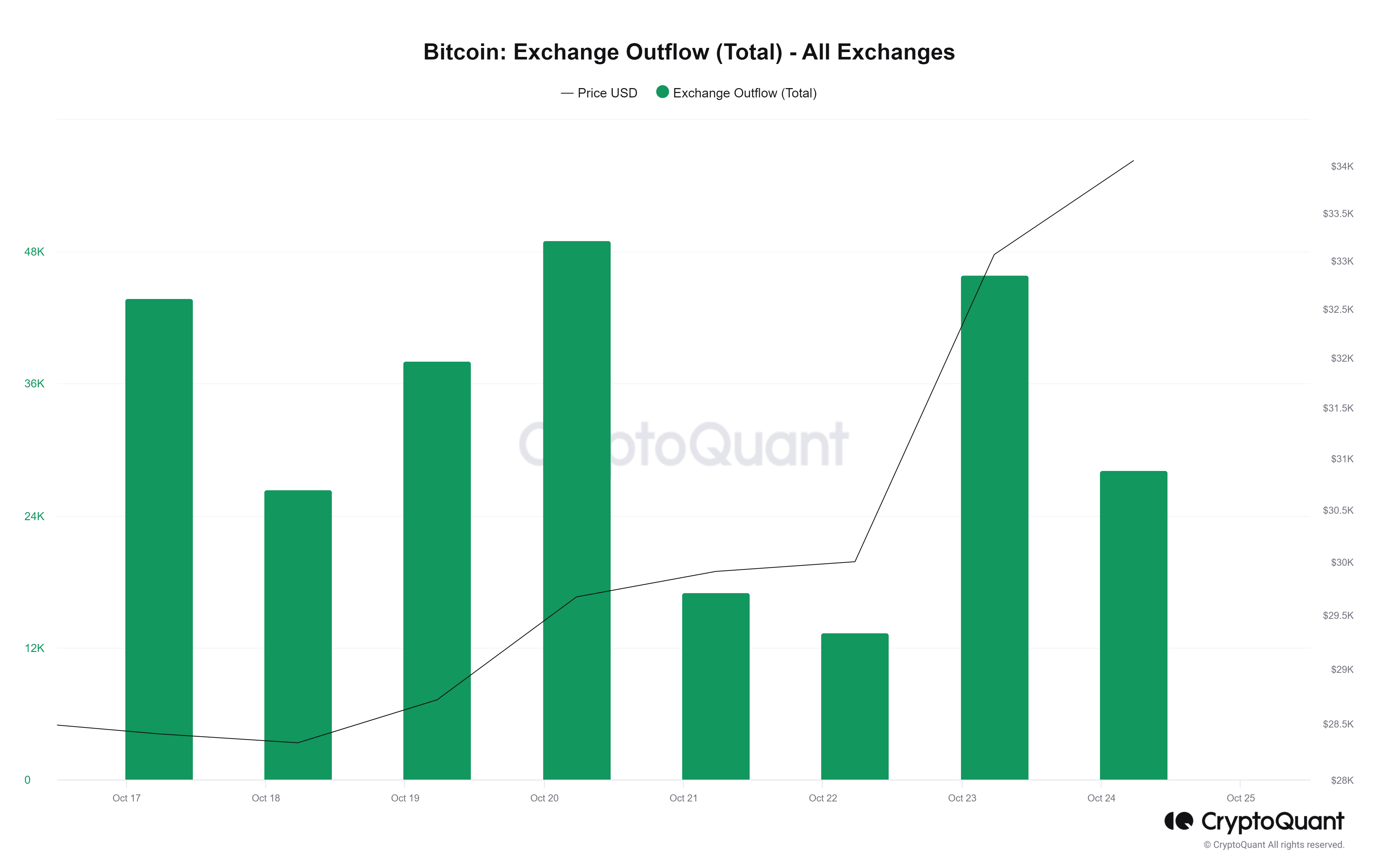

With Bitcoin price briefly reaching $35,000 for the first time in a year on leading cryptocurrency exchanges, there has been a short-term asset outflow. This is generally considered a sign of a bullish market as funds move away from exchanges and investors expect an increase in the crypto market, prompting them to move their assets to secure storage.

Bullish Sentiment is Heard

According to data shared by crypto data analysis firm CoinGlass, over $500 million was withdrawn from Binance in the last 24 hours, making it the largest outflow among exchanges. Crypto.com followed with a withdrawal of $49.4 million, and OKX with $31 million. Other exchanges experienced withdrawals below $20 million.

The recent outflows from crypto exchanges have raised concerns among investors, following the FTX crash in November 2022. Furthermore, the latest withdrawals are more in line with investor sensitivity rather than fear-driven withdrawals during the highest bear market. Glassnode, a blockchain analysis firm, confirmed that Bitcoin withdrawals from exchanges have increased parallel to BTC’s price rise in the past few days.

Latest Developments in the Crypto Market

The surge in Bitcoin caught many investors off guard, leading to significant losses, especially in the futures market. Following the price increase, approximately $400 million worth of short positions were liquidated. Within the last 24 hours, 94,755 investors witnessed the liquidation of their futures contracts, with the largest single liquidation order worth $9.98 million occurring on Binance.

Analysts also highlighted the Market Value to Realized Value (MVRV) ratio, a metric that compares the market value of an asset to its realized value by on-chain data. This ratio is calculated by dividing the market value by the realized value. The realized price is determined by the average price at which each asset or token last moved on the chain. The current MVRV ratio stands at 1.47, compared to 1.5 during the last bull run.

The total market value of the cryptocurrency market reached $1.25 trillion, the highest since April, with a growth of over 7.3% in the last 24 hours. The catalyst behind this increase was allegedly the launch of a spot Bitcoin exchange-traded fund (ETF).

Türkçe

Türkçe Español

Español