Crypto markets had a good start to the first business day of October. The price of BTC reached a daily high by surpassing $28,500. However, it faced some selling afterwards. Overbought signals on short-term charts indicate a potential pullback in price. So, what’s happening and what’s to come?

Bitcoin Bears Caught Off Guard

After a continuous rise for the past few days, it was expected that this recovery would also end in failure, as open interest had been decreasing. However, the opening of ETH ETFs today has sparked some excitement among investors.

The problem is that volumes have not increased as they should. This raises concerns that the rally could easily fizzle out. BTC sellers, who were expecting a decline, had strengthened their short positions. However, they incurred massive losses because the rally lasted longer than they anticipated.

Approximately $100 million was lost in the past 24 hours by those who had shorted Bitcoin (BTC) because it exceeded $28,000 after staying below that level for about a month. Liquidations accelerated as BTC surged by approximately 5% and reached $28,500.

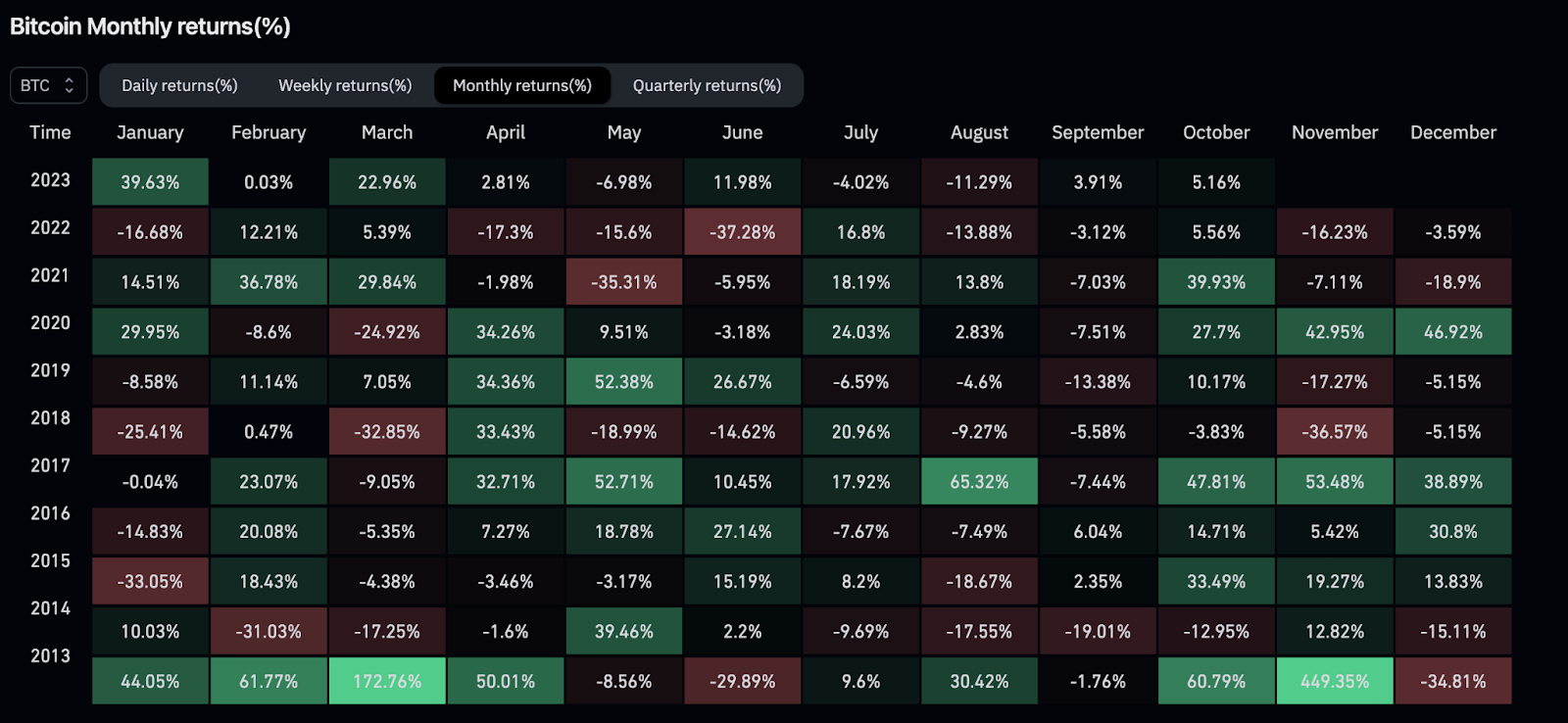

Cryptocurrencies and the Month of October

The biggest gainer among the top 20 cryptocurrencies was Solana (SOL). With an increase of 11.48%, its price surpassed $24.11. Along with the price increase of Solana, the Total Value Locked (TVL) of the network also reached its 2023 peak. This price increase was an important detail. TVL surpassing $337 million and sustaining this level in the future will be crucial for the recovery of SOL Coin.

As October approached, investors believed that the upcoming event would be a price increase due to its historical performance. October, popularly known as “Uptober,” has been the most profitable period for cryptocurrency investors. At least in the past 8 out of 10 years.

BTC has only generated negative returns twice since 2013, in 2014 and 2018. If the king cryptocurrency can remain above $28,300, it may lead to a retest of the $31,000 level. Moreover, the recovery of long-term moving averages strengthens the expectation of a strong rally before the halving.

Very good