Pyth Network (PYTH) recently caught the attention of investors following an announcement by Binance, the world’s largest cryptocurrency exchange by volume. According to the announcement, PYTH will be listed on Binance. Such news generally leads to significant upward movements for the specific altcoin in question. It seems that the same effect is occurring for PYTH, fueled by the excitement of investors.

Will Binance Boost Pyth?

As per Binance’s announcement, PYTH will start trading on Binance on February 3rd at 12 UTC. It will be available in PYTH/BTC, PYTH/USDT, PYTH/FDUSD, and PYTH/TRY trading pairs.

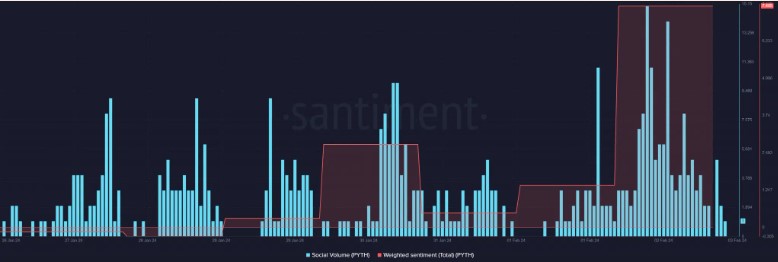

According to the announcement, there has been a significant increase in the token’s social measurements over the last few days. Data presented by Santiment indicates a sharp rise in PYTH’s social volume on February 2, 2024.

Furthermore, as understood from the weighted sentiment, another rising indicator, there has been an increase in the bullish sentiment surrounding the token.

Listings by major exchanges like Binance and Coinbase have historically led to price increases, so the rise in expectations for PYTH’s price surge is not considered surprising. Data from CoinMarketCap shows that PYTH has increased by more than 19% over the last seven days.

Despite this rise, a short-term price analysis suggests that things might not be going smoothly for PYTH. The charts seem to have turned red as of today. PYTH has faced a 4.8% decrease in the last 24 hours. As of the time of writing, PYTH is trading at $0.4886 with a market value of over $696 million.

The Potential Future of PYTH

A more detailed chart analysis to understand whether Binance’s listing will truly benefit the increase in PYTH’s value reveals high volatility in the cryptocurrency and continued dominance of buyers in the transactions.

Looking first at the Relative Strength Index (RSI), it is seen to have shot above 70, which could be interpreted as an indication of excessive buying. The dominance of the bulls is evident in this indicator.

On the other hand, the Chaikin Money Flow (CMF) is positioned above the neutral sign at a value of 0.13, which could be interpreted as a bullish trend. The derivative market for PYTH also seems to be faring well.

Additionally, the funding rate continues to trend in the green zone, which could be interpreted as active purchasing of PYTH by futures investors.