In 2020, many experts agreed that the BTC price would drop below $3,000. Some even speculated it could go as low as $1,500. Although this view presented significant buying opportunities for many investors at the bottom, most of them hesitated to take action. As most altcoins approach their all-time lows these days, it is uncertain whether the same will happen again. However, there is now a widespread expectation of a drop to $12,000 for BTC.

Polkadot (DOT) Price

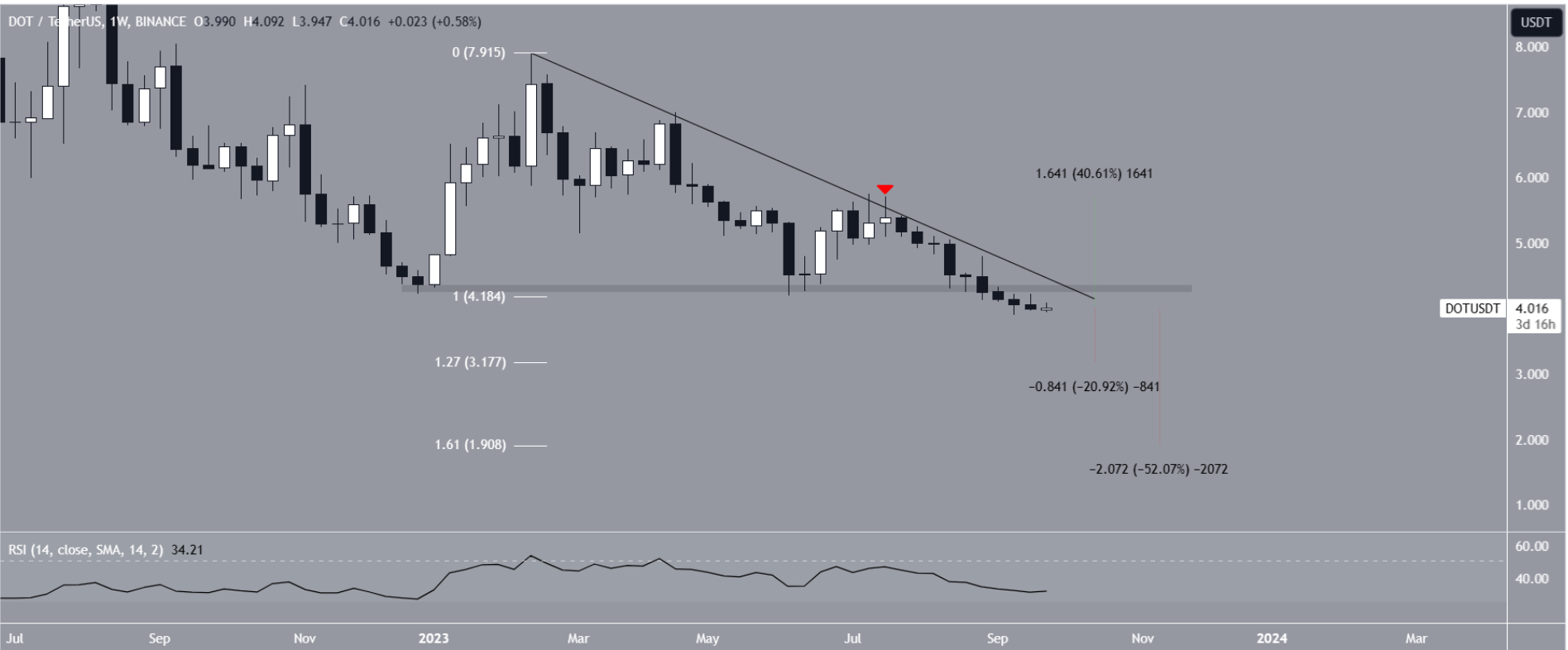

Throughout the year, we have seen a steady decline in the price of DOT Coin. Although there was a slight increase after the announcement by the Web3 Foundation in November 2022 that “DOT may not be a security,” there has been a 50% loss since February. In September, the popular altcoin dropped to $4.30. Now, it is expected that the $4.30 region will provide resistance.

The DOT price has dropped since February from its highest level of $7.90 this year. The decline remained below a descending resistance trend line. During the 221 days it traded below this line, DOT eroded by 50%. Although the resistance line was tested on July 21, the bulls failed to surpass this critical threshold.

DOT Coin Price Predictions

The daily RSI is in a downtrend. After serving as support at $4.30 throughout the year, it is now turning into resistance. If this region is strongly defended by the bears, we may see the DOT Coin price drop to the next Fib support at $2.69.

In a scenario where selling momentum intensifies, historical lows at $1.9 and $1.61 could also be revisited. Similarly, the weekly RSI is below 50 and falling, both of which are considered signs of a downtrend.

Despite all these negative factors, reclaiming the critical level of $4.30 and closing above the declining resistance trend line could indicate the end of the downtrend. In this case, we could see the price rise by approximately 40% to $5.70.

The current BTC price outlook supports the bearish sentiment for DOT Coin. If there is a massive inflow of BTC into exchanges, and if it is not aimed at manipulation, then we could expect the start of a sell-off in the coming days. On Friday, critical personal consumption expenditure data will be released, providing an important signal for inflation in the markets.