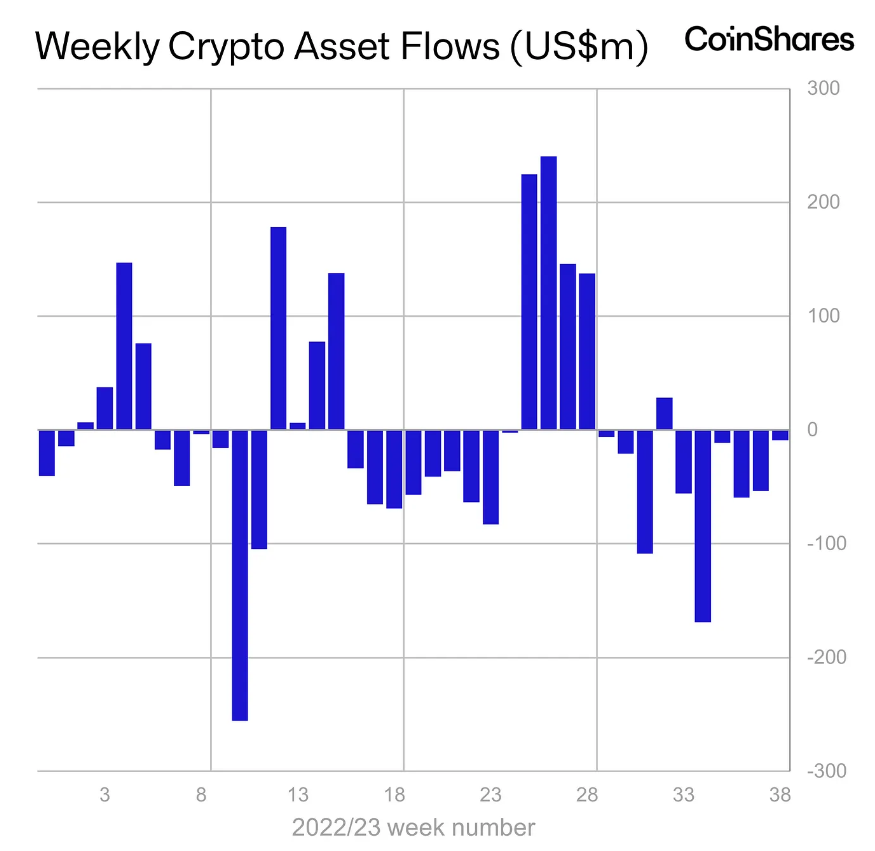

Crypto investment instruments recorded consecutive six-week fund outflows during the week ending September 24. According to data published by fund management company and data analysis platform CoinShares, fund outflows from crypto asset investment products reached $9 million last week. While there was a $16 million entry into crypto asset products in Europe, there was a $14 million outflow from US-based crypto investment products. This difference is attributed to the uncertainty surrounding crypto regulations in the US.

XRP and Solana Gain Trust

In the Bitcoin front, this situation has been occurring for the past three weeks. Fund outflows reached $6 million last week. Ethereum also joined this trend, experiencing $2.2 million asset outflows in the past six weeks.

While Ethereum, the king of altcoins, has been experiencing consecutive six-week asset outflows, other noteworthy altcoins XRP and Solana saw fund inflows. XRP had a fund inflow of $0.66 million last week, while Solana reached $0.30 million, leading to increased investor confidence. The report also mentioned that investors are keeping an eye on these altcoins due to ongoing fund inflows in the XRP and Solana fronts.

American Investors Concerned

The report also revealed a regional investment sensitivity among investors in Europe and the United States. This can be understood by the $16 million entry into crypto asset products in Europe and the $14 million outflow from US-based crypto investment products.

This regional difference is attributed to the uncertainty surrounding crypto regulations in the US and the recent decisions taken by the US Securities and Exchange Commission against crypto companies.

The report also highlighted that the weekly trading volume in the crypto market has dropped well below the average level of $1.16 billion in 2023. According to the report, this average has dropped below $820 million in recent weeks.

The latest crypto asset market report published by CoinShares reflects the current market dynamics along with the downward pressure in the market. The price of Bitcoin is currently stuck below the $27,000 resistance and has remained stagnant since the Federal Open Market Committee (FOMC) meeting where the decision to not raise interest rates for the quarter was made. Meanwhile, the delay in payments to Mt. Gox creditors also played a significant role in the BTC price last week, but BTC was not significantly affected by these two major market events.

Türkçe

Türkçe Español

Español