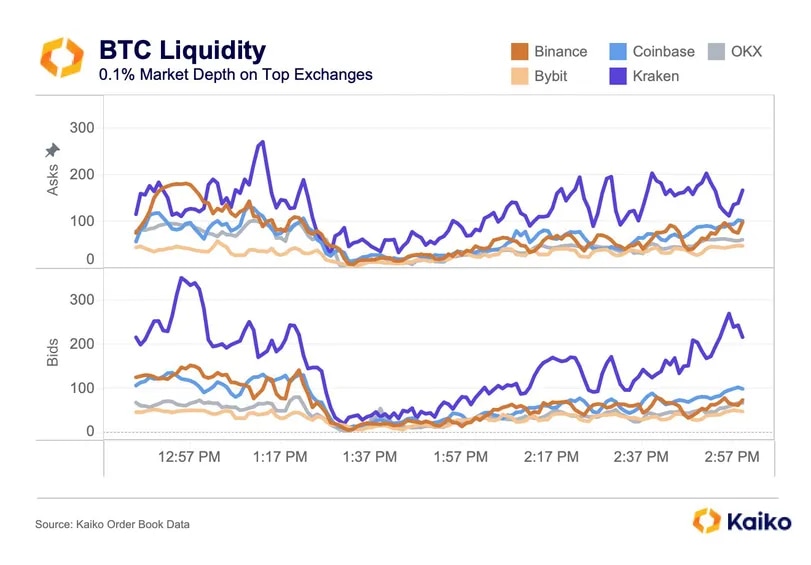

Binance, although being the world’s largest cryptocurrency exchange in terms of trading volume, has been facing some problems during the buying and selling process. However, data tracked by Paris-based Kaiko reveals that investors who want to buy and sell Bitcoin (BTC) quickly on Binance were at a disadvantage compared to their counterparts on Kraken and Coinbase on October 16th.

Demand Depth on Binance Drops from 100 BTC to 1.2 BTC

The 0.1% demand depth on Binance, which is a measure of buyer-side liquidity, dropped from 100 BTC to just 1.2 BTC following the surge in volatility after the false news of the approval of BlackRock’s spot Bitcoin exchange-traded fund (ETF) spread on social media. Furthermore, the largest cryptocurrency lost all the gains it made after rising 7.5% to $30,000 in response to the news, when BlackRock denied the news.

The 0.1% sales depth represents the number of pending buying orders within 0.1% of the average price or the average of the bid and ask prices. The bid price is the price at which the seller is ready to sell, and the ask price is the price at which the buyer is ready to buy. The higher the bid and ask depth, the easier it is to execute large buy and sell orders at stable prices, and the lower the slippage (the difference between the expected price of a transaction and the actual price it is executed at).

While the 0.1% depth dropped to 2 BTC on OKX and Bybit, the average demand on major cryptocurrency exchanges dropped below 95 BTC.

High Slippage Causes Many Investors to Lose Money

The significant drop in liquidity caused many investors, including prominent anonymous investors like exitpump and Omz, to lose large amounts of money due to slippage. Some investors experienced slippage of up to 20%. The graph shows that Kraken and Coinbase performed better than Binance and other cryptocurrency exchanges during the liquidity drop.

According to Kaiko researcher Riyad Carey, the sticky liquidity on Kraken and Coinbase likely reflects the relative sophistication of market-making firms responsible for creating liquidity in the order book.