Cryptocurrency investors are expecting significant price increases in the markets over the next 2 years, based on the 4-year cycles. But why? Because we have witnessed in previous years that the price has always moved in accordance with these cycles. On-chain models, technical setups, many have been shaped accordingly. But is it really like that?

Cryptocurrency Market Cycles

The number of investors who believe that there will be an upward trend in the next 2 years is not negligible. So why don’t we see a strong risk appetite today? The psychology of bear markets is extremely challenging. Investors who have encountered cryptocurrencies in 2021 felt like investment geniuses, but what most experts were trying to explain was these times. Bear markets are a period where even geniuses incur losses. Moreover, during the bull season, when everything is rising, even 89 IQ investors can witness capital growth that geniuses would see in normal markets.

So, can the relationship between Bitcoin price and halving, along with the 4-year market cycles built upon it, be questioned? Absolutely, by looking at the relationship between the price of Bitcoin and the yields of US Treasury bonds today.

When Will the Bitcoin Bull Run Begin?

When investors turn to safer options, risk markets perform poorly. Government bonds are the best investment option in uncertain environments like the ones we have been in for the past 2 years. Because they provide a certain level of return, albeit small.

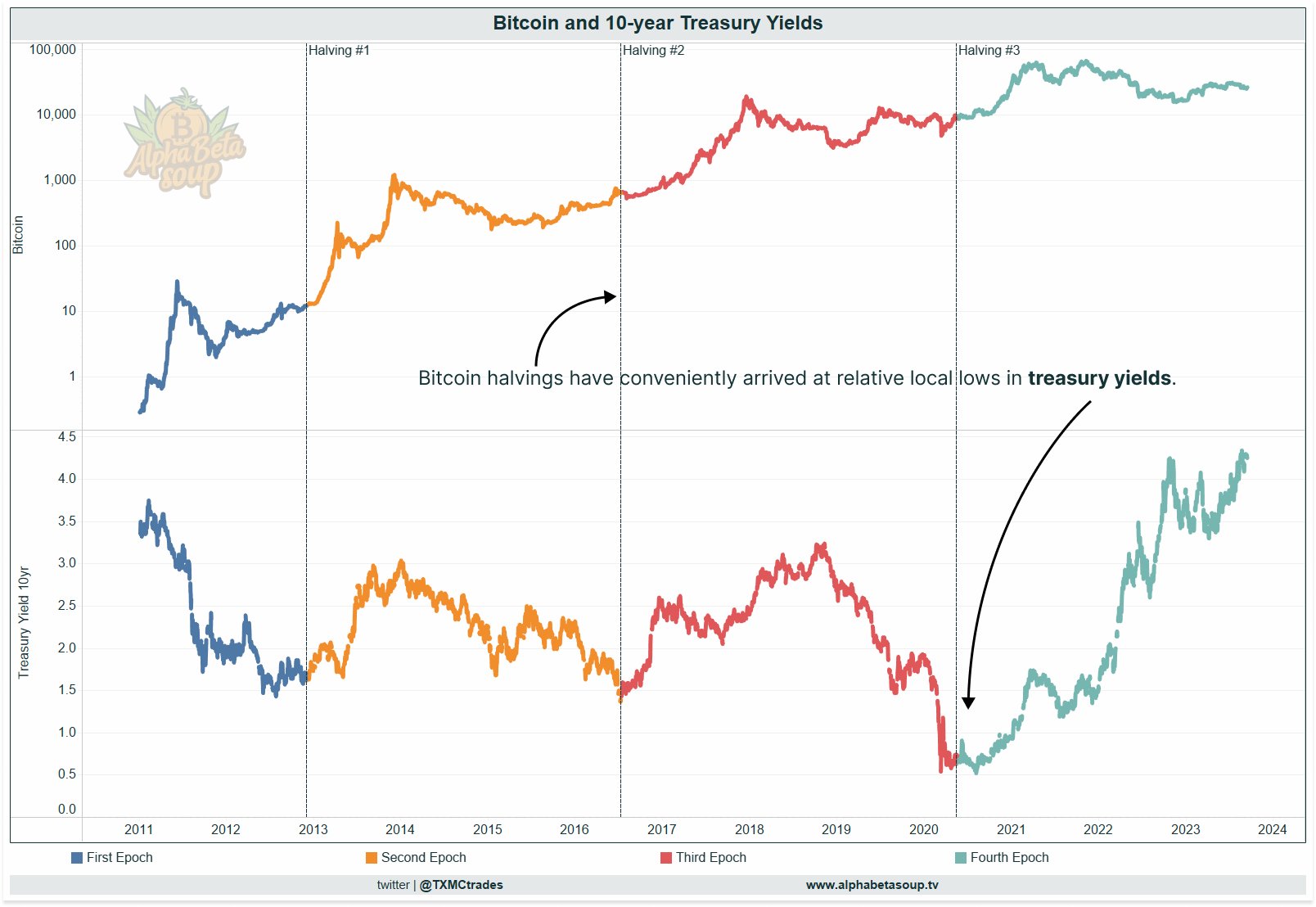

A noteworthy chart shared by TXMC from X account shows that the “relative local bottoms” in 10-year Treasury bond yields coincide with the halving period. Although the use of the term “relative” that does not exactly match the lowest level of the past three months is suspicious, past halving periods can be examined within this framework.

First of all, it is important to emphasize that the author claims that the correlation should not be taken as a “direct causal link between returns and BTC price”. In addition, TMXC suggests that more than 92% of Bitcoin’s supply has already been issued and that the possibility of daily issuance “supporting the price of the asset” is low.

When we examine the chart, neither halving nor the bottoming of bond yields alone is a definite signal of an upward trend.

Between October 5, 2020, and January 5, 2021, we saw a %247 increase in the value of Bitcoin. This rally occurred 5 months after the halving. For example, during this period, the Russell 2000 Small Cap Index outperformed the S&P 500 companies with a performance difference of 14.5%. This indicates a significant increase in demand for riskier investment options (including those outside of BTC) during the same period.

Cryptocurrency Cycles: Conclusion

Halving, bottoms in bond yields, historical lows in exchange reserves, and whatever else, none of these are definitive triggers for a market rally. The only thing that triggers major bull seasons is the investor’s inclination towards risky assets, which is strengthened by the global market environment. We can give an example of ourselves. In environments where access to credit is facilitated and money becomes abundant with government support, people invest their surplus money in alternative investment options.

But what about today? Today, most investors spend their money on credit card minimum payments, food, and accommodation due to high interest rates, leaving them with no extra money. What do those who have money do? They turn to safer investment options in an environment of high inflation and limited credit. So, it is not difficult to understand why there is no significant capital inflow into cryptocurrencies.

How can this situation be reversed? Dozens of factors need to come together to make the rush to risk markets possible. Access to credit should be facilitated, M2 money supply should increase, expenses such as food and housing should not represent a large portion of income, and although bonds are guaranteed, they should be less attractive to capital holders due to their low returns. We can see that this environment will begin to emerge in September 2024. With interest rate cuts, money will become cheaper. However, unless we see a significant recovery in global inflation, considering that the target for 2025 is 3.9% interest rate, the narrative of the 4-year cycle may remain up in the air. Perhaps this time, we will start talking about 5, 6, 7-year cycle structures?

Türkçe

Türkçe Español

Español