Uniswap (UNI) seems to have encountered a major obstacle in its price recovery attempts in the $4.30 range in September. On-chain analysis provides data-based Uniswap price prediction for the coming weeks.

Network Activity in UNI!

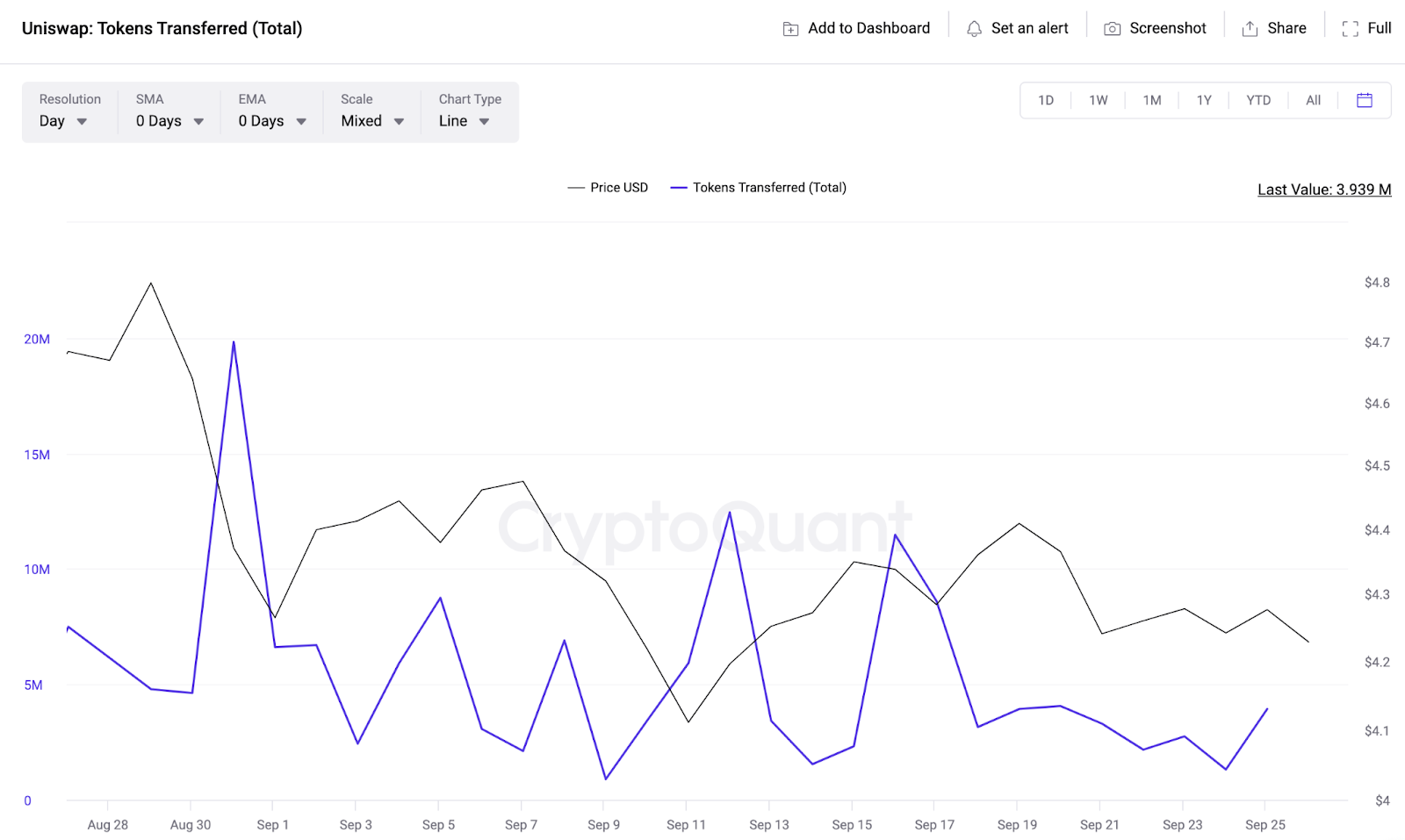

The price of popular altcoin Uniswap continues to fluctuate in September due to a decrease in network demand. Will the bears push it below $4? Uniswap network demand entered another downward trend this week after a short revival in mid-September. On-chain data compiled by Cryptoquant reveals that only 3.9 million UNI tokens were distributed in network transactions on September 25.

This represents a 67% decrease compared to the 11.5 million UNI tokens transferred on September 16. The measurement of transferred tokens tracks the total number of tokens distributed in network transactions during a specific period. The decrease in transferred tokens may indicate a decrease in demand. The Uniswap price has been declining for most of September 2023. On-chain data reveals that the increasing amount of currency deposits plays a critical role in the ongoing price decline.

At the end of August, the total Uniswap tokens held in wallets hosted on exchanges stood at 45.3 million. However, as of September 26, this figure rose to 47.02 million. This represents a net inflow of 1.7 million tokens deposited into various cryptocurrency exchanges this month.

Currency reserves track the total deposits currently held in wallets hosted by recognized exchanges owned by cryptocurrency holders. In general, when investors continue to increase their currency deposits, it indicates a dominant downward trend.

Large Transfers in UNI!

The entry of 1.7 million UNI tokens worth $7.3 million into exchanges indicates the addition of additional UNI to the exchanges, which could be a sign of an upcoming sell-off. The decrease in Uniswap network demand and relatively high currency reserves could trigger another UNI price correction.

On the other hand, if the price surpasses $6, Uniswap bulls can take control. However, as seen above, 42,300 addresses had bought 69.1 million UNI tokens at a maximum price of $5.81. If currency reserves remain high, they can take early profits and put Uniswap into a downward trend.