US markets opened negative as the price of BTC is just below the $28,300 resistance level. There has been no change in the lack of volume that has been going on for months, and investor interest remains weak. The exception is that with yesterday’s surprise movement, the cumulative trading volume surpassed the $50 billion threshold with an increase of over 60%.

The Future of Cryptocurrencies

Both institutional investment funds and exchanges have volumes well below the levels of the first quarter of 2023. Since April, due to the lack of volume, we have not seen a strong and sustainable rise in the market. The withdrawal of market makers from exchanges has contributed greatly to this. So, what does the current situation indicate?

The king of cryptocurrencies, BTC, is currently holding the $28,000 level due to optimism about the approval of the ETF. However, it is advisable for investors to be cautious ahead of the November 1 Fed meeting. We have generally seen selling pressure in the crypto market before Fed meetings.

On the other hand, Yann Allemann and Jan Happel, co-founders of lassnode, one of the largest on-chain analysis companies, said in their recent post that $28,000 is a critical turning point for BTC. This also has vital importance for the future of cryptocurrencies.

Bitcoin (BTC) Predictions

BTC price, which reached $30,000 for the first time since August, could only stay in this range for a few seconds. US stock markets are falling due to restrictions on Nvidia’s sales to China. While the company’s stock loss reached 7%, the market decreased by 1%.

However, according to Allemann and Happel, Bitcoin is currently at a decisive intersection.

“The crypto market will move based on BTC’s ability to exceed and consistently maintain a value above $28,000.”

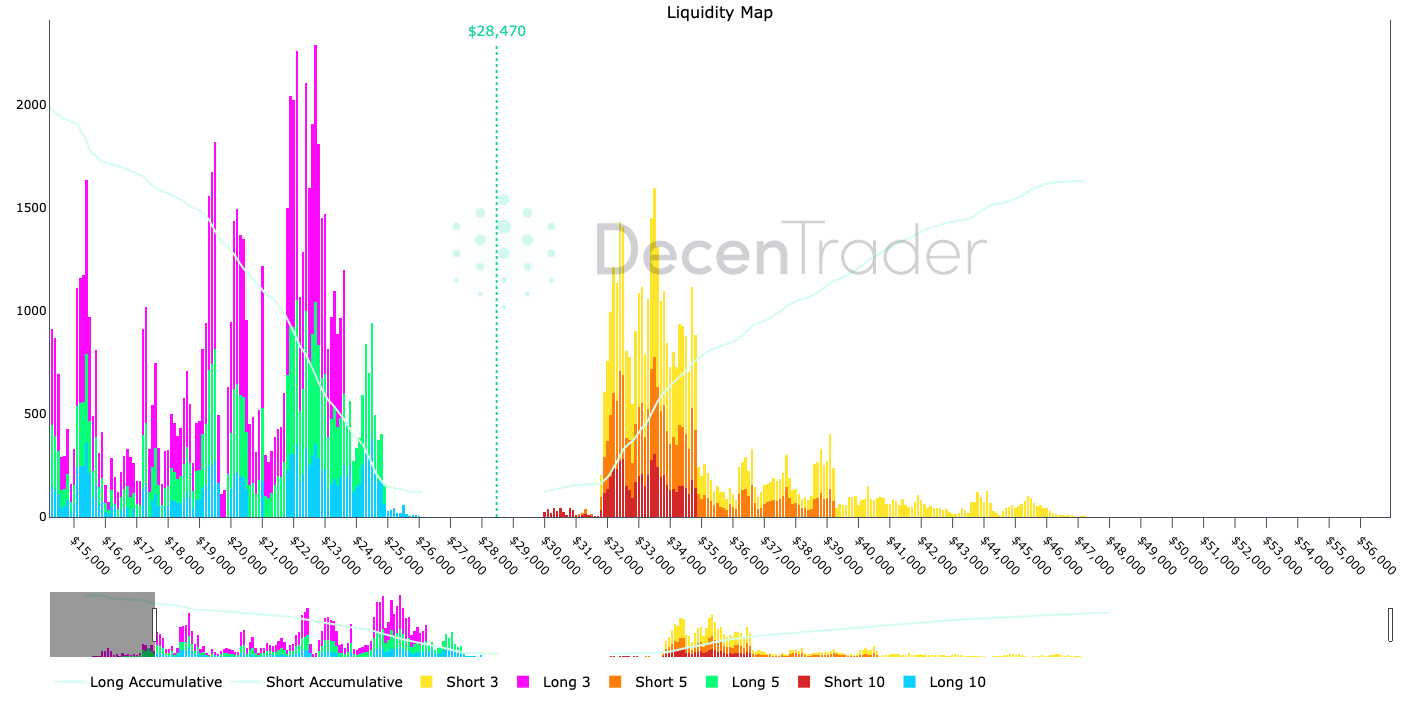

Data from DecenTrader shows that despite recent BTC price movements, futures continue to be driven by spot prices.

“Although this important milestone has been momentarily reached in futures trading, the spot market price reached $27,980 earlier today. Allemann and Happel clearly demonstrate how important this price point is in the larger scheme. Rapid movements and these price thresholds indicate investor sensitivity and market dynamics. Keep your eyes on the level above $28,000.”

Filbfilb, co-founder of DecenTrader, stated in an interview last month that he expects the BTC price to move up by the end of the year. He also said that during the halving period (April 2024), $46,000 could be reached, which would mean massive gains for altcoins.

On the other hand, Crypto Tony and many analysts are expecting a new low at $20,000 before the halving. QCP analysts, Rekt Capital, Tony, and numerous crypto commentators agree on this. Tony said the following today:

“Many can claim that they are currently in a long position and have caught this movement, but if you are not making a profit at resistance, you are doing something wrong. Personally, I will remain negative unless the $28,500 support is turned.”

Türkçe

Türkçe Español

Español