The past two weeks have surprised even the most optimistic group of cryptocurrency investors, and there are still those who can’t believe the rise. If you look back to the end of 2020, when the previous bull started, you will see that the markets rose sharply and stubbornly. The macro conditions were not the same as they are today, and that’s why investors find it difficult to believe in the bull.

Has the Crypto Bull Started?

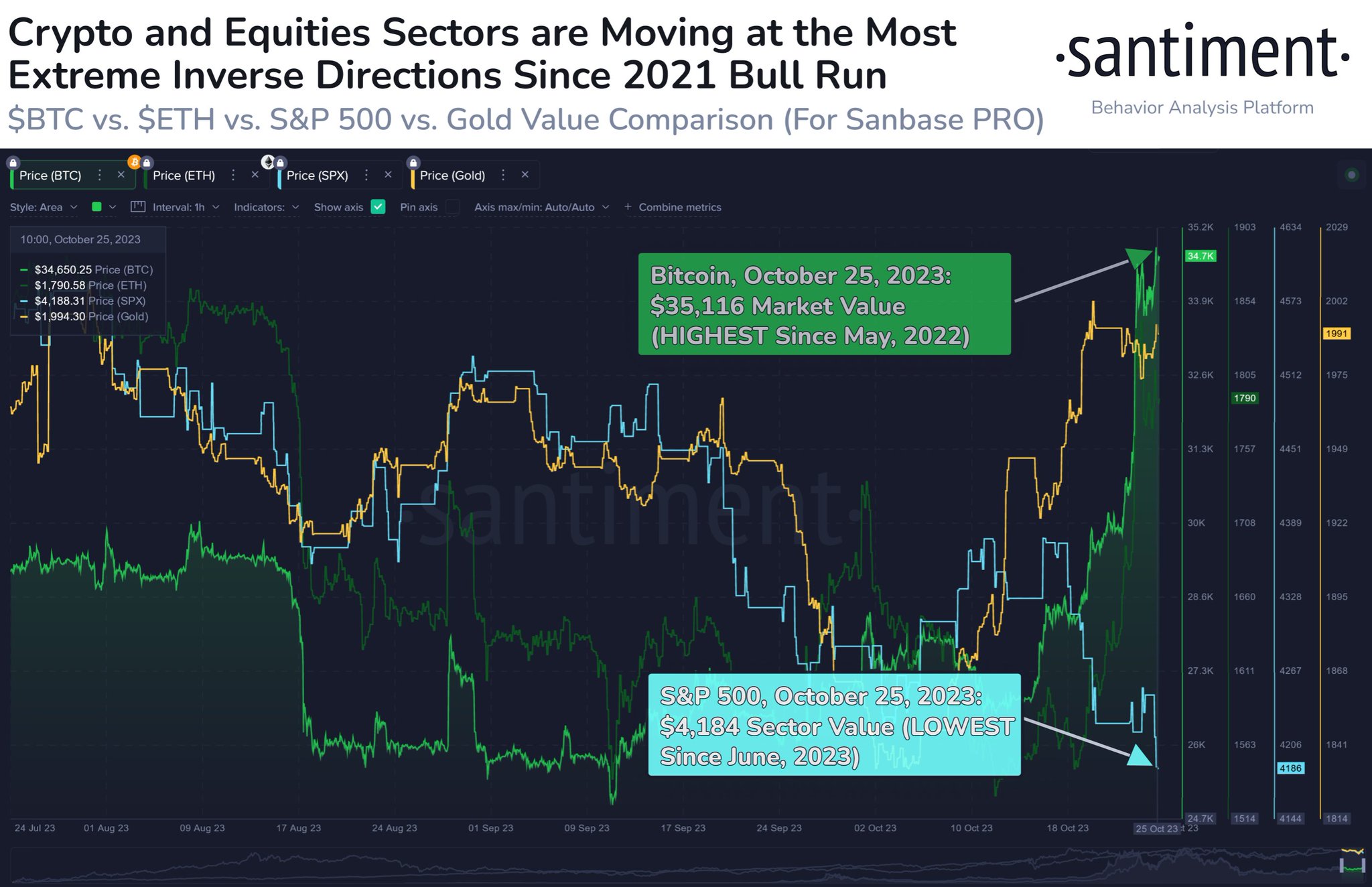

To understand this, the price needs to pass a few tests. The first test was the weekly close, and the price managed to close above $34,500. This is a very strong signal for a turnaround and the beginning of a bull run. The second test is whether the correlation in the stock markets will decrease. Indeed, while things are getting complicated on the macro front, BTC and gold are moving contrary to stocks.

Santiment, in its assessment last week, not only confirmed the decrease in stock market correlation but also said that this is a sign of the return of the crypto bull market itself. So if this divergence continues, we will have another evidence to say that the crypto bull has started.

Will Bitcoin (BTC) Rise?

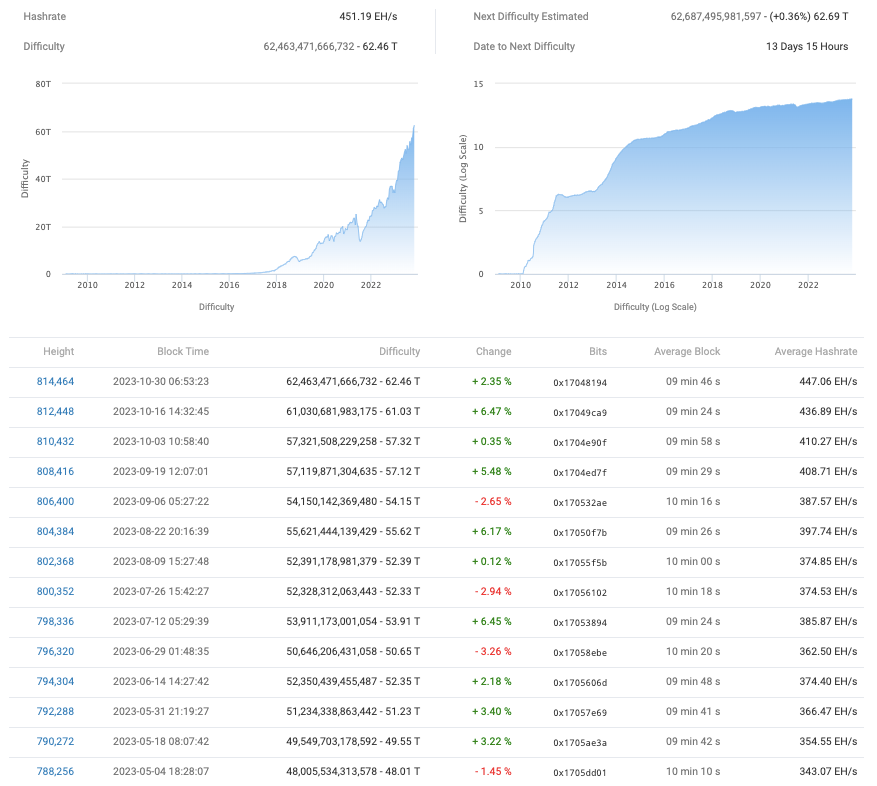

The mining difficulty increased by 2.35% on October 30. The current difficulty level of 62.46 trillion indicates that the competition among miners is more intense than ever. This figure, reaching an all-time high, also confirms the power of active miners. So why are they investing more energy and investing in new mining devices?

James Van Straten, a research and data analyst at CryptoSlate, said this is a very positive development for the price. Jaran Mellerud, a mining analyst at Arcane Research, said that the trend will continue to increase and added the following;

“The hashrate of Bitcoin shows that miners are upgrading and increasing their mining equipment before the halving. If this continues, I wouldn’t be surprised if we see 500 EH/s before the end of the year.”

- Increasing demand for institutional crypto investment products

- New highs in open interest for Deribit

- Increase in CME BTC product volume

- Competition among miners

These four factors show that besides individual investors, institutional demand is driving up the price.

Türkçe

Türkçe Español

Español