Ripple‘s recent price performance has resulted in a significant pullback, following the gains made after the Ripple decision in early July. The token, which aims to innovate cross-border transactions, may be struggling to secure support at $0.60 and potentially face shocking losses down to $0.50 and $0.40.

The Ripple Case Turned in Favor of XRP

Despite the partial ruling by Judge Analisa Torres, which determined that XRP sales conducted by third-party exchanges are not securities like those made directly to institutional investors, the XRP price failed to reach $1 and dampened hopes of a rally to its all-time high of $3.40.

The Securities and Exchange Commission (SEC) filing for a “temporary stay” of the court’s decision, announced on Wednesday, could further complicate the situation in the XRP market and potentially prevent the rise to $1.

While the regulatory agency objects to part of the Ripple decision, the remaining part of the case will be left for trial.

Will XRP Price Rise?

Despite the upcoming appeal, the XRP price appears to be fueling a breakout of a descending wedge pattern on the daily chart. The descending wedge, consisting of two downward trend lines connecting a series of lower highs and lower lows, suggests that the downtrend is nearing its tail end and a reversal is implied.

The break above the upper trend line around $0.65 confirms the wedge’s break height, indicating a potential breakout equal to the formation’s height. Investors looking to expose themselves to new XRP long positions may want to wait for the price to recover from immediate support at the 50-day Exponential Moving Average (EMA) (red) at $0.6261.

Moving Average Convergence Divergence (MACD) indicator should also turn bullish to validate the uptrend. Such a call may occur when the blue MACD line crosses above the red signal line.

Buy orders activated above $0.65 may target the initial profit at $0.70, which could lead to a reach of $0.85. Extremely bullish traders may decide to wait and see until the XRP price encounters resistance at $1.

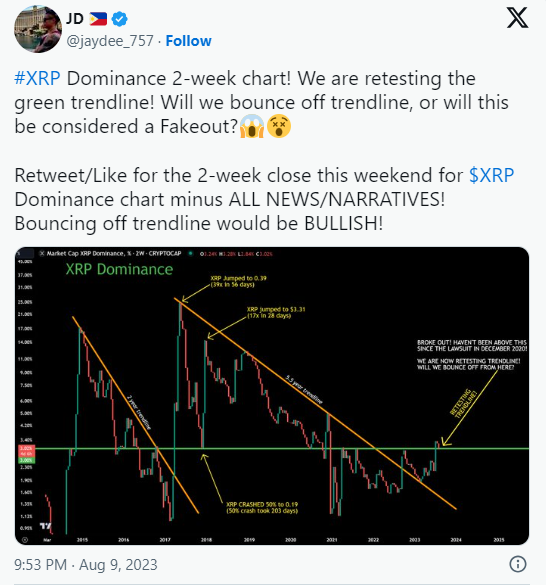

Fundamentally, XRP dominance has returned to retest a significant trendline based on a chart previously shared by crypto analyst JD on Twitter, now known as X. If dominance reverses from the trendline, investors may expect a rally towards $1.

However, if it turns out to be a fakeout, losses could gain momentum below $0.60 and potentially reach $0.50 and $0.40, respectively. Meanwhile, the XRP price is testing the daily Point of Control (dPOC) at $0.6344 after being rejected at $0.6433 at the daily open (dOpen). If pressure intensifies, losses could stretch down to the weekly open (wOpen) at $0.6234 and the weekly Point of Control (wPOC) at $0.5974.

The resumption of the uptrend depends on bulls’ ability to push the XRP price beyond the dOpen at $0.6433 – this move could potentially open the door to gains at the monthly Point of Control (mPOC) at $0.6763 and then resistances at $0.70, $0.85, and $1.