Grayscale, the world’s largest crypto asset manager, is currently receiving both good and bad news. The victory of GBTC was a significant step. However, its parent company, DCG, was recently sued, which poses a dangerous move for them. In order for the crypto giant to survive, SEC needs to quickly convert Grayscale Bitcoin Trust into an ETF.

Grayscale Spot Bitcoin ETF

If SEC does not resist further, it will likely approve the first spot Bitcoin ETF, which will be owned by Grayscale. Today, Grayscale Investments, the world’s largest crypto asset manager, submitted an application to the Securities and Exchange Commission (SEC) to register Grayscale Bitcoin Trust (GBTC) shares under the Securities Act of 1933. Bloomberg ETF Expert James commented on the S3 filing as follows:

“What does this mean? We see a new step being taken to convert GBTC into an ETF. While it may not mean much for the timeline, it is definitely a positive sign.”

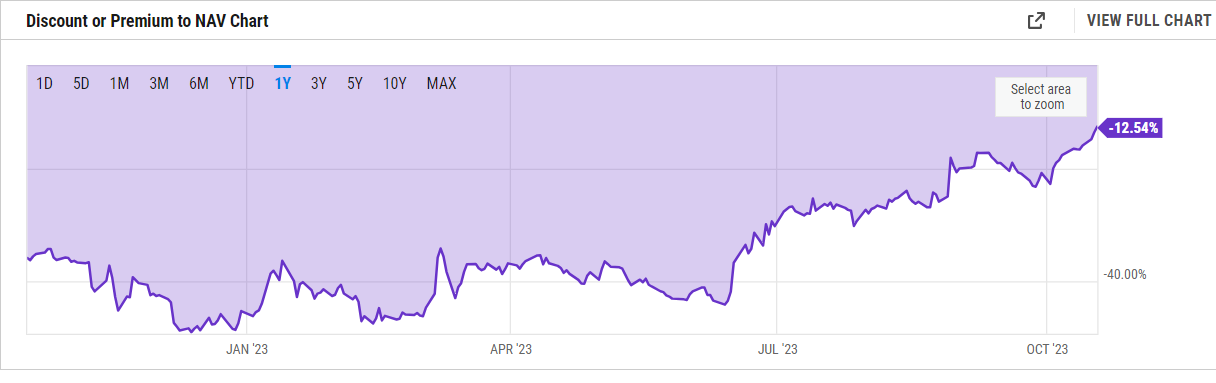

So, the process is progressing, and with the closing of the lawsuit this Friday, we will hear further communication between SEC and Grayscale. Founded in 2013, Grayscale, the world’s largest crypto asset manager, is getting closer to ETF approval, and the negative premium of the GBTC product is approaching zero.