Cryptocurrency market was shaken by a sharp decline in Bitcoin (BTC), dropping below the $58,000 level, its lowest since the end of February. This drop highlights Bitcoin‘s most challenging period since November 2022, showcasing the extent of panic across the market. Bitcoin is currently struggling to stay above the $57,000 mark after a more than 10% drop in the last 24 hours.

Why Is Bitcoin Dropping?

The cryptocurrency market faces turbulent headwinds amid rising concerns over stagflationary pressures in the US, coinciding with a global shift away from riskier assets in financial markets.

Signs of slow economic growth combined with ongoing inflationary pressures have diminished expectations for interest rate cuts by the Federal Reserve (Fed). At the beginning of the year, multiple rate cuts by the Fed were anticipated, but this expectation has largely changed. Experts now predict that the Fed might make at most one or two rate cuts by the end of the year.

Amid these developments, the Federal Open Market Committee (FOMC) will announce its latest interest rate decision today at 21:00 TSİ, with financial markets experiencing anxious anticipation ahead of the critical decision.

Altcoin Market Also Under Selling Pressure

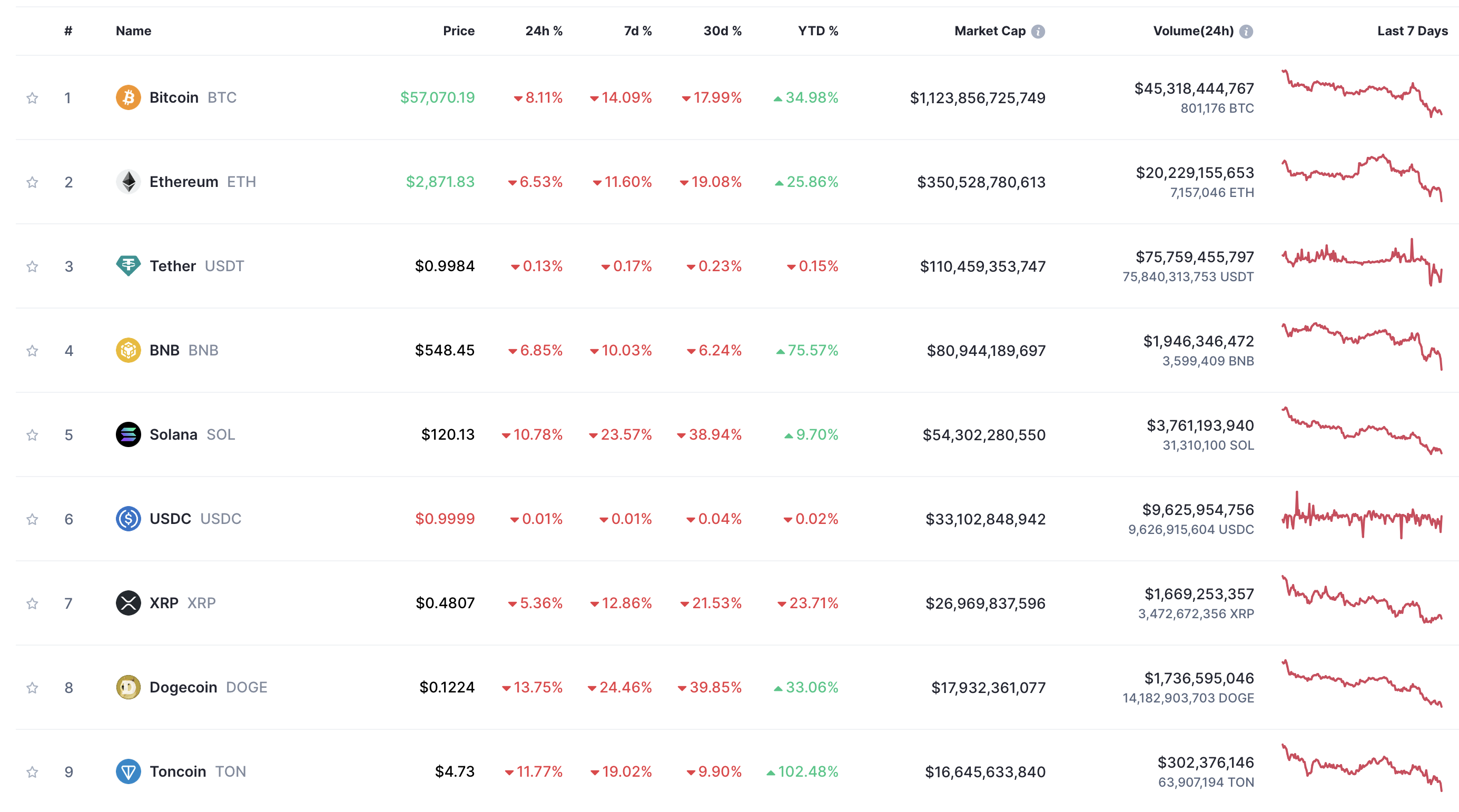

Parallel to the drop in Bitcoin’s price, the largest altcoin, Ethereum (ETH), also experienced a significant drop, losing about 9% of its value. Additionally, several major altcoins including Solana (SOL), Dogecoin (DOGE), and Avalanche (AVAX) have also fallen by more than 10%. This situation indicates that the entire cryptocurrency market is under similar conditions and strong selling pressure.

Bitcoin closing April with a sharp decline marked its first negative month since August 2023. The 16% decline throughout the month points to the worst performance since the collapse and bankruptcy of the cryptocurrency exchange FTX in November 2022. All these developments once again expose the high volatility in the cryptocurrency market, shaped by numerous internal and external factors affecting investor sentiment and market dynamics.

Türkçe

Türkçe Español

Español