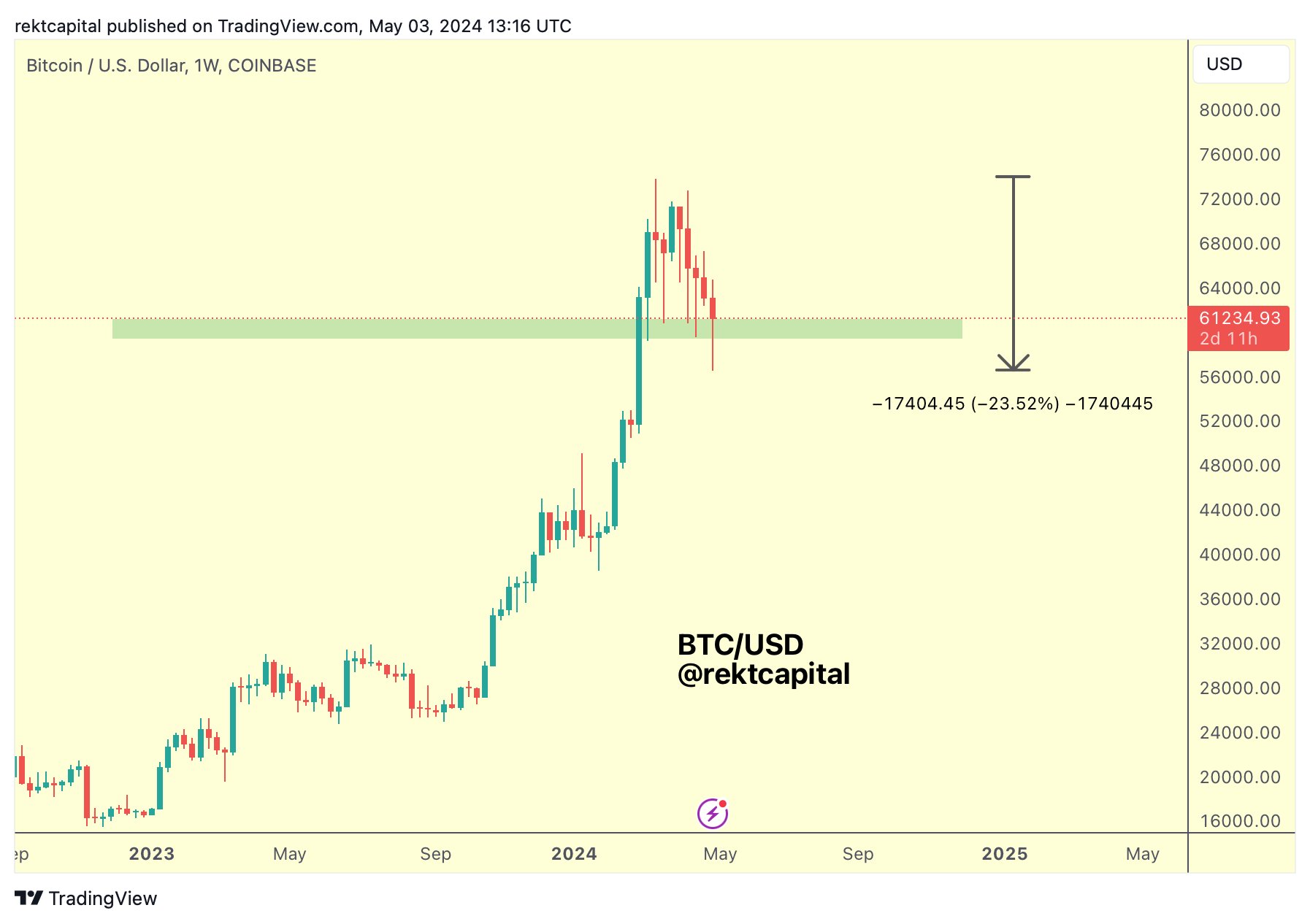

Bitcoin, on May 3rd, surged up to 5% as US employment data spurred a significant rise in risk assets. Data from TradingView followed a sudden Bitcoin price movement that pushed the BTC/USD pair above $62,000 on major crypto exchanges. The US non-farm payroll data for April came in well below expectations, revealing some of the weaknesses in the labor market that the Fed said would support a case for cutting interest rates.

Bitcoin on the Rise

Fed Chairman Jerome Powell, in a press conference on May 1st, announced they are ready to maintain the current target range for the federal funds rate as long as it is appropriate. Non-farm employment payrolls, conflicting with other current macro data pressures that weaken bulls’ confidence, immediately eased as Dow Jones futures rose by 500 points. The trade source Kobeissi Letter still questioned how the Fed would address future inflation issues, sharing the following statement:

“We now face a weakening labor market with lower GDP growth and rising inflation.”

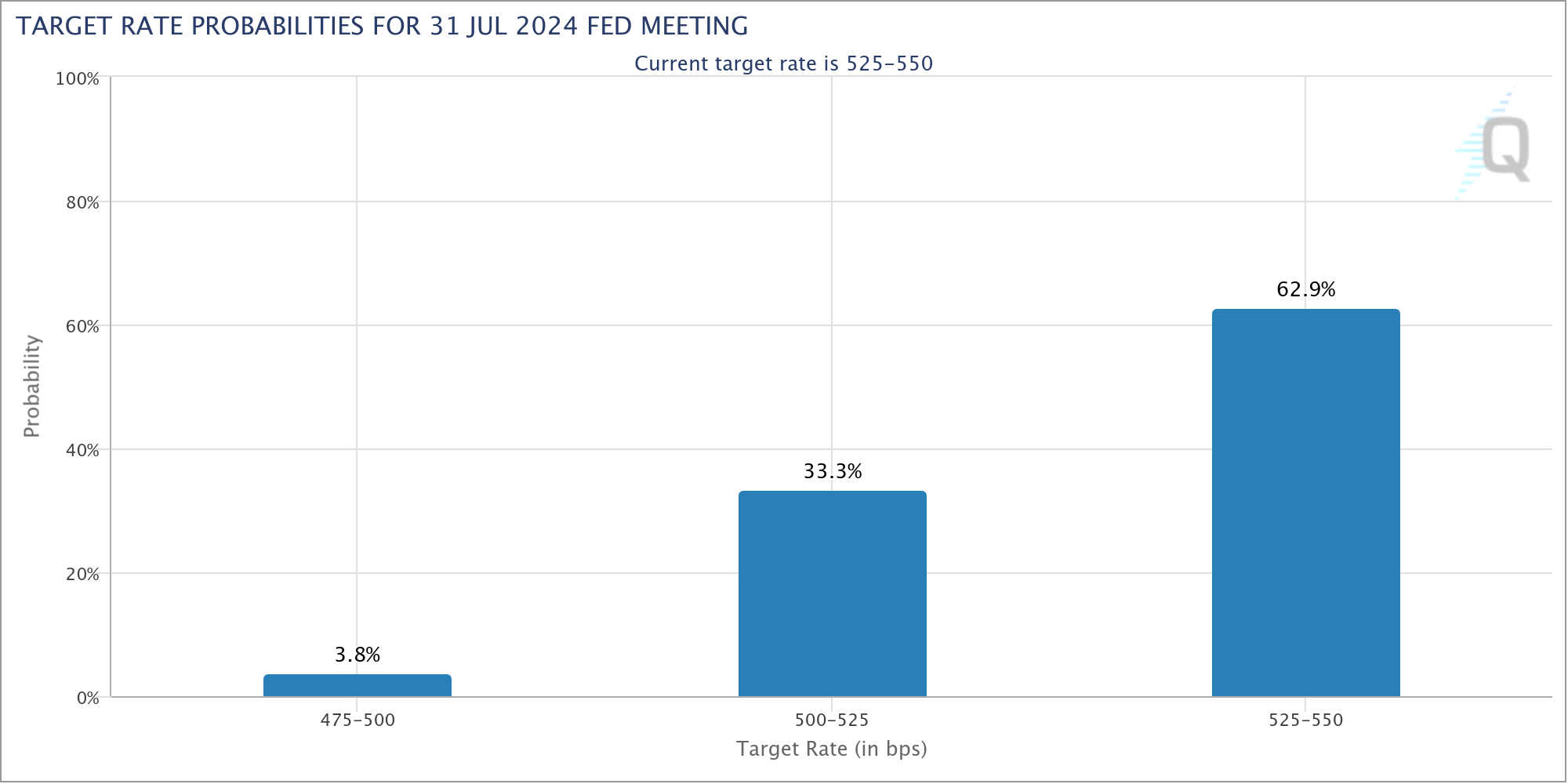

The latest forecasts from CME Group’s FedWatch tool show that the probability of a rate cut at the Federal Open Market Committee’s (FOMC) June meeting is just under 15%. Rates for a minimum 0.25% cut at the July meeting were at 33%.

What’s Happening on the Bitcoin Front?

Commentators responding to the recent rise in Bitcoin prices hope higher levels will remain as support, leaving the course of the week to a sudden reaction at two-month lows. Popular trader and analyst Rekt Capital stated in a post:

“This just looks like a negative wick. A weekly close like this will confirm this liquidity pool as a safe support.”

Rekt Capital added in a separate post that the BTC/USD pair is outside the dangerous zone that almost every block subsidy halving event has accompanied. Trader Josh Rager also commented:

“I’m watching this level around $62,000 to see if Bitcoin can be reclaimed. Historically, over the past year, Bitcoin had a habit of falling below support in higher time frames and recovering shortly after.”

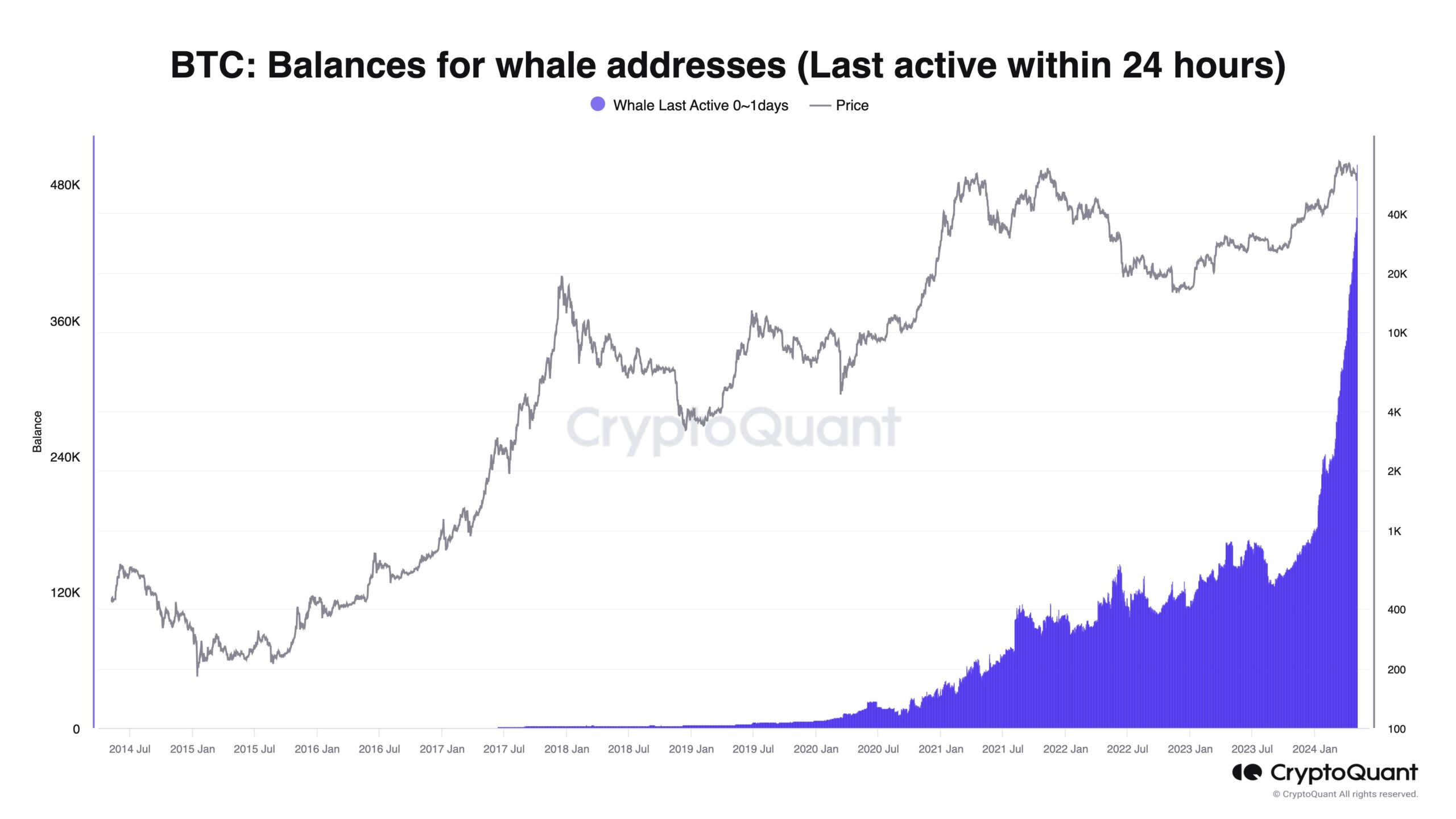

Meanwhile, Ki Young Ju, founder of the on-chain analysis firm CryptoQuant, revealed that the region below $60,000 is a popular area to buy the dip, stating:

“Bitcoin whales have accumulated 47,000 Bitcoins in the last 24 hours. We are entering a new era.”

Türkçe

Türkçe Español

Español