October started well in the cryptocurrency markets, continued in a depressing manner, and seems to be ending well. If BTC can close above $30,000 for the month, the Uptober story will come true. The increasing optimism regarding ETF approval surprised analysts who were expecting deeper lows. Moreover, despite the lack of volume in ETH ETFs, sentiment has improved.

Crypto Market Analyst’s Prediction

Credible Crypto, a renowned cryptocurrency analyst known for his market predictions, made statements that will disappoint those expecting chaos. Just last week, there were experts confidently stating that BTC’s price would drop to $20,000. Today, however, the king of cryptocurrencies is trading above the $28,800 resistance level.

Credible Crypto stated that it is impossible for BTC to drop to $20,000, highlighting the open interest in derivative markets.

“So why is it so impossible to see BTC at $20,000 or below?

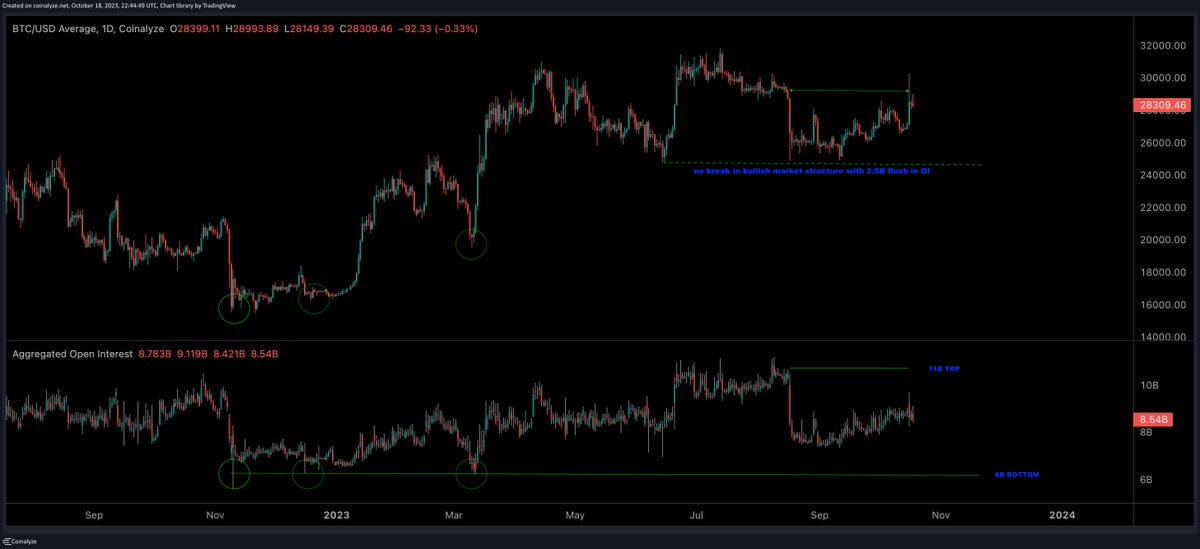

Looking at the chart below and considering the data we have, we can see that the total OI of around $6 billion is a historical low (it has remained stable for over 12 months, marked by the highest fear/panic at the bottom of the FTX crash) and that approximately $11 billion is a local high.

The last major drop we experienced in August wiped out about $3 billion from the OI (it dropped from $11 billion to below $8 billion), but we still couldn’t break our last major drop at $24,800. We are currently trading at almost the same price as when this drop was triggered.

So, we are currently at the point where we were before it dropped to $25,000, but there is about 50% less leveraged positions inclined towards liquidation in the system compared to August.”

Bitcoin Price Prediction

So, Credible Crypto is saying that BTC will not drop below $20,000 and that even if cryptocurrencies drop to $25,000, most of them will still experience massive losses close to the ATL level.

According to the analyst, in the worst-case scenario, the BTC price could drop to $24,800. He emphasizes that those waiting for closures below this level are taking a huge risk.

“Betting on the breaking of the $24,800 support is betting against the odds, because you will be looking for a bigger drop than the one in August, and you will have half as much ammunition (liquidation-sensitive leveraged positions) to cause this drop.”

In summary, when we look at the open positions in futures, historical data suggests that we may not experience a sharp drop. This possibility can encourage professional investors, which can turn $30,000 into a support level. Or it may not, as the cryptocurrency market is full of surprises, and historical data does not have to repeat itself.

Türkçe

Türkçe Español

Español