Experienced cryptocurrency analyst Ali Martinez, Bitcoin (BTC) may have recently reached its peak in the current bull market cycle. The analyst mentioned that $59,800 is a critical threshold for the largest cryptocurrency, and if the price stays below this threshold, the downward pressure will continue.

Bitcoin’s Decline May Continue

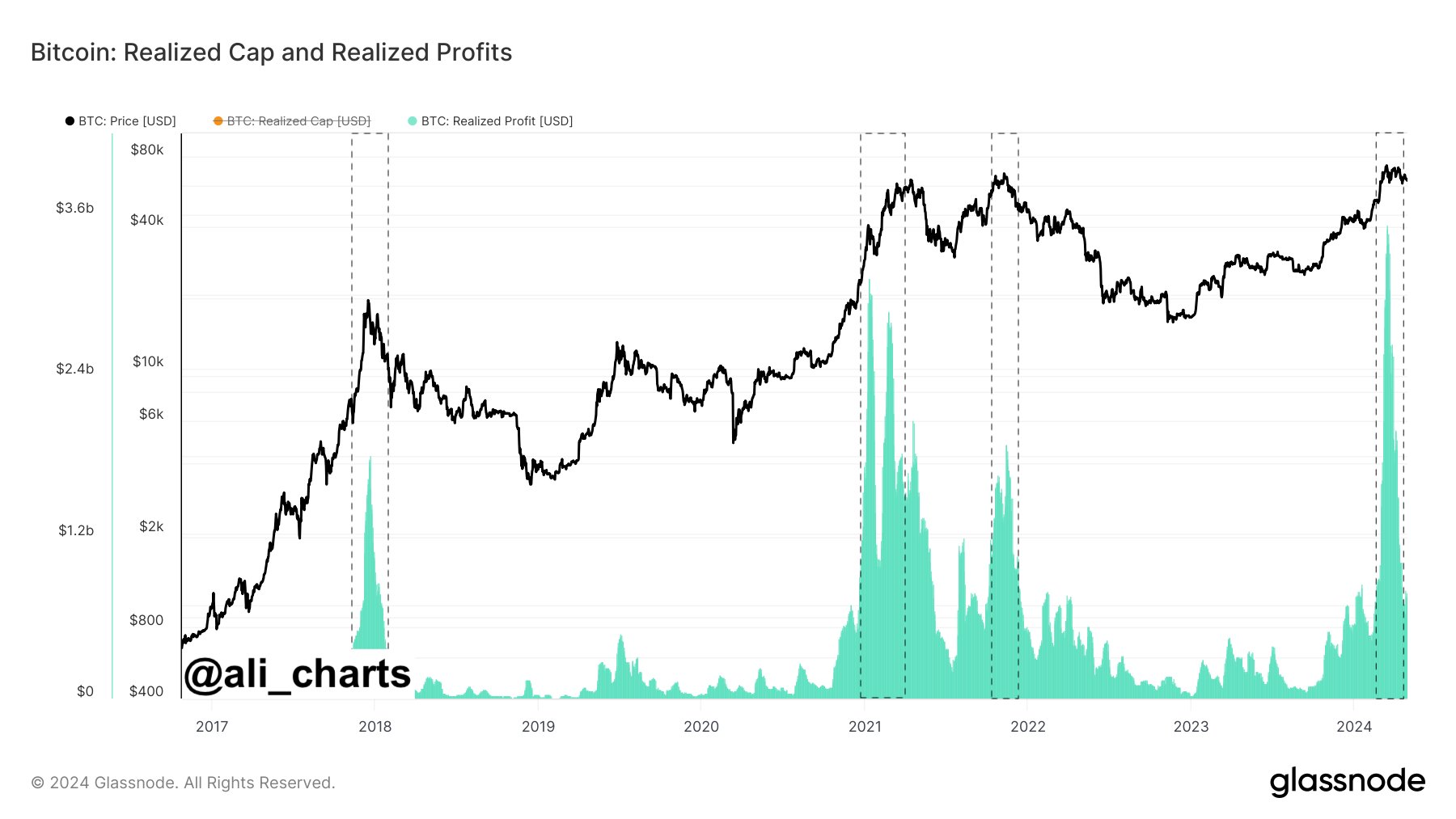

Martinez shared his latest Bitcoin observations with his followers on his personal X account, highlighting the historical correlation between realized profits in the Bitcoin market and market peaks.

The analyst pointed out that during Bitcoin’s rise above $73,000, reaching an all-time high, the realized profit overshadowed those observed during previous bull market peaks in 2018, 2021, and 2022. “Last month, while BTC peaked at $73,880, the realized profit rose to $3.52 billion. This could be a potential peak sign in the Bitcoin market,” he said.

According to Martinez, the achieved realized profit indicates a critical turning point in the market’s direction. The analyst added that further confirmation is needed before solidifying the downward expectation, and staying below the short-term realized price around $59,800 could potentially confirm the market peak.

At the time this article was prepared, Bitcoin was trading below the $59,800 threshold mentioned by the analyst, at $57,489. This suggests that the largest cryptocurrency is under selling pressure and may have reached its peak in the current cycle.

Will Bitcoin Rise?

However, Martinez also outlined a scenario where the downward trend could turn into an upward trend if Bitcoin passes a significant price threshold. “If Bitcoin can surpass $66,250 and confirm this level as support, the downward scenario will lose its validity,” he said.

According to the analyst, surpassing $66,250 will strengthen the momentum of the largest cryptocurrency and pave the way for a rise towards $69,150. If this resistance is breached, Bitcoin could target its all-time high of $92,190.