 30% in October. According to analysts at on-chain data monitoring platform Material Indicators, the real problem for Bitcoin lies in the trading volume.

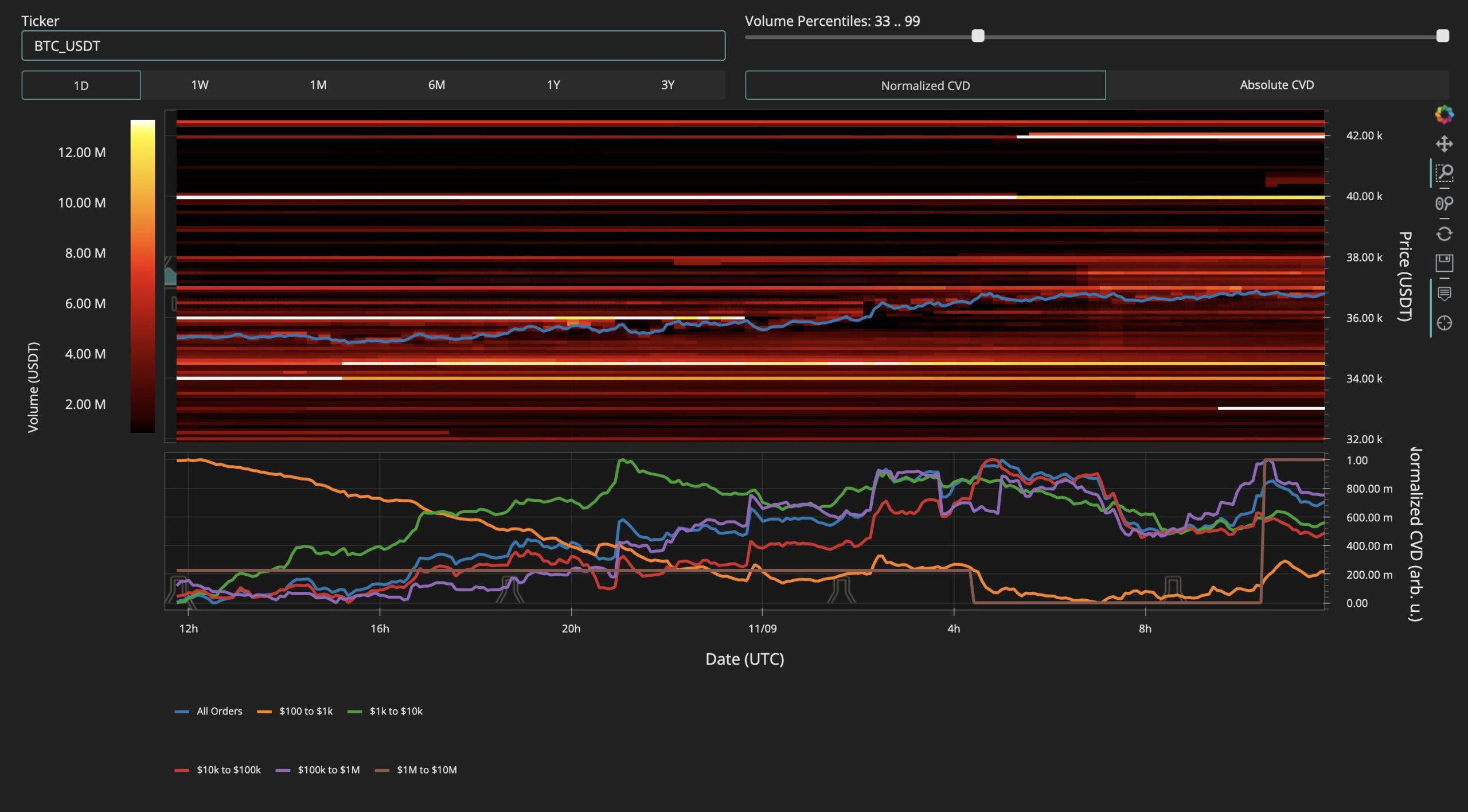

The company shared in a post from its official X page that this rise was fast, but the support based on strong volume at current levels has never been seen before:

“Support is fixed at the $33,000 level. Meanwhile, the $40,000 resistance has risen to the $42,000 range. It is undeniable that the price challenges a series of different local peak signals, but it is also impossible to deny that something seems wrong with this movement.”

Attention-Grabbing Bitcoin Comments from Market Analysts

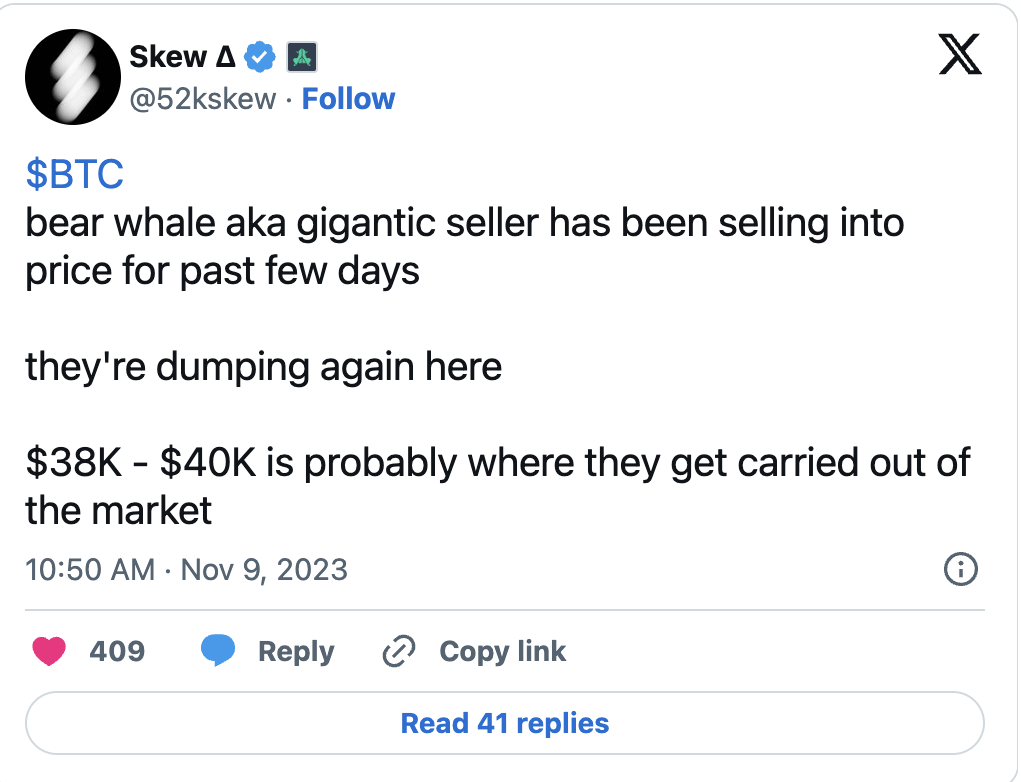

Following these comments, popular investor Skew, who attracts attention with his posts on X, revealed the ongoing whale sell-off towards $40,000, which will most likely be seen as an important psychological level on its own.

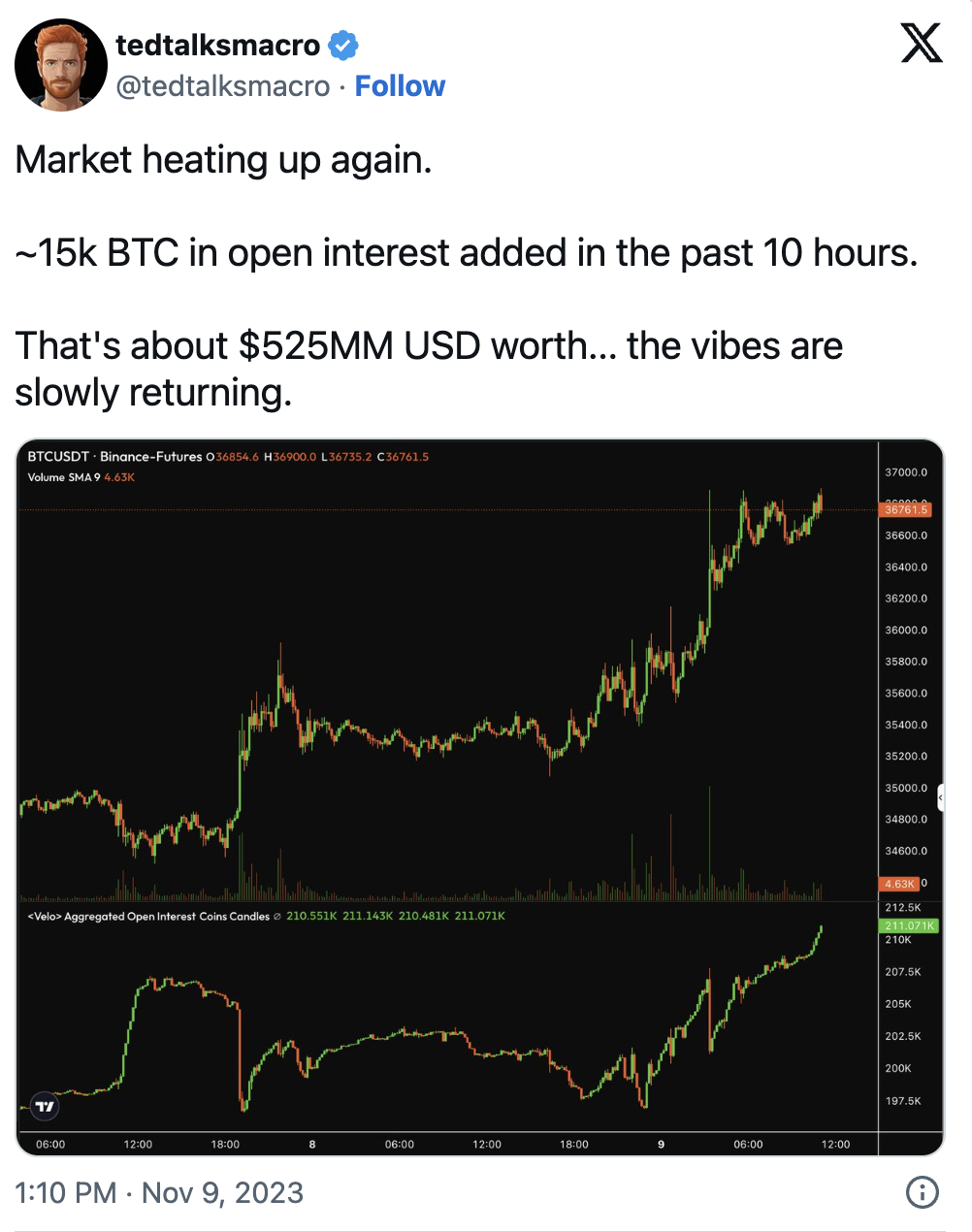

With these developments, popular analyst Tedtalksmacro, closely followed by the crypto community, pointed out the increasing open interest (OI) that constitutes the fundamental basis for the sudden upward movements in recent weeks and months.

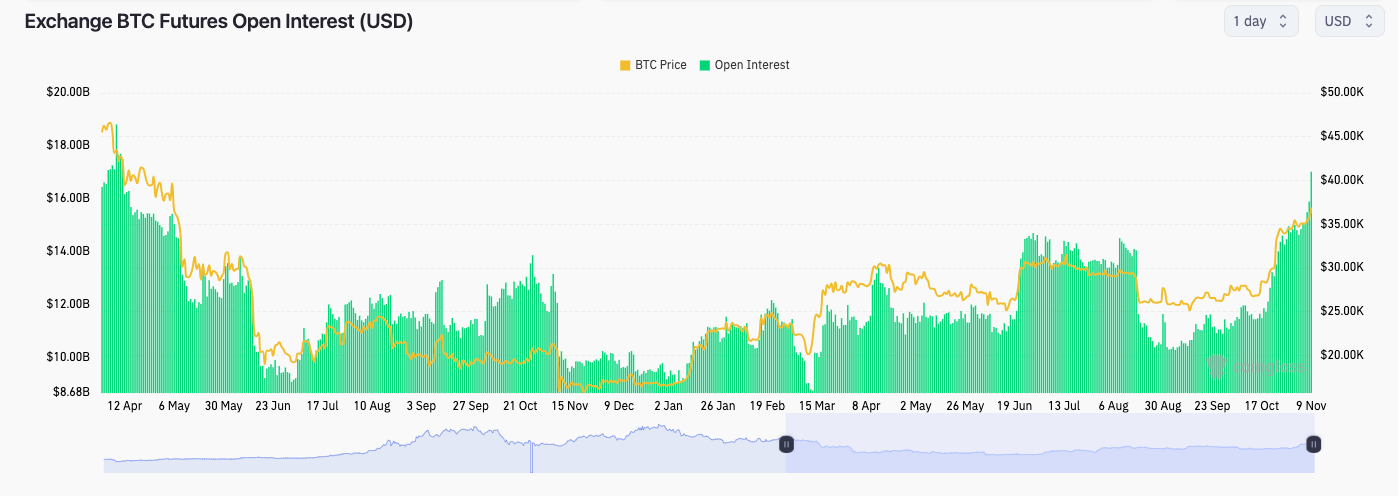

According to CoinGlass, a blockchain data analysis company, the total Bitcoin futures trading OI data was over $17 billion at the time of writing, which is the highest value since mid-April. Tedtalksmacro made the following comments in his analysis:

“We will realize that it is a full bull time when the market ignores this and follows higher trends with higher OI values. It is a data to be monitored.”