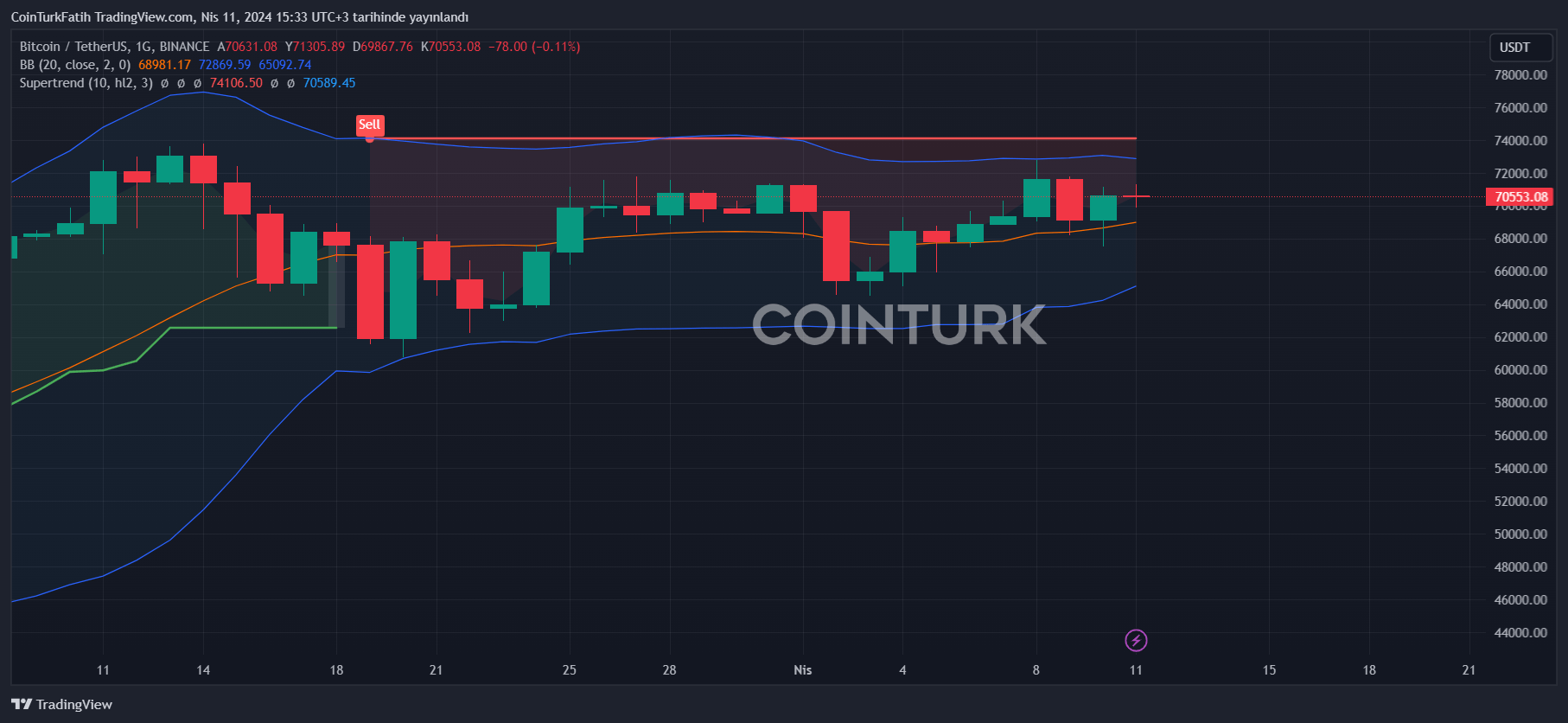

Bitcoin (BTC) experienced a sharp decline following the release of US inflation data but subsequently rallied. Now, data as significant as consumer inflation has been released. The recent data presents producer inflation, which serves as a leading indicator of the Federal Reserve’s (Fed) stance in its fight against inflation.

Will Cryptocurrencies Decline?

US Producer Inflation data has been disclosed. The latest CPI figures came in high, which could work against cryptocurrencies. Following the disappointing data, the Fed’s interest rate cuts have been postponed until the September meeting. Worse yet, Chairman Powell has not yet given a comprehensive assessment speech regarding the latest data. If the Fed hints at a further 25 basis points hike as expected, the situation could deteriorate.

It was anticipated that the Fed would reach its 2% inflation target by 2025, with the first rate cut expected in March 2023. However, poor data from the first quarter has reversed these expectations.

PPI data was announced at 2.1% against an expectation of 2.2%. Core PPI came in at 2.4%, against the expectation of 2.3%. The previous month’s figures were 1.6% and 2%, respectively.

Türkçe

Türkçe Español

Español