Amidst the recent market downturn, Ripple‘s XRP has shown signs of recovery, leading prominent analyst Dark Defender to identify key support and resistance levels that investors should closely monitor.

XRP Analysis

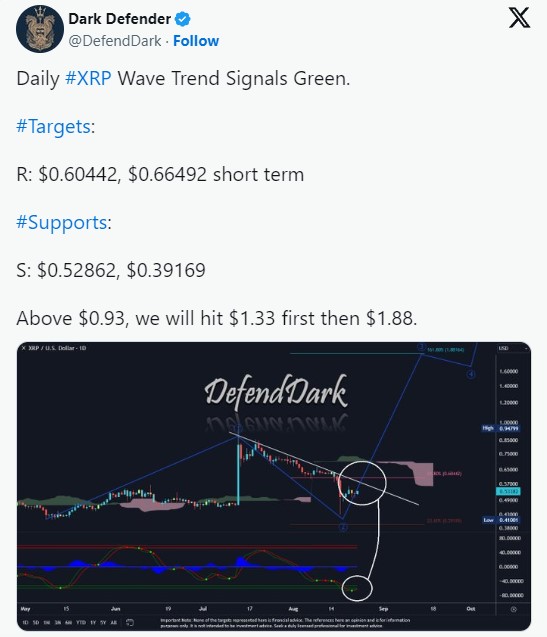

Esteemed analyst Dark Defender recently highlighted the current support and resistance levels for XRP, which is the fifth largest cryptocurrency by market value. Based on the daily chart analysis of XRP, the analyst indicates a positive price outlook due to the green signal of the daily wave trend.

As mentioned by the analyst, the initial support level for XRP was $0.52886. However, XRP is currently trading at $0.5161, falling below this support level after experiencing a decline following yesterday’s gains. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

XRP rose to $0.5368 earlier today, but has since been on a downward trend and broke below the $0.52886 support level. The next support line lies at $0.39169. On the other hand, if XRP recovers, Dark Defender has identified the first major resistance level at $0.60442. XRP has not reached this price point for over a week.

Although XRP has remained below this level for eight days, a sustained recovery could enable it to surpass this resistance. According to Dark Defender’s short-term analysis, achieving this would set the next target at $0.66492.

Looking ahead, the analyst sees a longer-term potential for XRP to reach and surpass parity with the US dollar. It is worth noting that XRP reached $0.9380 on July 13th following Judge Analisa Torres’ positive decision.

Dark Defender sets a target of $1.33 once XRP surpasses the $0.93 resistance. The analyst predicts a rise to $1.88, which represents an impressive 258% increase from the current price.

XRP Price Outlook

The recent recovery attempts of XRP came after a decline that started on August 15th when the crypto asset fell below the psychological support level of $0.60. In the following days, bears further jeopardized XRP’s position, causing it to drop to $0.4226, the lowest level in two months, on August 17th.

Since then, despite modest recovery, XRP has continued its downward trend. Although the current recovery campaign provides some hope, caution is advised as the extent of its success has yet to be determined.

Türkçe

Türkçe Español

Español