After the news of the ETF in the cryptocurrency market, a bull rally started. Investors’ interest in Bitcoin, which led the rally, increased rapidly. The value of Bitcoin traded above the $35,000 level for a short period of time. However, the created confidence environment, known to bring the possibility of a price correction, can also be considered as an indicator of a decline.

Will Bitcoin Price Drop?

According to the data from 21milyon.com, the price of Bitcoin has increased by more than 12% in the last seven days. At the time of writing, it had a market value of over $670 billion and was trading at the $34,300 level.

Not only the price of the cryptocurrency has increased, but it has also seen a noticeable increase in the 24-hour trading volume, which can lead to further increases. Additionally, the possible growth movement of BTC has stopped as the price has been moving within a range in the last 24 hours until the time of writing. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

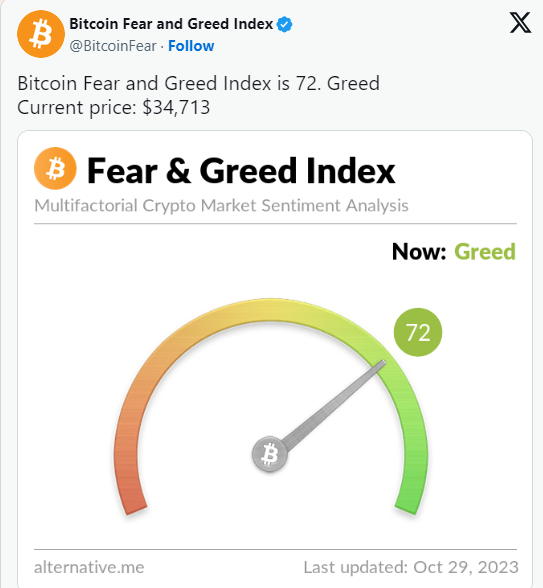

Interestingly, this price movement occurred when Bitcoin’s fear and greed index reached a value of 72. Briefly mentioning the Fear and Greed Index, it is expressed with a number between 0 and 100, where approaching 1 represents extreme fear and approaching 100 represents greed.

When the index moves above 50, it significantly increases the likelihood of a price correction. Therefore, at the time of writing, the possibility of a price drop for BTC may be higher than expected.

Furthermore, when examining the metrics of Bitcoin, it was revealed that investors were selling Bitcoin at the time of writing. According to CryptoQuant’s data, there has been an increase in BTC’s exchange reserves, which could indicate a potential increase in selling pressure on the cryptocurrency.

Bitcoin Price Future

In addition to the mentioned measurements, Bitcoin’s RSI was also giving overbought signals at the time of writing. This could strengthen the selling pressure on the cryptocurrency and potentially trigger a price drop.

Similar to RSI, Bitcoin’s Money Flow Index (MFI) was also giving signals close to the overbought zone. This situation increased the likelihood of a downward price trend for Bitcoin. However, BTC appears to be above the neutral zone of the Chaikin’s Money Flow (CMF).

Türkçe

Türkçe Español

Español