InvestAnswers’ anonymous server and cryptocurrency analyst James predicted that the approval of a Bitcoin (BTC) exchange-traded fund (ETF) in the US would trigger a significant influx of money from Wall Street giants.

Prediction of Over 3,200% Rise in Bitcoin

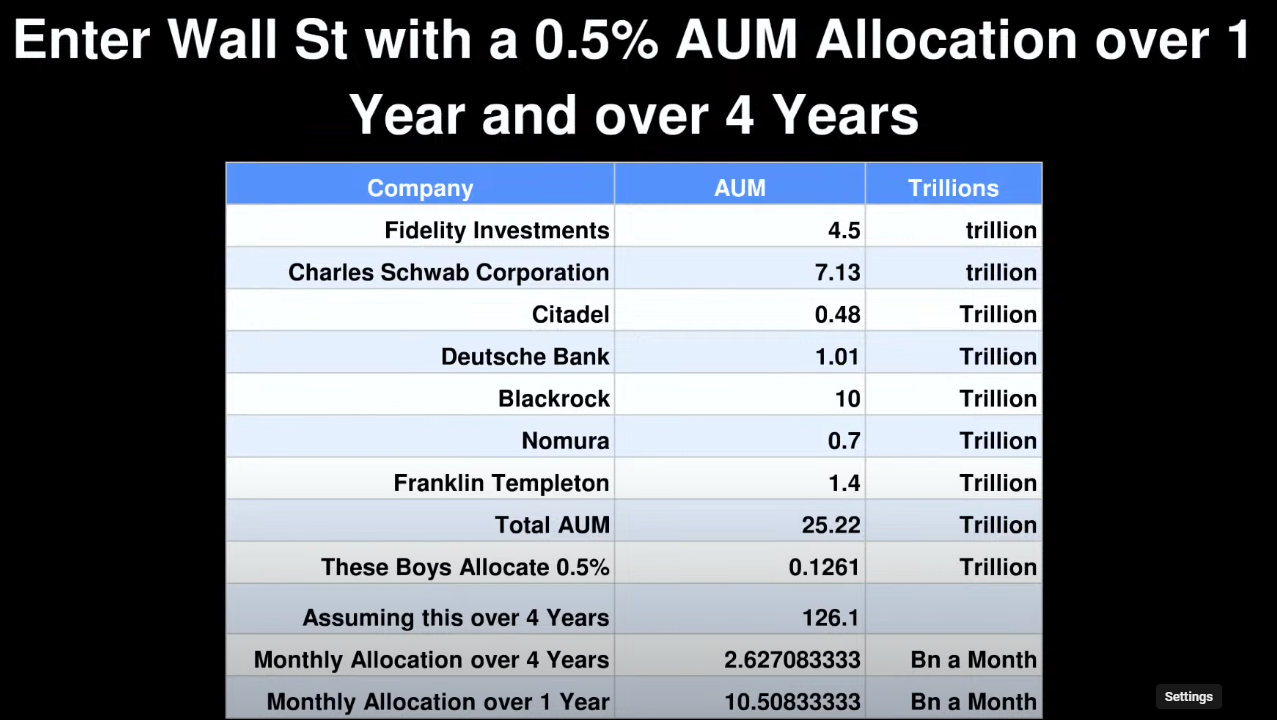

James, the anonymous server of InvestAnswers, shed light on the future of Bitcoin and the overall cryptocurrency market in his recent YouTube video. He highlighted that the total value of assets under management by investment giants Fidelity Investments, Charles Schwab, Citadel, Deutsche Bank, BlackRock, Nomura, and Franklin Templeton is $25.22 trillion.

According to the analyst, if the seven Wall Street companies allocate only half a percent of their assets under management (AUM) for Bitcoin ETFs in the first year after the expected block reward halving in April 2024, the largest cryptocurrency could rise by over 3,200% from its current price levels in less than five years:

Many people believe that if Wall Street giants allocate just 0.5% of their assets to Bitcoin, it would cause a major boom. This trend is particularly likely for retirement funds and similar entities that need some kind of alpha to get out of the hole; otherwise, retirement funds will go backwards and even be liquidated.

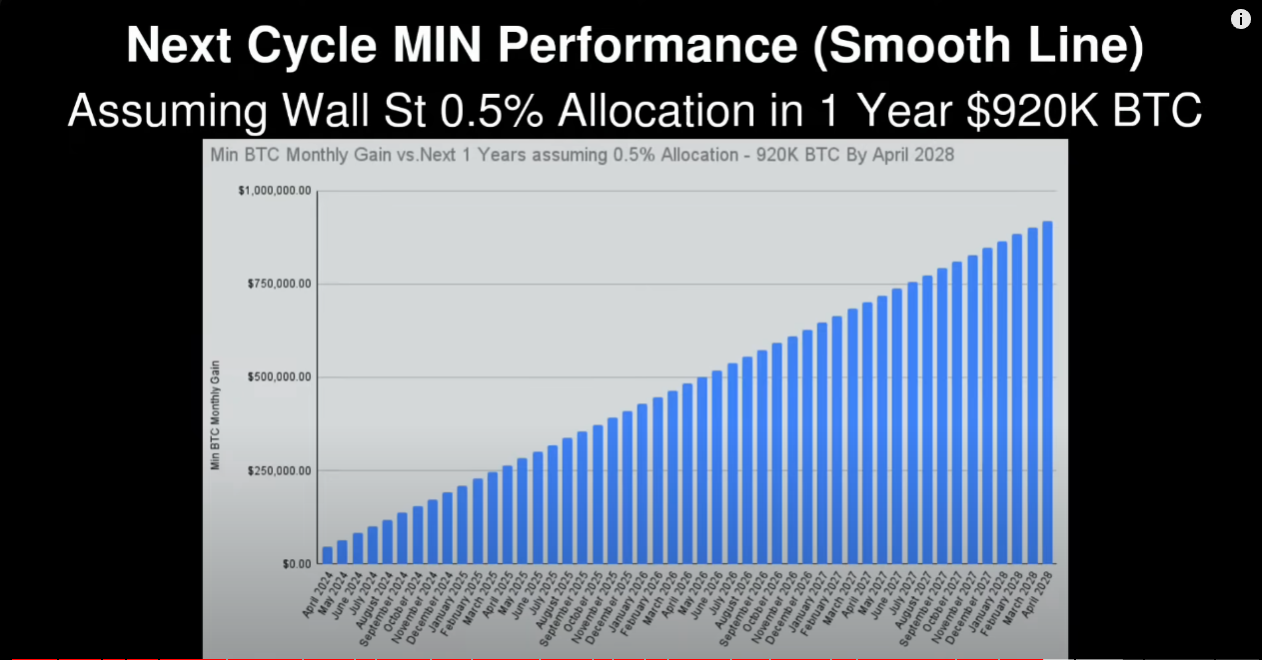

This assumption is based on the allocation of 0.5% of assets under management to Bitcoin by the giants in the first year starting from April 2024. If this happens only within the first year, the demand that will arise will likely lead to a seamless rise of Bitcoin until April 2028.

Assuming a 0.5% allocation in the first year, followed by another 0.5% and so on, Bitcoin’s price could reach up to $920,000 by April 2028.

“Block Reward Halving is an Important Threshold for Spot Bitcoin ETFs”

Regarding when Wall Street giants can start buying BTC if spot Bitcoin ETFs receive approval from the US Securities and Exchange Commission (SEC), the analyst said:

A former senior executive of BlackRock said that ETFs will be approved within the next three to six months. As I said, this approval will probably come before the block reward halving. BlackRock does not want to enter the market after the block reward halving. They are aware that the fireworks will explode after that moment.