The impressive surge in the price of Bitcoin has led to massive gains in altcoins, with some cryptocurrencies doubling or tripling in value. However, the increased volatility has also saddened those who have been growing their capital through short positions by selling short. Last week, we witnessed many popular accounts losing their entire capital quickly due to the rapidly rising BTC price. So, will this situation continue in November?

Bitcoin Forecast for November

After surpassing $35,000, the BTC price is once again aiming for this level this week. As the CoinShares report came out, we saw the price approaching $34,900 again. The price consolidating near its peak and the significantly increasing institutional volume indicate that the next bull run, if it happens, could result in unique parabolic rallies.

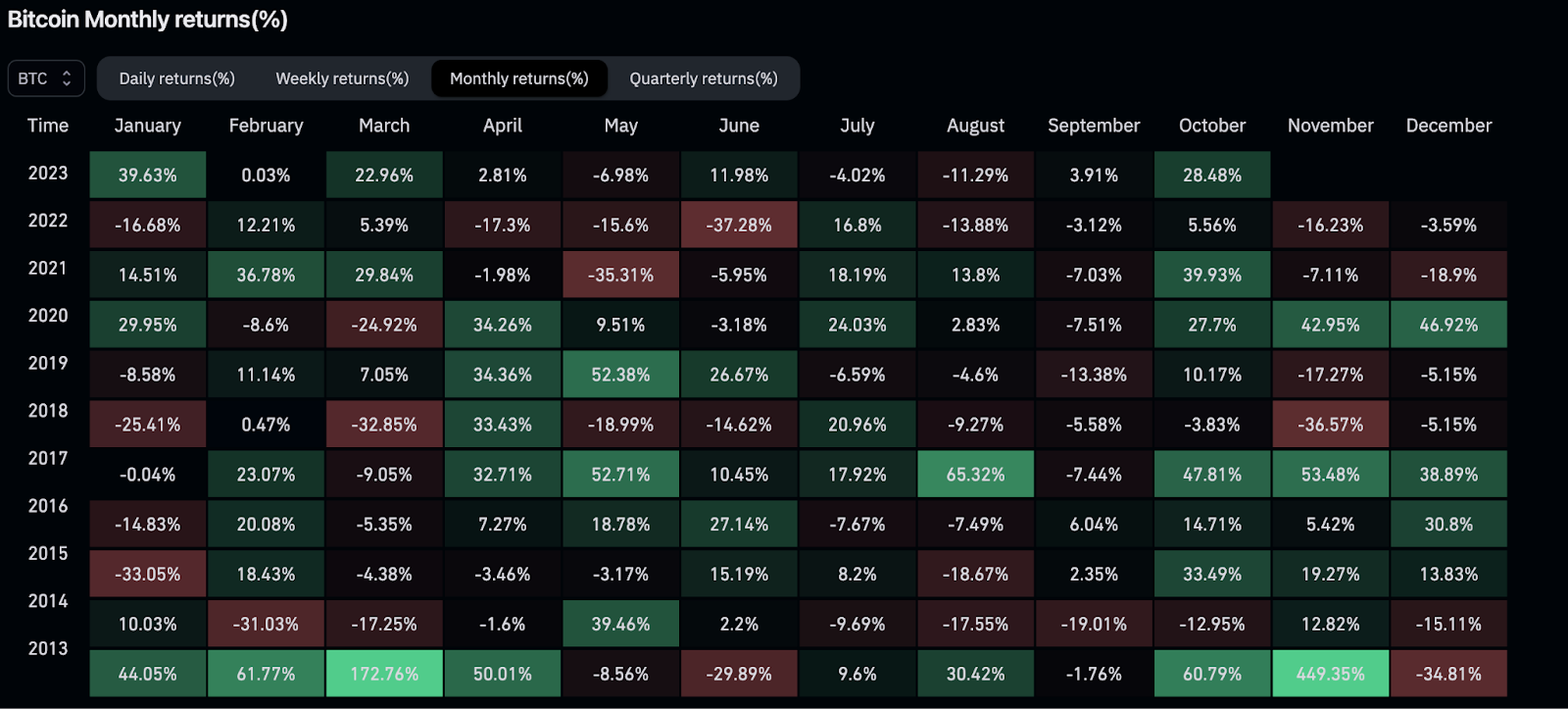

If October ends with a monthly close at these levels, it will fulfill the expectations. Despite a bad start in October, it is ending on a positive note. Below, we can see that Bitcoin has had eight positive monthly closes in October since 2013. Out of these eight positive monthly closes, November has remained positive for Bitcoin five times.

While we mentioned that October is historically prone to a rise, it does not guarantee a definite outcome. Now, we are saying that we may see a double-digit increase in November, but that does not guarantee anything either. Historical data in cryptocurrencies does not always predict the future.

Cryptocurrency Analysis

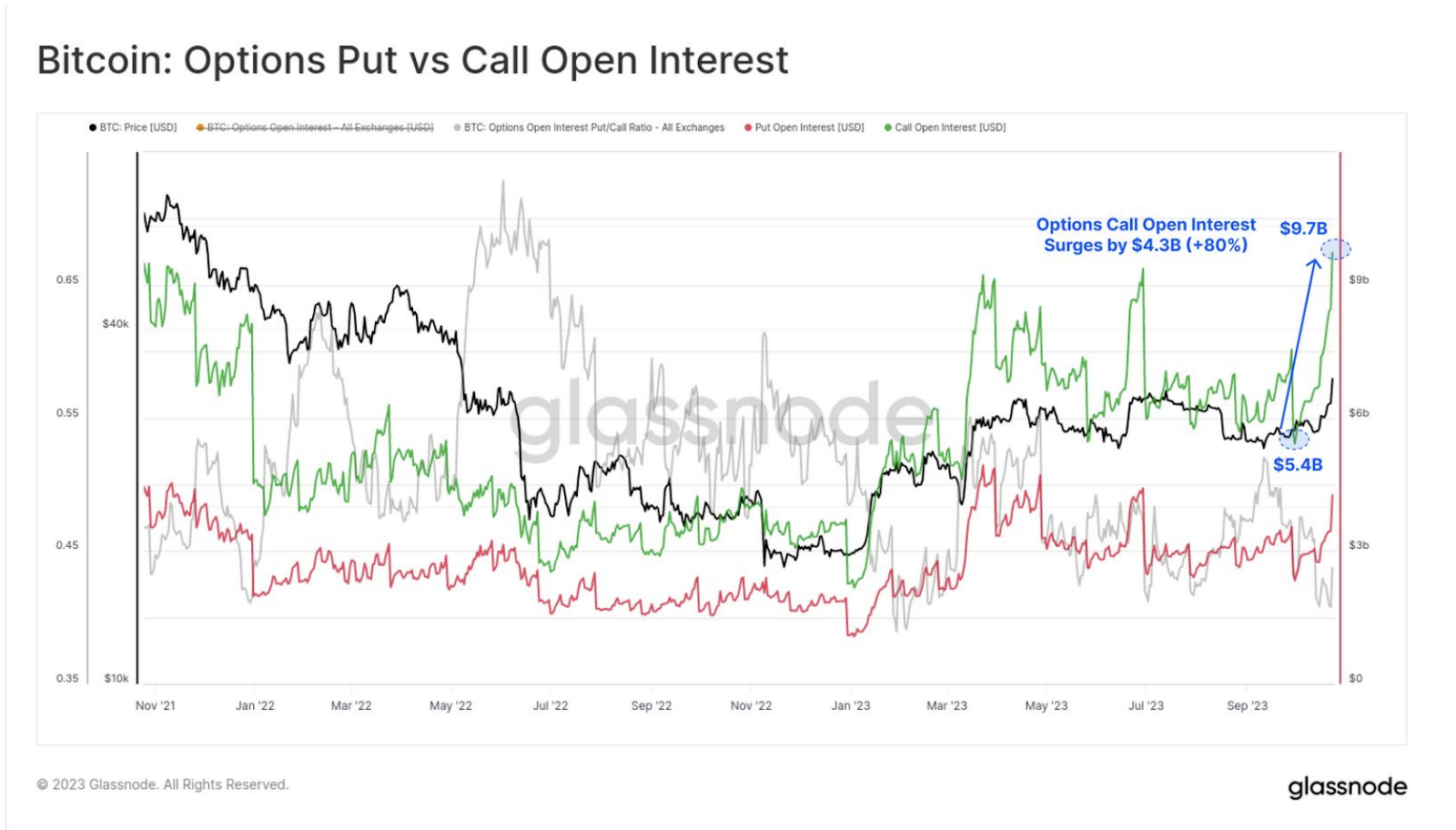

The Bitfinex Alpha report indicates a strengthening bullish sentiment in the options market. The screenshot below shows an 80% increase in open call interest in October. This month, the options market saw a total of $16.35 billion in trading positions, surpassing the 2021 peak.

The Bitfinex Alpha report states the following:

“These measurements reflect a clear trend. Both experienced and novice investors are directing significant amounts of capital towards options. The increased open interest in call options does not immediately indicate a bullish outcome. However, most of these newly added positions are for options with year-end expiration, representing a change in risk appetite and investment strategy.”

Short-term investors selling their profits suggest that the price may move upwards and sideways next month. However, the potential approval of an ETF (upwards) and the ongoing Binance case by the US Department of Justice (downwards) can cause unexpected movements.

Türkçe

Türkçe Español

Español