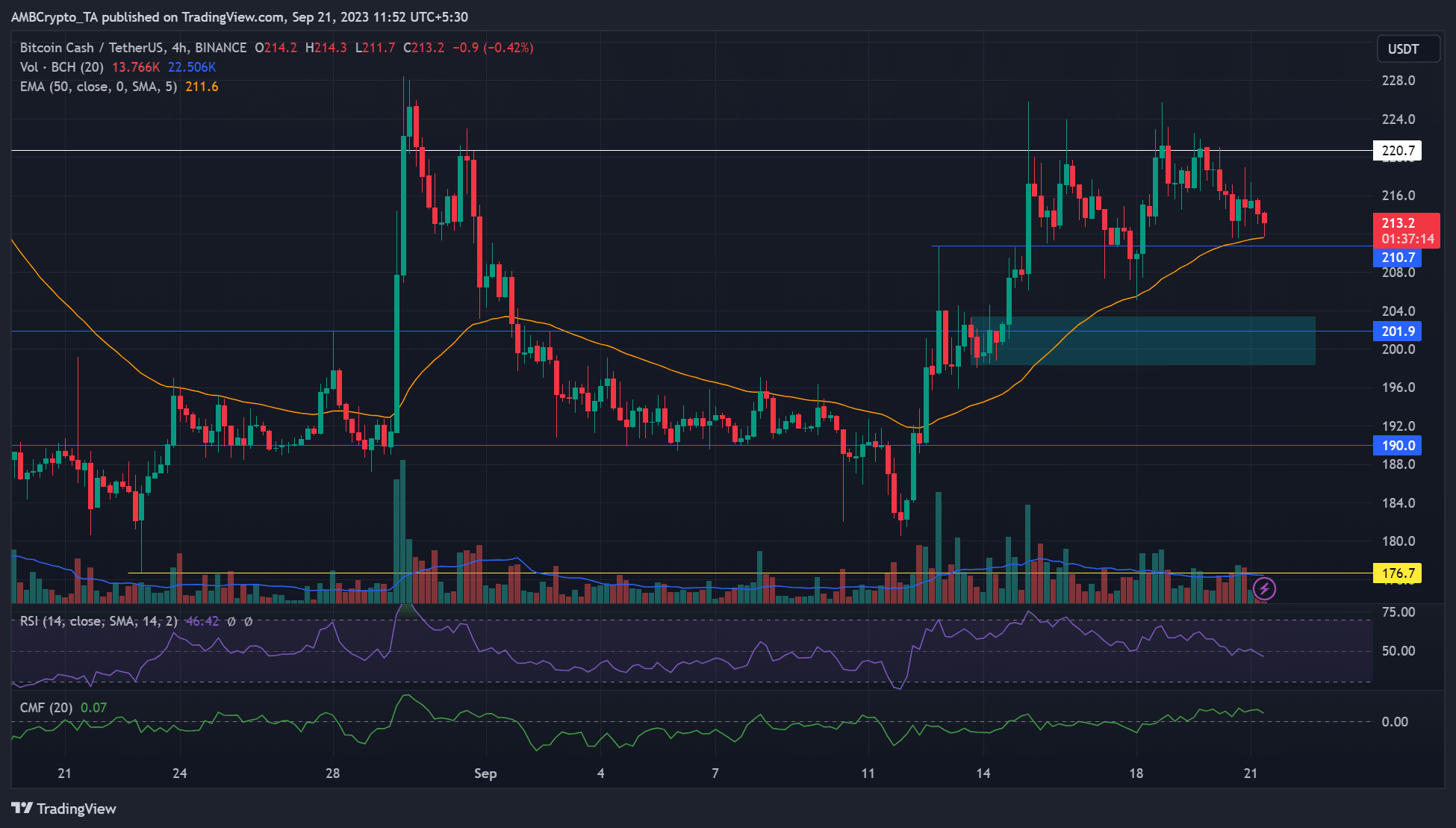

Bitcoin Cash (BCH) bulls are defending the $210 level, but sellers are looking to break it. After failed attempts to reclaim $220, the cryptocurrency bulls have chosen to secure $210. However, selling pressure has intensified.

BCH Price Movements!

In the short term, due to the focus being off the September Fed decision, there was no significant catalyst that could influence the price movement other than the pending Ethereum (ETH) ETF approvals. The $210.7 short-term support is in line with the 50-EMA (exponential moving average). Sellers failed to push BCH below the 50-EMA at the time of writing this article.

If the leading cryptocurrency Bitcoin holds above $27,000, it can expand the BCH consolidation and lock in further gains above $210, affecting BNB. The CMF (Chaikin Money Flow) is moving sideways and is above zero. It also reiterated that there are positive capital inflows but with volatility. Selling pressure has intensified in the past few days, influenced by the negative RSI.

Current Data on BCH!

Furthermore, a drop below the 50-EMA and $210.7 could lead sellers to push their gains to $205 (the recent lowest level) or to the H12 ascending order block at $180 and $203. As indicated by the Open Interest rates, demand for BCH in the futures market has significantly decreased between September 15 and 20. During the same period, the measurement dropped from $250 million to approximately $214 million.

The decrease in demand favored sellers who gained more market advantage, as indicated by the decreasing cumulative volume delta. However, as shown by the positive Accumulative Swing Index (ASI), the long-term trend was positive. ASI monitors the strength of price fluctuations, and a decrease to a negative reading could indicate a long-term downward trend for BCH.

Bitcoin Cash (BCH) is trying to maintain the $210 support level, but selling pressure is increasing. Demand in futures is decreasing, but the long-term trend is positive. BCH is showing limited movement with the $210.7 short-term support. Negative RSI and low demand make the future price movement of BCH uncertain.