For cryptocurrency investors, the approval of the spot Bitcoin ETF is a powerful price catalyst, at least as strong as the upcoming halving. However, the SEC has always rejected the applications so far. While the negative responses to the applications result in loss of earnings for cryptocurrency investors, the situation is much different for Grayscale. The fate of the crypto giant depends on this.

GBTC Lawsuit

Grayscale has to be strong due to its bankrupt subsidiary Genesis and its struggling parent company DCG. The only way to do this is for GBTC to be approved by the SEC to become a spot Bitcoin ETF. Since the SEC did not grant this approval, the last resort was to knock on the court’s door, and Grayscale was found to be right.

The victory of Grayscale in the GBTC lawsuit deeply shook the SEC, and their only statement so far was that they were reviewing the decision. However, the SEC’s deadline to request a final hearing with all the court members expires by Friday. In other words, the SEC has reached the end of the road in the GBTC case.

The glass is more than half full because all the court members found Grayscale to be right. The SEC could not provide a reasonable argument for approving futures ETFs while rejecting spot ETFs. This resulted in them losing the case.

Will Spot Bitcoin ETF Be Approved?

Let’s go back months and remember the transcripts from the first Grayscale hearing. You can also take a look at our article on Grayscale Hearing Transcripts. The SEC’s lawyers prevented the transformation of GBTC into an ETF by stating that the spot ETF would be speculative and would pose risks to investors.

The court did not present another strong argument. There is a reason why we are referring back to the hearing transcripts. If the SEC wants to continue rejecting spot BTC ETF approvals, it has two options. Either it will play its last card to overturn the GBTC decision by Friday. Or it will come up with another rejection argument.

If they have another rejection argument, why didn’t we see it in the hearing transcripts? Then the SEC’s strongest and only rejection argument will disappear after Friday. Since they have approved ETF futures, they are not considering canceling and backtracking on BTC futures.

So they have only one option left. If the SEC lawyers do not come up with another rejection argument that did not occur to them during the GBTC case, we will see the approval of Spot Bitcoin ETF start to come in. And the first ETF to be launched will be Grayscale, which emerged victorious from the tough battle.

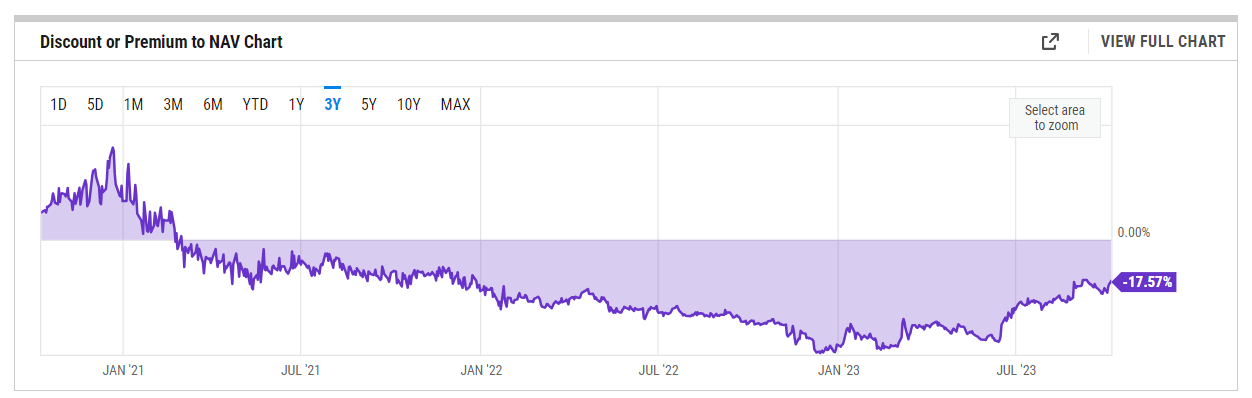

This is a great success story, and if the cryptocurrency markets are going to enter a period of growth by the end of the day on Friday, investors can buy into this expectation. On the other hand, the negative premium of GBTC, which returned to its levels at the end of 2021, is around 17%. This indicates that investors’ interest in Grayscale Bitcoin Trust has increased due to the possibility of GBTC turning into Spot BTC ETF.

Türkçe

Türkçe Español

Español