The price of Ethereum experienced a 9.7% decline, falling to $1,664 on Tuesday, returning to a troubled zone for investors. The leading smart contract token dropped from its support level of $1,800 amidst market-wide selling that caused Bitcoin to drop from $29,000 to seek support at $25,000.

Ethereum Coin and Its Future

Ethereum has come under heavy selling pressure as investors quickly switch to short positions, leaving many investors in a state of liquidation. The expected support between $1,780 and $1,800, due to the presence of the 200-day Exponential Moving Average (EMA), did little to prevent bears from pushing the price down.

Trading below the upper-trendline support that has provided support since November 2022 after the collapse of the FTX exchange has increased bearish tendencies, encouraging traders to sell more.

Although the ETH price reached $1,545 during the decline, a strong rebound reclaimed the support at $1,600 with the help of the lower-trendline. This buyer congestion continues to be critical for the resumption of the upward trend, even as Ethereum escapes at $1,664.

What is the Price of ETH in Turkish Lira?

Since reaching $2,144 in April, Ethereum has faced a weakening market structure. The battle between bulls and bears has trapped Ethereum in a rectangular pattern with resistance at $2,000 and support at $1,650. Within the rectangle, a narrow range has formed as Ethereum holds on to higher support at $1,800. After last week’s losses, the ETH price is now at a crossroads:

A break below the rectangle support of $1,650 could trigger another breakdown, potentially leading Ethereum to fall to $1.56, a 17.76% drop. On the other side of the trendline, if this support holds, bulls may be encouraged to push their efforts and attempt a breakthrough above $2,000.

In the short term, the outcome may likely be in favor of a bearish direction, depending on the appearance of the Moving Average Convergence Divergence (MACD) indicator moving below the average line (0.00).

Despite being in a continuous downward trend since early July, the Relative Strength Index (RSI) is not yet completely oversold. This indicates that sellers still have room to maneuver and may push the price further down. Additionally, 1 Ethereum is currently trading at 45,783 TL with a 0.29% decrease.

SEC and ETF Approval

Investors are becoming increasingly cautious about exposure to crypto products, as revealed by CoinShares’ report on crypto asset investment products. Crypto investment products recorded outflows of up to $55 million last week, compared to $29 million in inflows the previous week.

While the market-wide sell-off may have contributed to the poor figures in crypto asset investment products, the CoinShares report argues that this can be attributed to the media’s response emphasizing that the US Securities and Exchange Commission (SEC) is not close to approving a US spot-based ETF.

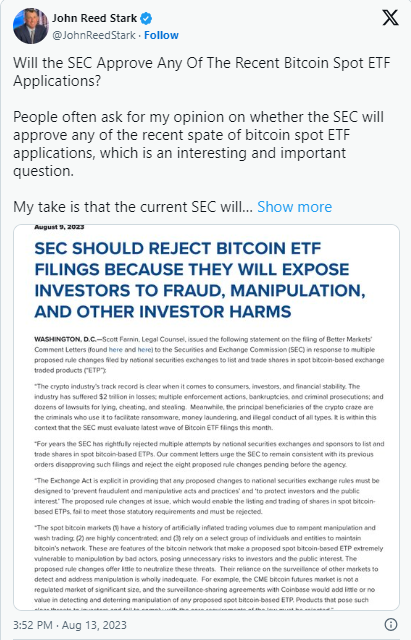

According to John Reed, a former SEC attorney, it is unlikely that the SEC will approve a spot-based ETF. Reed referred to Better Markets’ views in a letter to the SEC, urging the agency not to approve any spot-based ETF.

Although Bitcoin has been the most affected by the uncertainty surrounding ETF approval, Ethereum saw outflows of $9 million, erasing the $2.5 million it gained the previous week. Given the current turmoil, the crypto markets, especially with the Federal Reserve considering further interest rate hikes in September, may remain in this devastated environment.