The “FOMO” expectation in the bull market of Bitcoin, which has increased by 120% this year, has not yet started to be discussed in the market. According to the data obtained from Look Into Bitcoin, a blockchain data analysis platform, it is seen that on-chain data transactions only include recently acquired Bitcoins. In other words, long-term investors do not make any transactions on their Bitcoin assets.

What’s Happening with Bitcoin Price?

Bitcoin is trading near the highest levels in 18 months and continues to trade well beyond several important resistance levels and the bear market trading range. While the number of small wallets in Bitcoin continues to increase, there is not much interest from speculator investors who hold Bitcoin for a short period of time.

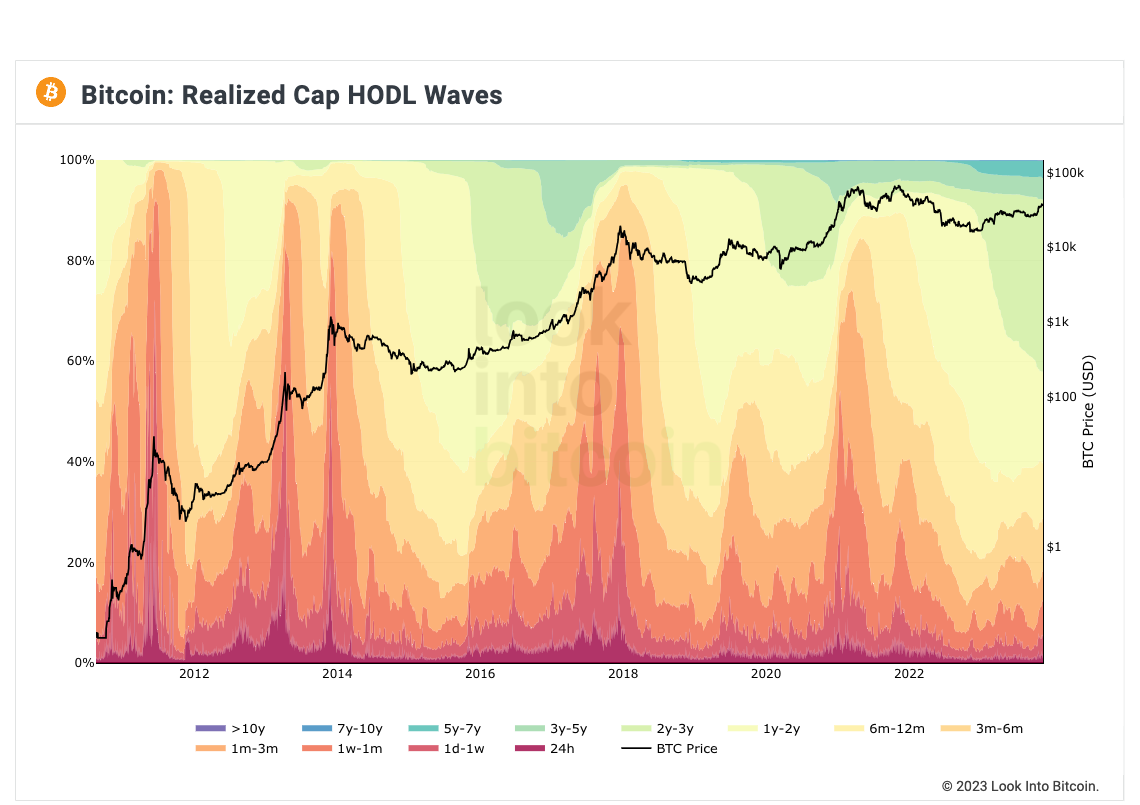

Philip Swift, the founder of Look Into Bitcoin, shared the data of realized HODL waves, also known as RHODL data, in an X post shared on November 16. RHODL divides the supply in Bitcoin into age groups and compares it with the latest price at which it moved with on-chain data.

As a result, an increase occurs in coins that frequently move in bull market stages, and the opposite happens in bear markets where investors are afraid to sell or have losses in their assets. Swift made the following statements about the current situation in the RHODL data:

“The hotter-colored low timeframe waves start to increase only as tokens are transferred on-chain. There is no FOMO yet, it’s too early for that.”

NUPL Data Draws Attention to ATH Levels

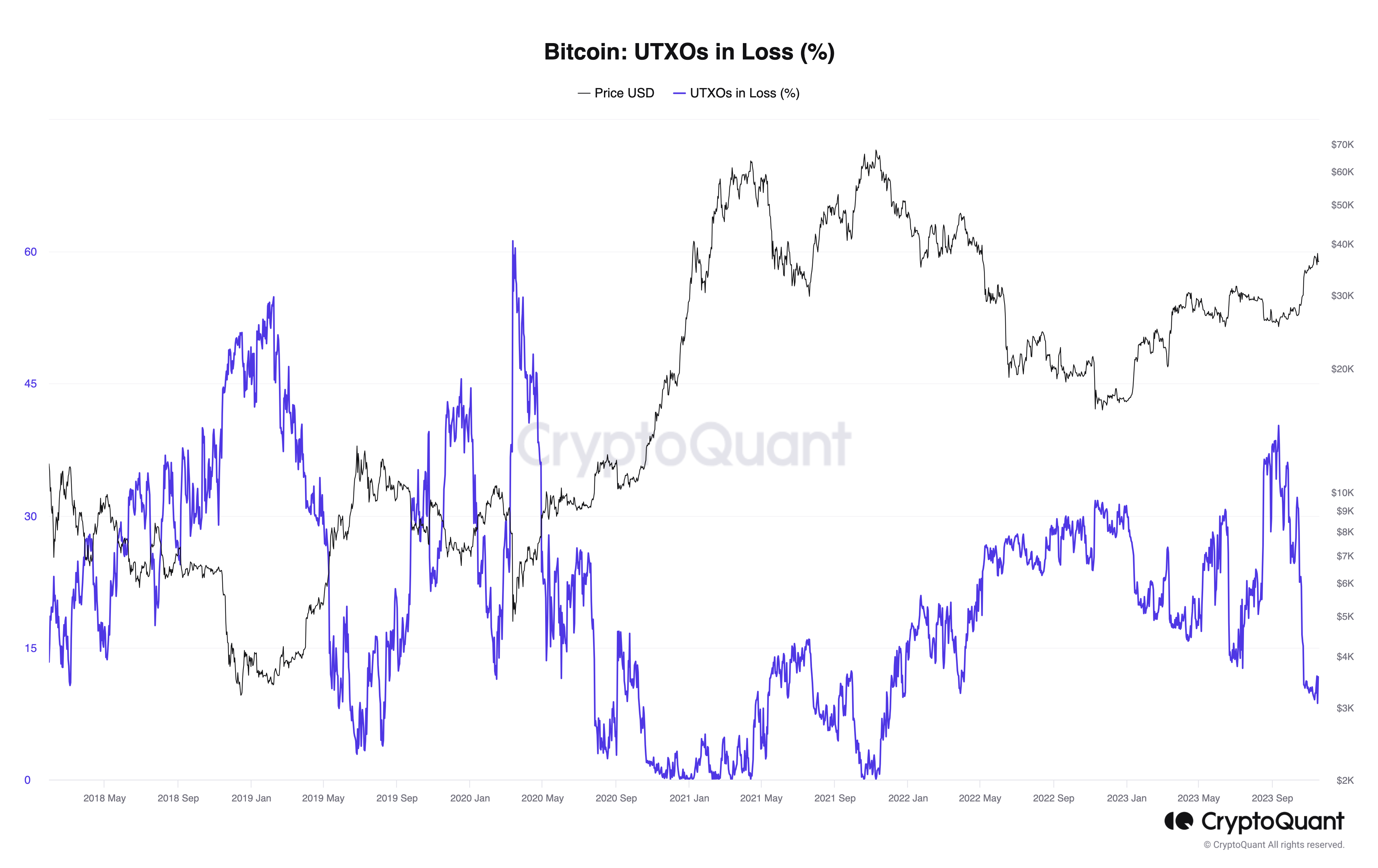

Onchained, contributing to the on-chain data analysis platform CryptoQuant, continued to interpret Bitcoin supply data and once again highlighted that those who increase their Bitcoin assets suffer serious losses as it reaches all-time highs in 2021.

This situation was realized using net unrealized profit or loss (NUPL) data, which provides profitability rates for stored token groups. However, very soon, an important line will emerge in the market for bull market hodlers:

“This is in line with their entry when the price of Bitcoin rose to $67,000. The proximity of NUPL data to the 0 profitability benchmark indicates a potential breakeven point if Bitcoin continues to rise beyond $39,000.”

Türkçe

Türkçe Español

Español