Avalanche (AVAX) has experienced a significant price increase in the past two weeks. As Avalanche defends its previous lows and eyes are now set on the $11 level.

Recently, Avalanche faced a CEO resignation in its newly emerged project, Stars Arena. This development follows the hack incidents that occurred on October 7th, resulting in approximately $3 million in losses.

Will AVAX Stay Above Resistance Level?

AVAX has been trading in the range of $8.72 to $10.92 (orange range) since the end of August. Bears have been trying to take control over the past two weeks, testing and strongly defending the bottom level of this range at $8.7. Supported by Bitcoin‘s rise to $26,700, AVAX has surpassed the $11 resistance and seems to have found the strength to maintain it.

At the time of writing, the market structure on the daily chart indicated an upward trend. The RSI, closely monitored by investors, was at 66, supporting a strong upward momentum. Another notable indicator, OBV, showed a significant increase in the past two weeks, reflecting the rise in buying volume for investors.

Another noteworthy point is that the breakout occurred during a period of increased trading volume. Additionally, the levels of $11 and $11.6 were retested as support levels on lower time frames. This indicates that AVAX may move towards the main resistance level at $13.9 and potentially higher levels, depending on the market structure.

Will the $14 Level Be Surpassed?

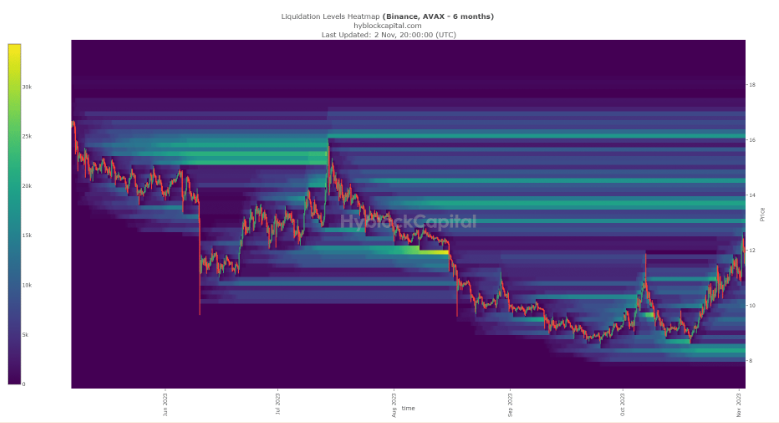

The liquidity heatmap shown in the chart below revealed a significant amount of liquidity just below the $14 level. This effectively limits the resistance at $13.9. Furthermore, the next major liquidity presence is at $14.5 and $16.15.

Liquidity has always drawn the attention of investors. Therefore, if the buying pressure continues, AVAX may likely rise targeting these levels. Investors may consider the levels of $13.9, $14.5, and $16.15 for evaluating long positions or realizing their profits.

Türkçe

Türkçe Español

Español