Cryptocurrency markets have experienced a relatively calm period compared to previous times, but it has been more challenging for these three altcoins. Will the decline momentum in these altcoins continue?

BETA Price Analysis!

The price of BETA broke the rising support trend line on June 10. It then bounced twice on June 23 and July 11, confirming the line as resistance. Such movements are commonly seen after a decline momentum. Since then, the altcoin has been declining. On October 4, it reached the lowest level of $0.067, confirming the ongoing descending support trend line since June.

The mentioned region is said to be the last support level before the lowest level of the year. If BETA breaks the line, it could drop by 15% and reach the horizontal support area of $0.058. This level would mean a new low of the year. On the other hand, a bounce could cause a 28% increase to the next nearest resistance at $0.089.

Current Status of BOND and WTC!

The price of BOND fell below the descending resistance trend line since January 22. This line has been rejected multiple times so far, with the latest rejection on October 1. According to experts, the daily RSI supports the ongoing decline. Investors use RSI as a momentum indicator to determine overbought or oversold conditions and decide whether a token should be accumulated or sold. Readings above 50 and a rising trend indicate that bulls still have the advantage, while readings below 50 indicate the opposite.

As RSI is rejected by 50, the descending resistance trend line rejected the price. This also supports the downward movement, according to analysts. If the price continues to decline in the cryptocurrency, the next support could be at $1.78, which is the 1.61 external Fib retracement of the last uptrend. The decline could lead to a 17% drop as the new lowest price of all time.

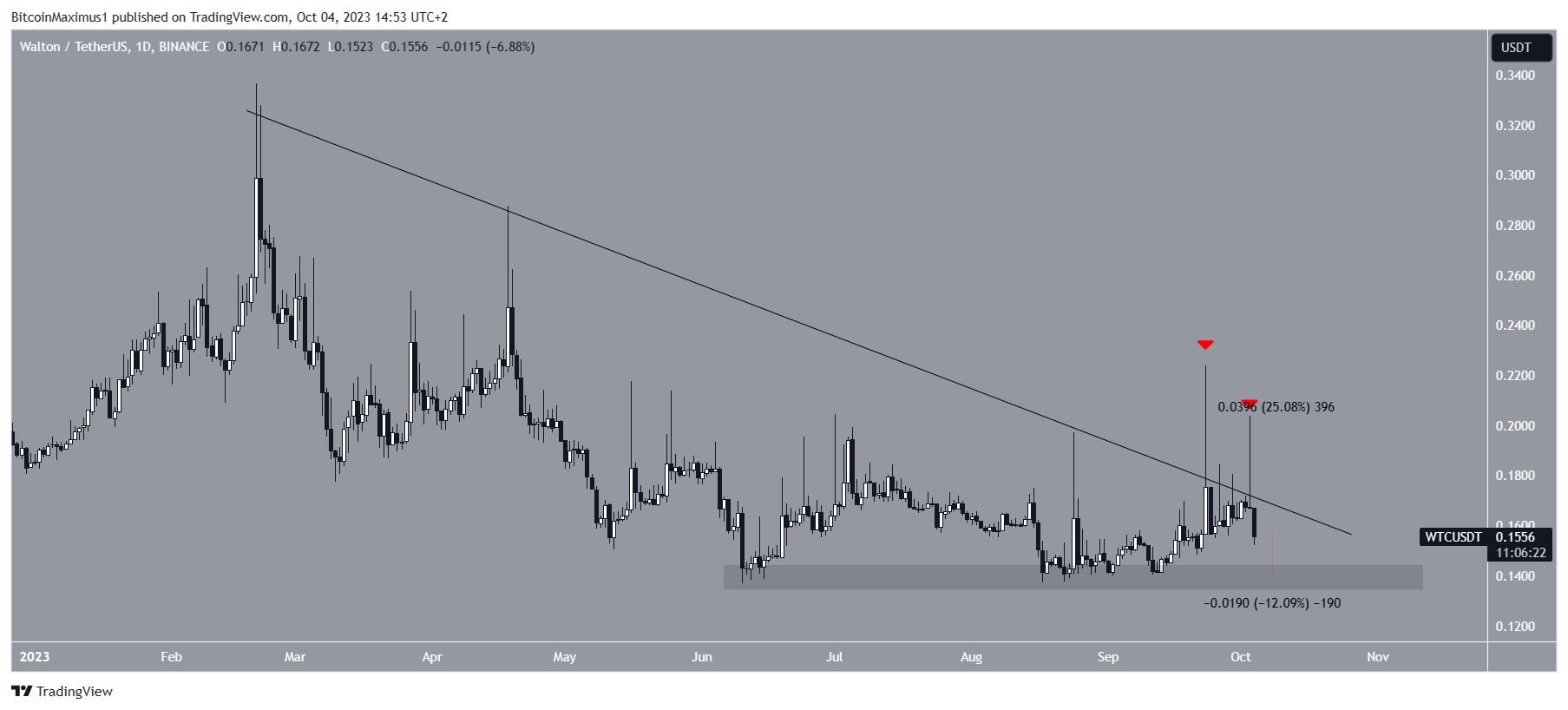

The price of WTC fell below a descending resistance trend line since February 2023. The line has been rejected multiple times, with the latest rejections on September 23 and October 3. Both created long upper wicks, indicating that sellers took control. If the rejection continues, the WTC price could drop to the nearest support at $0.140. This represents a 12% decrease compared to the current price of the token. On the other hand, a sudden breakout from the resistance trend line could cause a 25% jump, taking the price to the resistance area of $0.200.

Türkçe

Türkçe Español

Español