Willy Woo’s Bitcoin prediction has created significant excitement within the cryptocurrency community. Considering Woo’s past successful forecasts, this prediction is noteworthy. Particularly, speculations following the approval of spot Bitcoin ETFs seem to reinforce Woo’s predictions.

Growing Interest in Bitcoin

The approval of spot Bitcoin ETFs has facilitated traditional investors’ access to digital assets, thereby increasing interest in Bitcoin. This has allowed Bitcoin to reach a broader investor base, causing significant price volatility. Woo indicates that this situation has led to a substantial influx of capital into the cryptocurrency.

As Woo highlights, spot Bitcoin ETFs have created a bridge between traditional financial markets and the crypto world. Considering the traditional markets’ massive size of 100 trillion dollars, Bitcoin’s presence on these platforms could accelerate the acceptance and adoption of digital assets.

Bitcoin Shows Historical Parallels

We are in a period where Bitcoin is trading at $67,182, with daily and weekly increases of 0.5% and 8.4%, respectively. These increases are generating significant excitement in the cryptocurrency community. However, upon examining the roots of this rise, we see an interesting parallel to periods when Bitcoin experienced similar growth in the past.

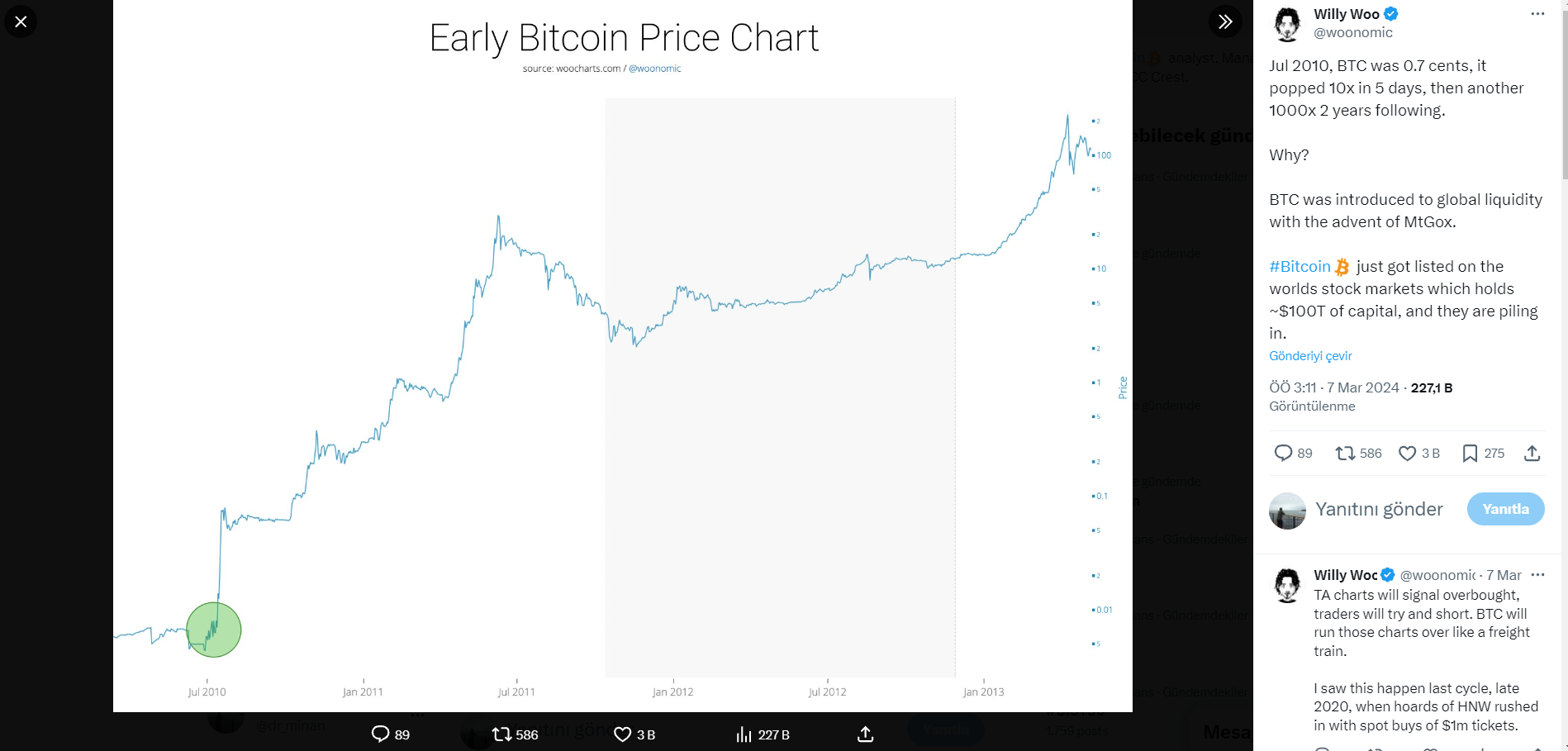

Bitcoin saw a similar rapid increase during its foundational period on the Mt. Gox exchange platform in 2010. The initial surge in global liquidity caused Bitcoin to increase tenfold in five days and recorded a thousandfold increase over the following two years.

Famed analyst Woo claims this period presented a significant opportunity for Bitcoin. He notes that Bitcoin recently reached an all-time high of $69,000 and has shown steady stability at these levels. This creates considerable optimism within the crypto community and signals a potential explosion. Woo hints at the possibility of a significant increase on the cards.

Uncertainties and Reservations Persist

It is important to remember that past performance does not guarantee future results. Even though technical analysis charts currently indicate an overbought market, some analysts still believe technical indicators can be effective in determining price direction.

At this point, there is some uncertainty and reservation among investors. Some highlight that excessive enthusiasm calls for caution and the market may still face decisive factors.

Türkçe

Türkçe Español

Español