Bitcoin (BTC), the world’s largest cryptocurrency, has been moving within a narrow range for the past week and beyond. However, this range has started to show signs of downward movement in the new week. The current price of BTC is currently trading below $30,000, and investors are asking many questions like whether the largest cryptocurrency will fall or rise, and whether they should buy or sell.

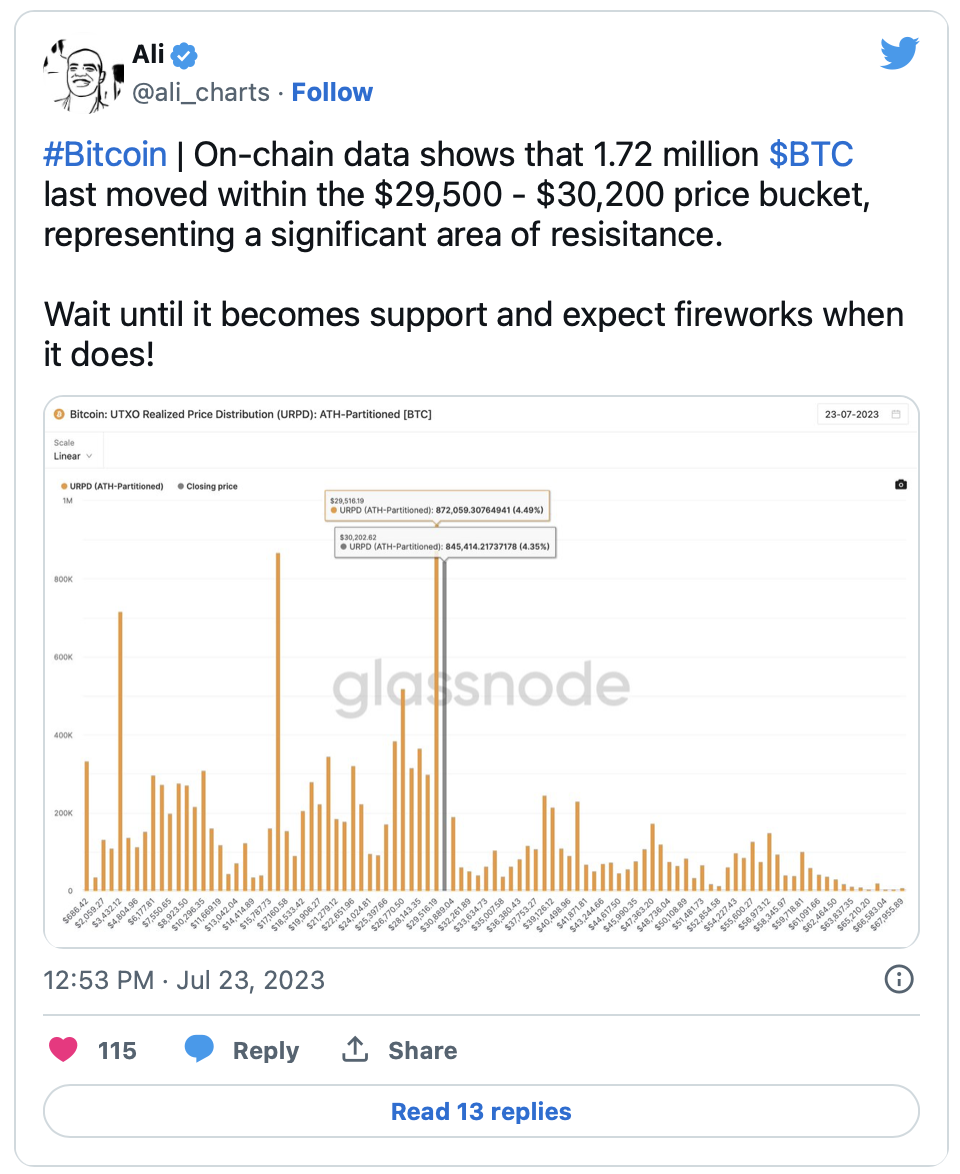

At the moment, Bitcoin is facing downward selling pressure and struggling to hold above the $30,000 level. Renowned cryptocurrency analyst Ali Martinez, referring to data provided by on-chain data platform Glassnode, reported that approximately 1.72 million BTC moved in the range of $29,500 to $30,200 most recently. Currently, this range serves as a significant resistance area preventing the price from rising.

Martinez commented on this range, saying, “Keep an eye on this range as it could turn into a support level. If this happens, we can expect exciting and positive price movements!”

The analyst also drew attention to the TD Sequential indicator, stating that the indicator provided a buy signal for the daily chart of BTC. If the daily closing price remains above $30,000, the upward signal will be confirmed. With this confirmation, a rise towards the range of $30,400 to $30,600 can be expected.

However, investors need to be cautious if the price remains around the $29,500 level. Any sign of weakness or the breakdown of the support provided by this level could invalidate the buy signal and intensify the decline.

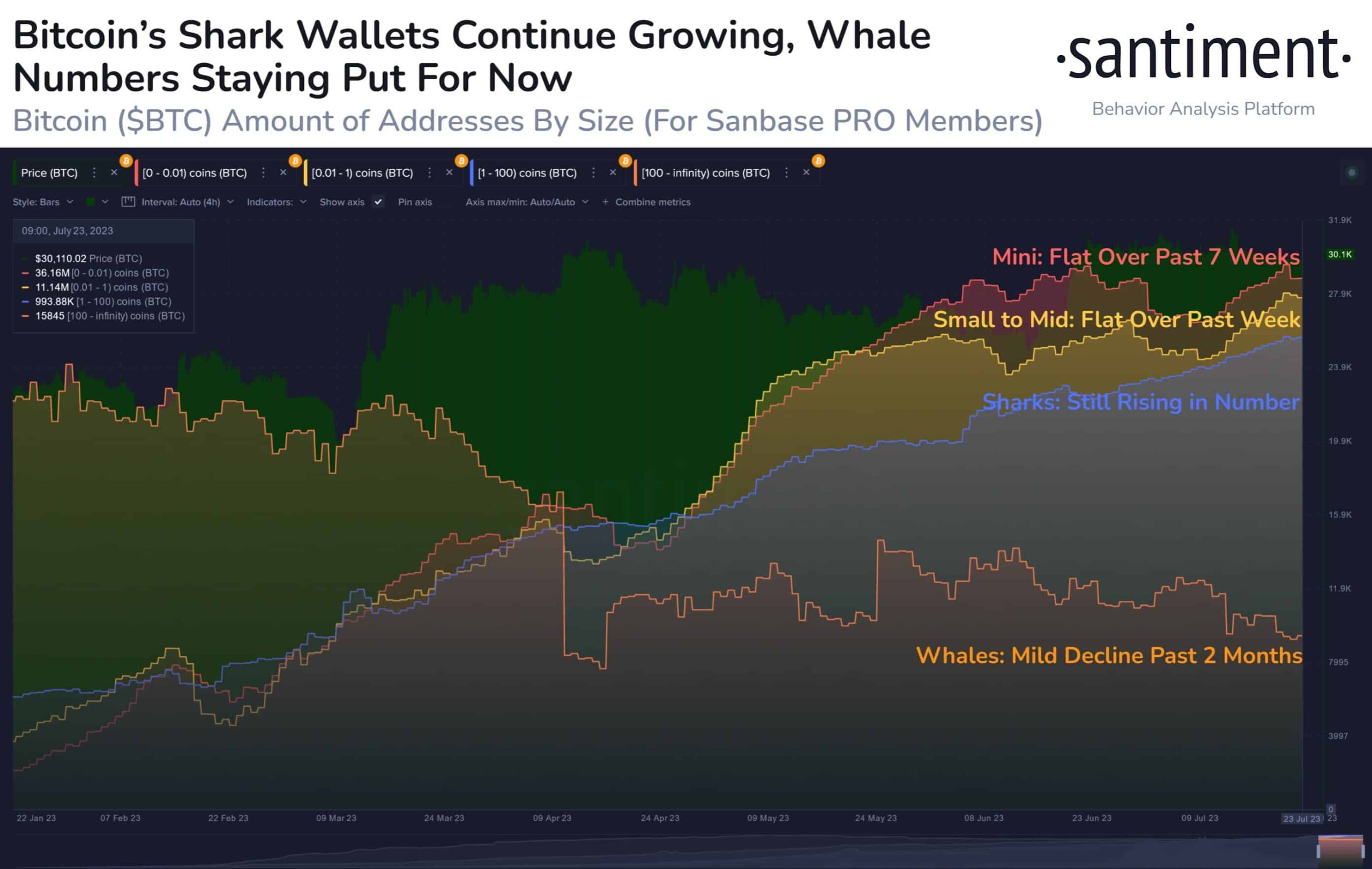

“Shark” Level Slows Down Bitcoin Wallets

Other on-chain data of Bitcoin shows that large Bitcoin investors, known as “sharks,” continue to accumulate even during the current consolidation period. However, it is now observed that this group of investors is slowing down. On-chain data provider Santiment recommends monitoring the number of large wallet addresses as Bitcoin rose above $30,000 again over the weekend and as summer progresses. If wallet addresses holding 100 or more BTC start increasing their holdings again, there is a high likelihood of a new breakout.

However, some market analysts continue to expect a rise in Bitcoin, considering the upcoming block reward halving event next year. According to Geoff Kendrick, an analyst at Standard Chartered, Bitcoin miners are creating a positive cycle that could push the price far beyond optimistic predictions. The cycle emphasized by the analyst stems from the tendency of miners to sell less when the price of Bitcoin rises.

On the other hand, Standard Chartered analysts have revised their Bitcoin price predictions, suggesting that the largest cryptocurrency could rise by over 300% from current prices to reach $120,000 by the end of 2024.

Türkçe

Türkçe Español

Español