The king cryptocurrency bitcoin showed promising movement over the weekend, which surprisingly encouraged altcoins as well. The conversion of Bitcoin‘s $28,800 resistance area into support was a significant move. However, experienced investors are focusing on long-term cycles rather than short-term movements. One famous crypto analyst says that this cycle is different, and he has five reasons for it.

Crypto Cycles

BTC rise equals the rise of other cryptocurrencies. We have never seen the majority of altcoins reach new all-time highs during a bull season when BTC ATH was not seen. Since the king cryptocurrency dominates the market, investors should follow the 4-year BTC cycles.

The halving represents a crucial period in these cycles. Historical data tells us that there are 2 years of increase, 1 year of decrease, and the last year is an accumulation period. The crypto analyst known as Caprioleio believes that the current cycle is different from the others. He has five main reasons for this:

- The hash rate reached ATH in the middle of the bear season.

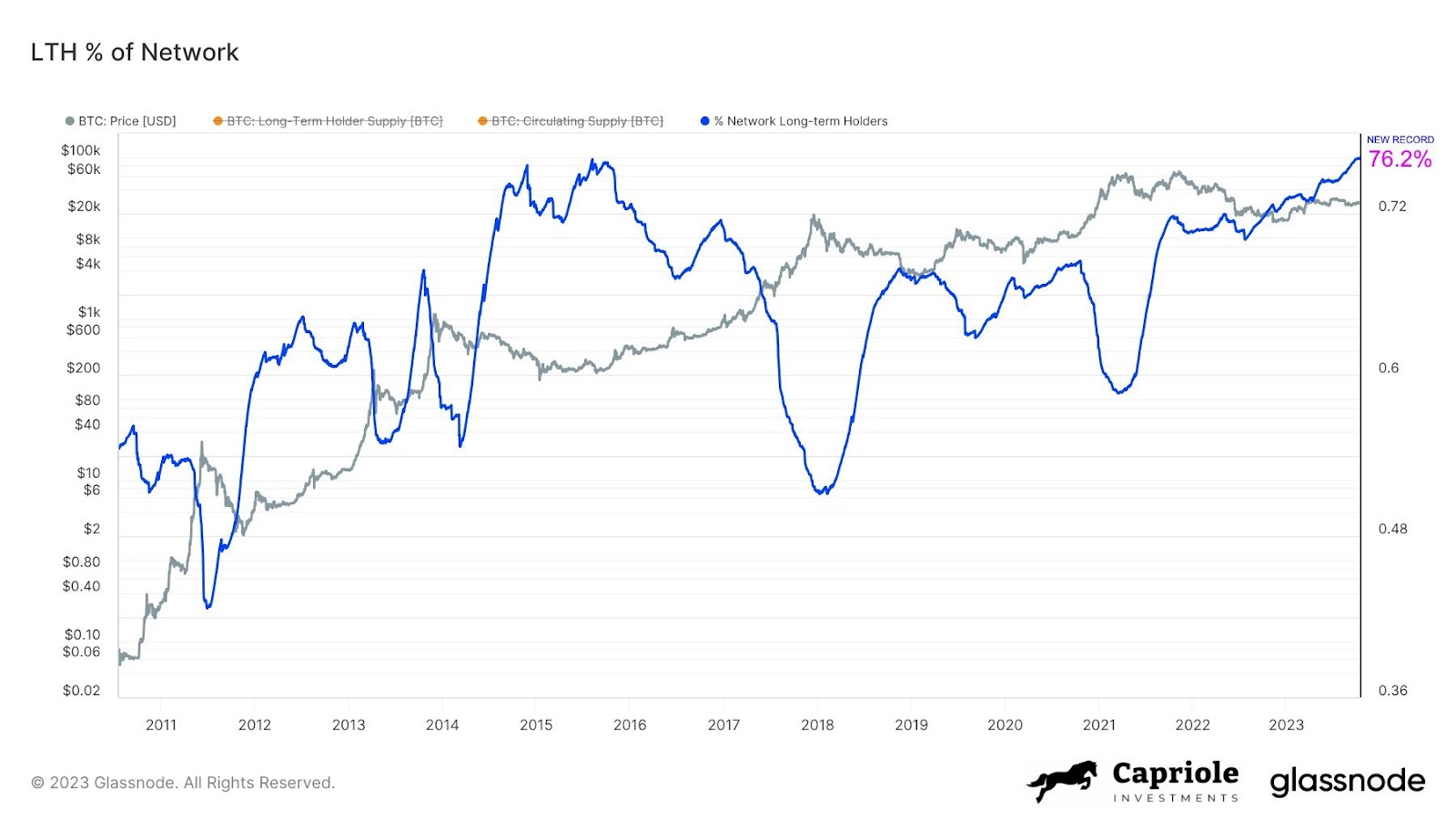

- The supply held by long-term investors reached an all-time high of 76.2% (also recently).

- Even governments in many countries have entered the BTC mining business.

- Adoption of BTC has reached unprecedented levels, with more and more companies accepting crypto payments.

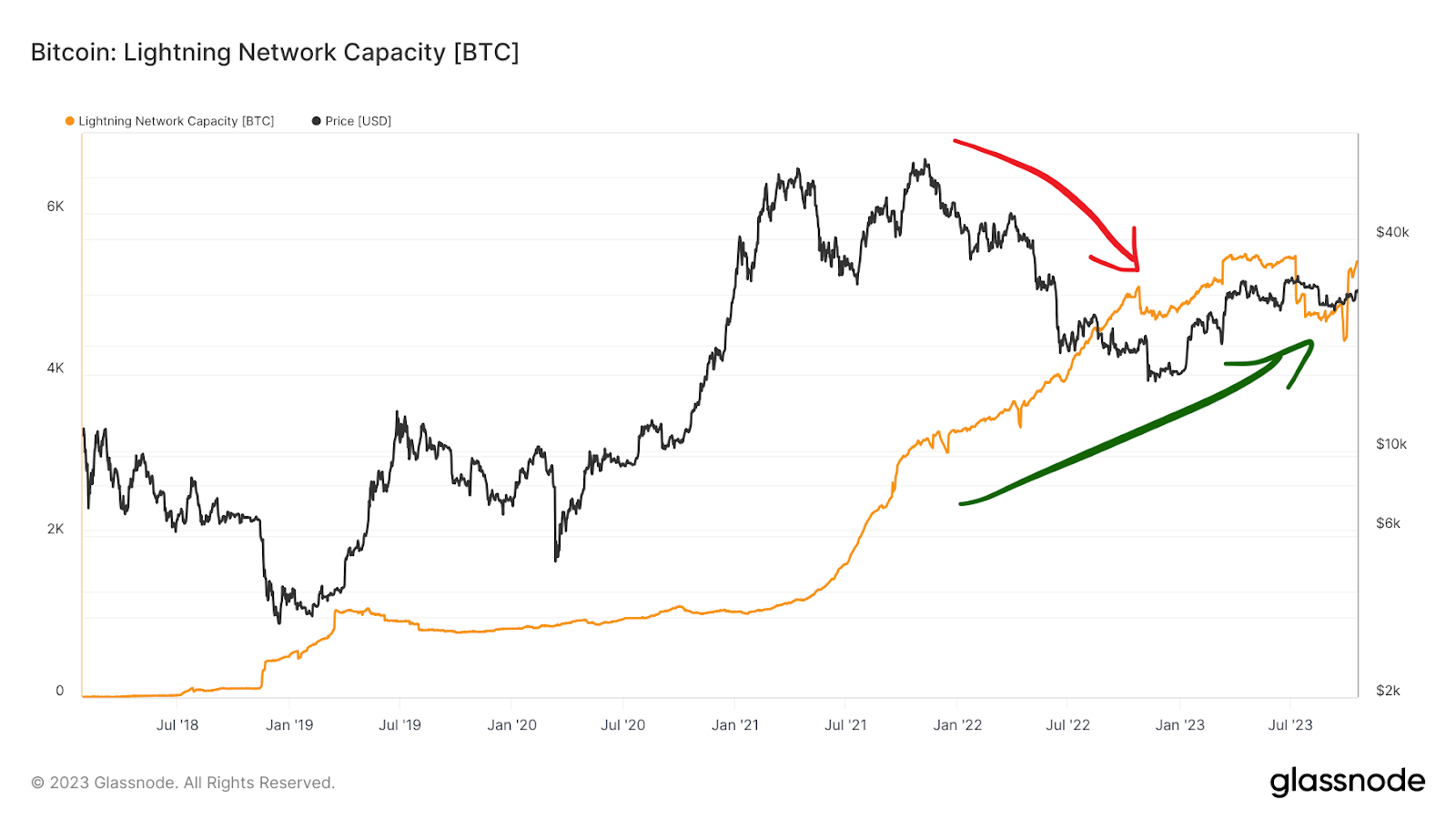

- The locked value in the Lightning Network has surpassed $150 million.

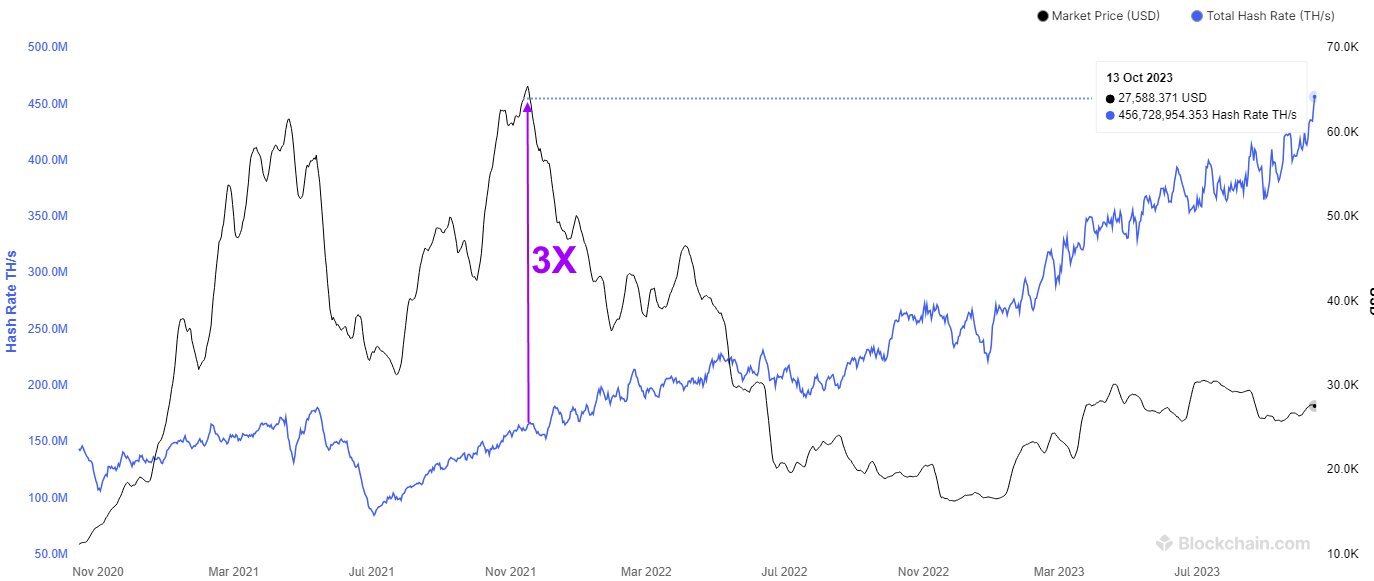

Bitcoin Hash Rate ATH

The first detail that Caprioleio highlights is the hash rate. It shows how active miners are and how much computational power they dedicate to this process. If this is strong, the network becomes more secure and powerful. According to the graph shared by the analyst, this indicator is at a “crazy” level.

While BTC reached ATH at $69,000, the hash power was at a lower level. So why did this happen?

“This indicates the growth in industrialization. Energy companies and governments are here.”

Long-Term BTC Investors

This cycle is different because, as we mentioned earlier, long-term investors have been accumulating like crazy. The metric that reached this level in 2015 is now back at its peak in the middle of the bear market. These levels were not seen even at the beginning of the 2021 bull market or the 2017 bull market.

If a large part of the supply is in the hands of long-term investors, there is less BTC available for sale on exchanges. It is not difficult to predict where the situation can evolve with the approval of a spot BTC ETF. Although volumes are weak, only 24.8% of the supply is available for sale. This means that there could be a larger rally in case of increased demand.

Governments and BTC Mining

If governments can mine gold, why not mine BTC? If you had asked this question years ago, the answer would have been “What is Bitcoin?” Today, governments legitimize, support, and even engage in mining themselves. Apart from being on the US sanctions list, there is no problem with this.

- El Salvador: Mining project with volcanic energy and promotion of this field.

- Iran: Encouragement and legitimization of mining. It even has an inclusive approach, allowing some companies to source BTC from local miners for export.

- Venezuela: Although Petro is almost forgotten, the approach to this matter is positive.

- Russia: There are reports that Russian government institutions are involved in cryptocurrency mining.

- Kazakhstan: Incentives for miners were initiated openly after the ban in China.

- Bhutan: It is mining and represents 1% of the total power of the network in the country.

Lightning Network

Lightning Network transactions have increased by 1200% in 2 years. We have seen this despite the fluctuations in the king cryptocurrency. The expert analyst said that the locked value on the network has exceeded $150 million for the first time. The increase in interest in LN that makes the decrease in BTC price meaningless is exciting.

LN, which helps fast and cheap BTC transfers, stands out more in the crypto payment services sector. If transactions are increasing by 1200%, what does this mean? We should definitely say that the king crypto is being used more intensively for payments.

Bitcoin (BTC) Adoption

Analyst Caprioleio gives an example of a hamburger that can be bought with BTC at McDonald’s. Elon Musk’s steps, more companies starting to accept crypto (LN data supports this), and many other developments confirm this.

This is a fillable opinion, and it may be useful to remember some of them.

- Online shopping platforms such as Overstock and Shopify

- Microsoft (through its Xbox service), Steam, and various online gaming sites.

- Some companies in the travel sector accept BTC for services such as flight tickets and hotel reservations. You can even access this through the Binance exchange application.

- Hosting and VPN providers have started accepting BTC payments. Google Cloud has even started setting up its own nodes by staking tokens on a broader scale. This news alone could trigger significant price rallies in previous years.

Conclusion

So what’s the conclusion? Many metrics are at bull levels, and it’s in the middle of the bear season for BTC. As the CEO of BlackRock said, there is suppressed interest, and that’s why the price is not at the desired levels. But why? The only explanation for this is the macro developments. Indeed, the reason behind everything we follow, from US PMI data to Unemployment Claims (data we didn’t care about in the past), is when will the Fed give up tightening further?