Ripple‘s native token, XRP, gained over 10% on November 6th, reaching its highest level in the past three months at $0.72. This surge in XRP’s value came after Grayscale, a New York-based investment firm, made a decision on its Bitcoin investment product on October 19th.

Why is XRP Surging?

According to reports, Grayscale has refiled its application with the US Securities and Exchange Commission (SEC) to convert its Bitcoin investment product into a spot ETF. This development has sparked a recovery in the cryptocurrency market. Since this announcement, XRP has gained approximately 45% in value, becoming the fourth largest cryptocurrency by market capitalization. As a result, Cardano has slipped down in the rankings.

Furthermore, the positive news surrounding XRP continues to drive its price higher. Ripple Labs recently received regulatory approval for XRP in the Dubai International Financial Centre (DIFC), which has further boosted its momentum. Financial institutions in the DIFC can now legally transact with XRP tokens.

In addition to these developments, the gains in the XRP/USD pair have come amidst speculations that Ripple may announce its Initial Public Offering (IPO) plans before the Swell conference in Dubai on November 8-9.

Historically, XRP’s price has responded positively to similar positive developments surrounding the Swell event. Additionally, Ripple recently obtained approval from the National Bank of Georgia to develop central bank digital currency (CBDC) projects.

XRP Whales Continue to Accumulate

The recent price rally in XRP has led to a fierce accumulation battle among the richest XRP investors. According to blockchain data analysis firm Santiment, the supply held by addresses with holdings ranging from 100,000 to 1 billion XRP reached its highest level in November 2023, setting a new record.

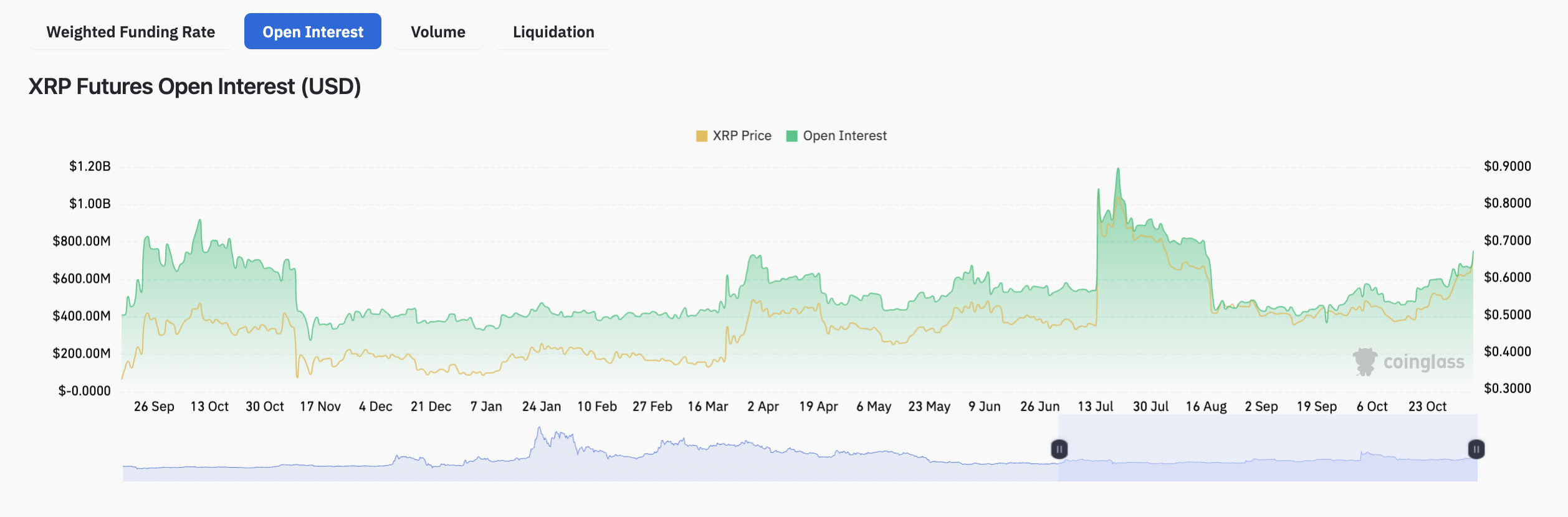

The price increase in XRP is accompanied by gains in the futures market as well. For example, the open interest (OI) of the cryptocurrency increased by approximately 13.5% in the past 24 hours, reaching $751.75 million. However, this figure has not yet surpassed the $1.19 billion OI recorded following the SEC-Ripple court decision in July.

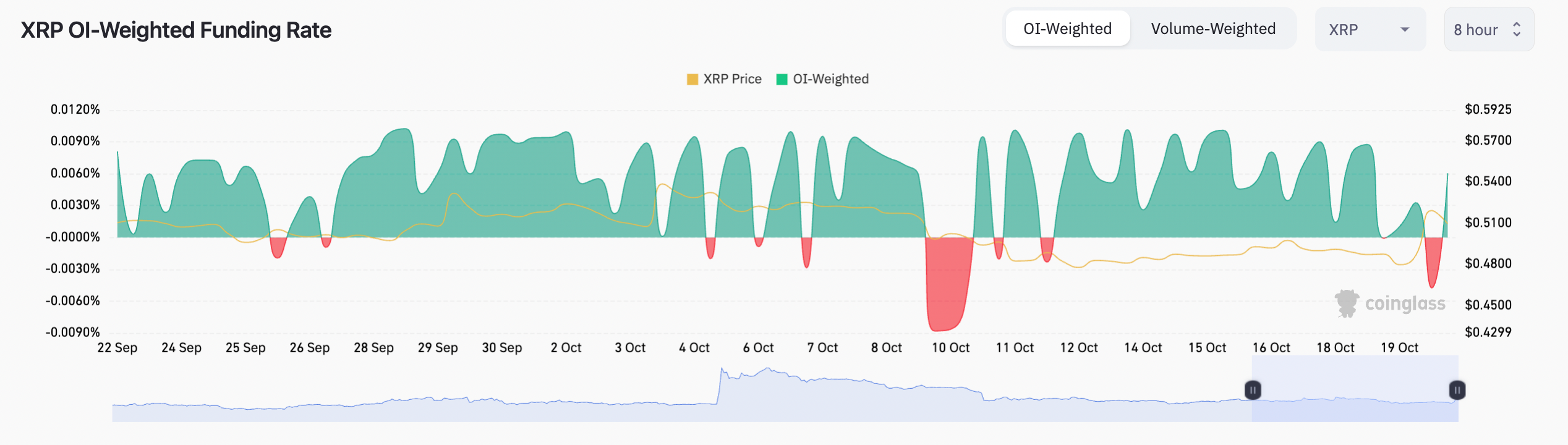

Additionally, the funding rate for XRP’s OI dropped from 0.03% to 0.01% every eight hours on November 6th. This corresponds to a weekly rate of 0.2%, indicating that long positions are covering the leverage cost. However, it is worth noting that funding rates below 1% are not considered expensive.

Türkçe

Türkçe Español

Español