XRP, recently, has been drawing attention not only due to its price rise but also due to the increased liquidity in US-based exchanges. This makes US exchanges more attractive to whales wanting to execute large transactions.

Liquidity of XRP in US-Based Exchanges Increases

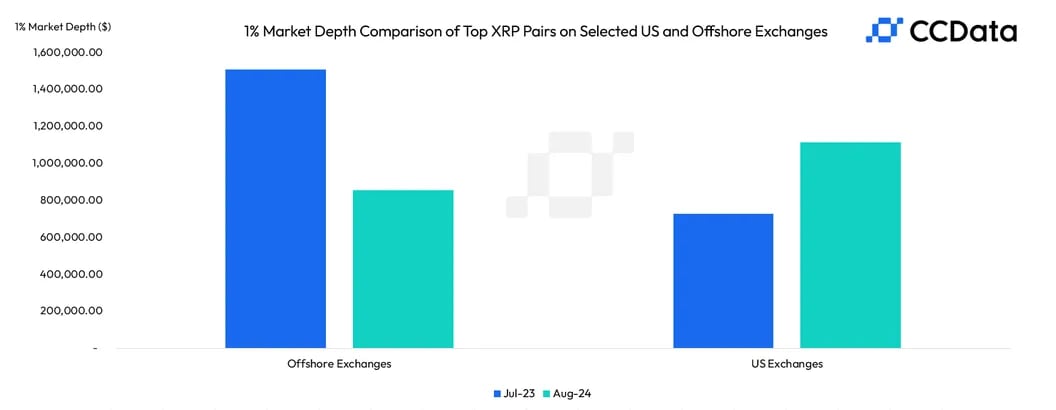

As of Thursday, US-based exchanges like the Nasdaq-listed Coinbase (COIN) and Kraken reached $1.12 million in the metric known as 1% market depth. This represents 30% higher liquidity compared to offshore exchanges like Binance and OKX. The 1% market depth indicates that at least $1.12 million worth of transactions must pass through US exchanges to move the spot price by 1%. In offshore exchanges, a smaller transaction volume can create the same effect.

Market depth refers to the ability to handle large buy and sell orders without significantly affecting the market price. The 1% depth is used to evaluate liquidity conditions by analyzing orders within a 1% range of the asset’s market price. The higher the depth, the easier it is to execute large orders with minimal slippage.

Moreover, the XRP trading volume in US exchanges is also increasing. However, offshore exchanges are still dominant. US exchanges currently account for 14% of global XRP volume, a level last seen four years ago.

SEC Obstacle for Ripple and XRP Removed

The positive development in US exchanges is believed to be due to the reduction in regulatory uncertainties for XRP. Last year, Ripple Labs achieved a partial victory in its long-standing case with the US Securities and Exchange Commission (SEC). The court ruled that Ripple’s institutional sales of XRP were not sales to individual investors, thus not considered an unregistered securities offering. Following this decision, demand for XRP in the US market has steadily increased.

Earlier this week, the court fined Ripple $125 million for its institutional sales of XRP. The fine was significantly lower than the $2 billion demanded by the SEC, causing XRP’s price to rise by 20%. The decision is seen as a positive sign for Ripple’s presence in the US market, its liquidity, and future price movements of XRP.

Türkçe

Türkçe Español

Español