Coinbase‘s Layer-2 project Base has been overshadowed in the Ethereum (ETH) L2 scaling ecosystem after a long period of dominance. According to data shared by Chris Burniske, the unique daily active addresses interacting with Base on October 6th were 74,850.

Tough Competition for Base!

This number was much lower compared to the active address count on zkSync and Arbitrum (ARB). Burniske shared that Arbitrum had 155,070 active addresses, while zkSync had the highest number of addresses with 235,510. According to the disclosed data, Base managed to surpass Optimism (OP), which only recorded 57,990 active users during the same period. Although Base’s decline can be attributed to several reasons, the most obvious one could be the activity on the decentralized social network Friend.

Friend.tech, operating on the Base network, has seen an increase in fees, revenues, and total locked value (TVL) in the past few weeks. However, Stars Arena, a similar social interaction platform on Avalanche (AVAX), seems to have caught Friend.tech’s attention in the past few days. Therefore, the impact of this change has also affected the Base network.

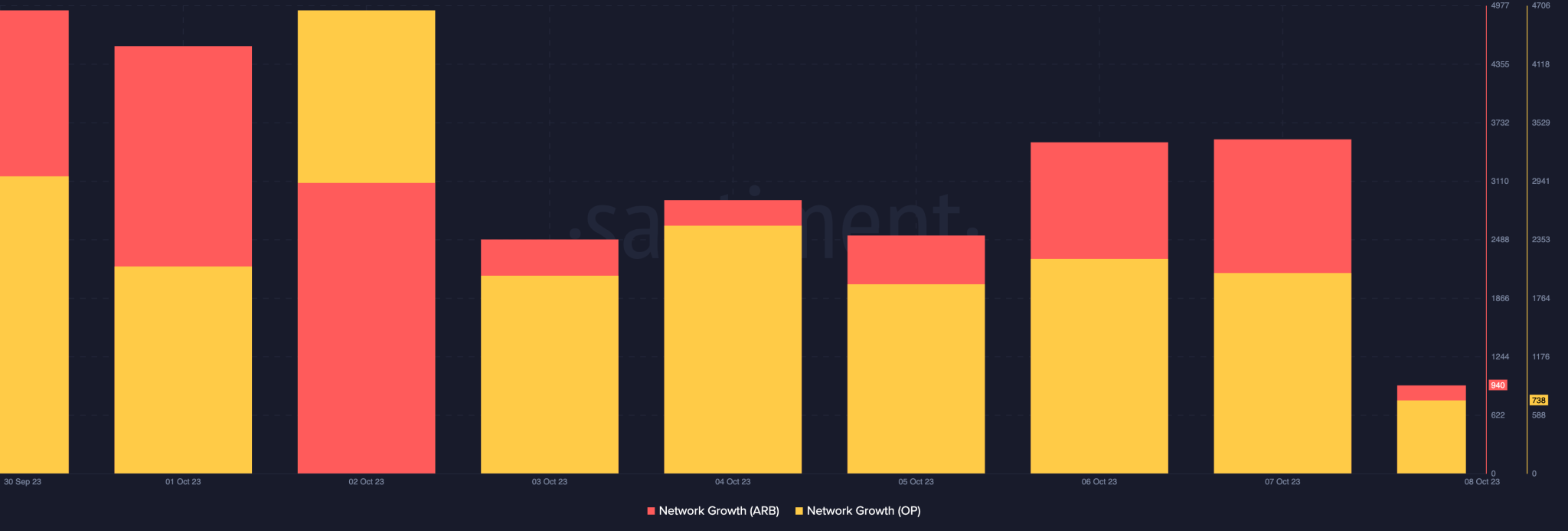

Despite impressive active addresses, the network growth on Arbitrum was not something to get excited about. Network growth can indicate the number of new addresses generated daily on a network. At the time of writing, Arbitrum’s network growth was at 940. This could imply that user adoption has been low over time.

A similar situation existed for Optimism with a network growth of 738, which suggests that the competition on OP Mainnet might not be as strong. On the other hand, zkSync failed to replicate the increase in active users in TVL. TVL is a measure used to assess the total value of assets locked or staked in a decentralized application (dApp).

Analytical Company Reports

The higher the TVL, the more reliable a dApp can be perceived. When TVL decreases, it may indicate some skepticism about the protocol’s usage. At the time of writing, zkSync Era’s TVL had dropped to $120.47 million.

The reason for this could be the inability of chains like SyncSwap and Mute.io to attract enough liquidity to the zkSync ecosystem. Meanwhile, the decrease in the number of active users on Base did not help overcome the weekly costs. According to Dune Analytics, Base’s weekly revenue was $155,532. Among these amounts, operational costs were $75,921, and profit was $79,611.

Although the network has achieved some gains, the profit may not be very encouraging, especially when compared to previous weeks. The improvement in activity on the network may be necessary for Base to revive its incredible performances in those weeks.