While cryptocurrency investors eagerly await the launch of the first spot Bitcoin ETF in the US, Bitcoin’s (BTC) price has been hovering around the $42,500 level for some time. Last week, news emerged that the US Securities and Exchange Commission (SEC) was likely to approve at least one ETF this week. This led to increased expectations that the price would drop following the ETF approval.

Will Bitcoin ETF Approval Result in a Downturn?

After a strong 160% rise in 2023, analysts started to suggest that Bitcoin’s price might see a pullback shortly after the ETF approval. Following this pullback, there is a consensus among analysts that BTC will consolidate until the planned Bitcoin block reward halving around April 2024.

Prominent investor and cryptocurrency analyst Rekt Capital shared his views on Bitcoin’s recent monthly close, highlighting fundamental support levels and historical models. The analyst noted that Bitcoin historically hovers around the support level near $41,000, undergoing volatile retests. During these retests, downward wicks extending to around the $37,000 region indicate a significant formation in price movement.

Rekt Capital suggested that a potential drop to the $37,000 level could be considered a healthy retracement point, based on past price movements. The analyst pointed out that Bitcoin has made similar price movements in the past, and such price actions have historically contributed to the overall market health of the largest cryptocurrency.

Moreover, Rekt Capital emphasized that deeper pullbacks during the period leading up to the block reward halving, which is about 100 days away, could offer ultimate buying opportunities for investors. As the market continues to evolve, traders and investors are closely monitoring these fundamental support levels and historical patterns for potential forecasts on Bitcoin’s future price movements.

Bears Begin to Take Control

There has been significant weakness in options expiring on January 12th, suggesting that the recent price rise may lack support. Analysts also believe that even if BTC’s price rises with ETF approval, the upward movement could be limited.

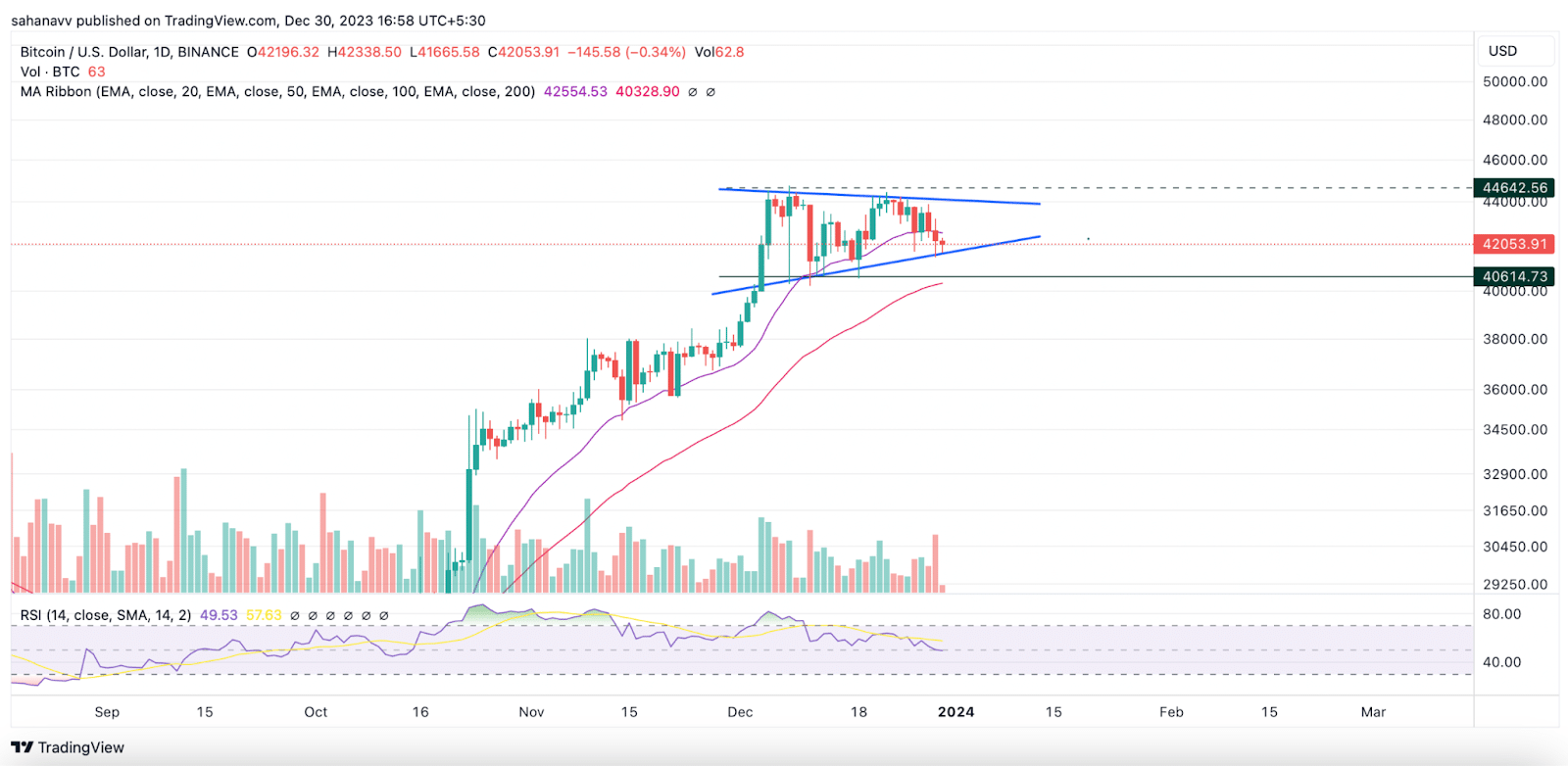

According to a recent analysis, the current state of the Bitcoin market indicates an increase in the power and control of bears, characterized by lower highs and lower lows. In particular, the fact that the previous peak of $44,800 has not been retested yet supports the bearish trend.

An analysis of Bitcoin’s price chart reveals that the largest cryptocurrency recently fell below the daily EMA-20, which is around $42,542, a level that has not been surpassed for several months after reaching the highest level in the last few months. The increase in the sell volume over the last two days, reaching peak levels not seen since April, indicates the possibility of an impending correction.

Türkçe

Türkçe Español

Español