Uniswap, one of the largest DeFi platforms, made an important announcement today that affects 11 cryptocurrencies. The challenging environment of bear markets has led centralized exchanges to take important steps to diversify their revenues. The DeFi king has also joined this caravan. So, what will change for investors with the latest announcement?

Uniswap (UNI) News

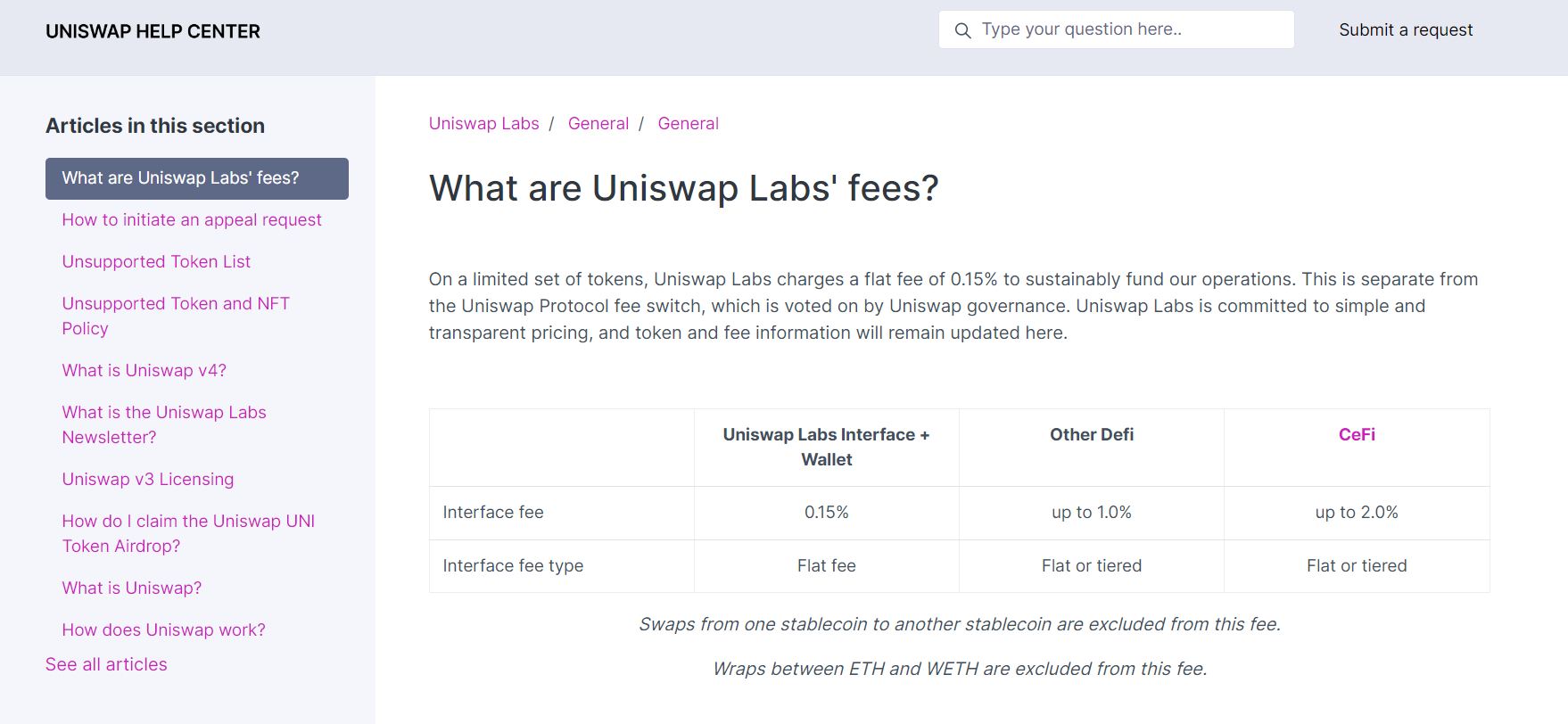

Decentralized cryptocurrency exchange Uniswap will charge a fee of 0.15% for those who want to trade via its website as of October 17. According to the announcement on its website, this fee will apply to certain altcoins. The altcoins mentioned in the announcement are as follows:

- ETH

- USDC

- WETH

- USDT

- DAI

- WBTC

- AgEUR

- GUSD

- LUSD

- EUROC

- XSGD

Uniswap founder Hayden Adams said that this decision is a different step from the Uniswap Protocol fee change voted by the UNI token governance.

“Users have countless options to bypass this fee by directly interacting with smart contracts and through other user interfaces. Our interface continues to be the best, and a lot of love (and money) is being spent to keep it that way. This interface fee is one of the lowest fees in the industry and will allow us to continue researching, developing, building, improving, and expanding DeFi.”

UNI Coin Comment

The previous decision introduced a 0.3% liquidity pool fee. In addition, the clarification of the protocol fee is expected. If Uniswap continues its current volume strength, it can put an average of $1 million per day into its treasury with its latest decision.

Although it is not good for users, the steps taken regarding fees seem beneficial for the protocol. At the time of writing, UNI Coin is at $4,139. After the ETF news, the price exceeded $4.25, but it dropped after being denied by BlackRock based on news fed by Benzinga Pro.

The critical level for UNI Coin is the $4.35 mark, and if it closes daily above this level, it can target the $4.65 resistance again. Closing above this region can ensure the dominance of the upward trend. The next targets will be $5.32 and $6.23.

However, if the BTC positivity ends and the price loses $4 again, we may see a new low of $3.7.

Türkçe

Türkçe Español

Español