Bitcoin fell below $35,000 after the Wall Street opening on November 2. Currently, the downward momentum is dominating, especially after the warning that trading activity has heated up in the futures market. Let’s take a look at what the data and analysts are saying about Bitcoin, which is currently trading at $34,728.

Notable Detail in Jerome Powell’s Speech

According to data from TradingView, Bitcoin has given back the gains it made in the past 24 hours. However, before this decline, it reached the highest level in the past 18 months, reaching $35,968.

The most important factor contributing to this rise was Federal Reserve Chairman Jerome Powell’s statement in a speech that interest rate hikes would end soon. The Fed, at the last meeting of the Federal Open Market Committee or FOMC on November 1, decided to keep interest rates unchanged, and the following statement was shared by the institution:

“Recent indicators suggest that economic activity has been expanding at a strong pace in the third quarter. Although employment gains have been moderate since the beginning of the year, they have remained strong, and the unemployment rate has remained low.”

“Inflation continues to run high. The U.S. banking system is sound and resilient. It is likely that tighter financial and credit conditions for households and businesses will put pressure on economic activity, hiring, and inflation. The size of these effects remains uncertain. The Committee will continue to be extremely vigilant against inflation risks.”

Futures Market Triggers BTC Decline

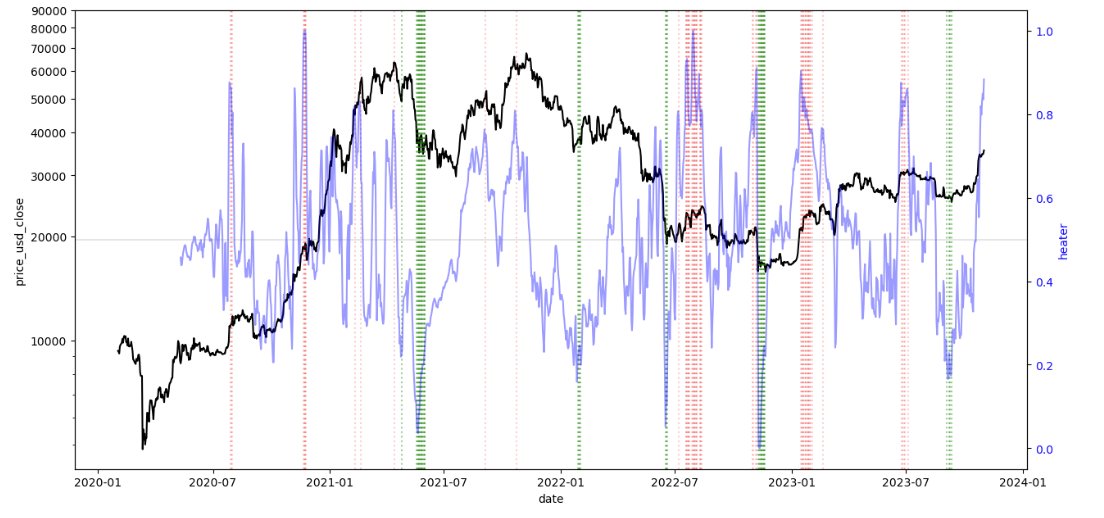

Bitcoin, currently experiencing a drop of over $1,000 from its highest level, continues to worry some investors, especially in the context of futures markets. Charles Edwards, the founder of quantitative Bitcoin and crypto asset fund Capriole Investments, shared an interesting analysis in the Bitcoin futures market based on Capriole’s own data.

Another popular investor, Skew, reacted to this situation and argued that spot markets are now responsible for maintaining Bitcoin’s price strength. They shared the following comment with their followers:

“It’s something to keep in mind when sizing positions. When the futures market heats up, it leads to more focus on the spot market to support current prices and trends.”

Türkçe

Türkçe Español

Español