Bitcoin (BTC) remained relatively stable around $35,000 last week. Altcoins, on the other hand, led the weekend rally in the cryptocurrency market. The date that will cause a earthquake in the crypto market with the latest employment data in the US has started to become clear.

Fed Could Lower Interest Rates Until March 2024

Last week, employment data from the US for October of this year came with colder figures than expected. As a result of the data, analysts started to make predictions that the Fed will cut interest rates earlier than expected when entering 2024.

Some analysts have already started to give higher probabilities for the first interest rate cut to be made until March 2024. This may mean that there will be a major rally in risky assets such as stocks and cryptocurrencies. Interestingly, Bitcoin’s next block reward halving will also take place around April 2024, which could add more fuel to the BTC price rally.

According to CME FedWatch Tool, the probability of the US Federal Reserve cutting the headline interest rate by 25 basis points below current levels at the March meeting increased from 12.9% on Thursday last week to 25.9% on Friday. Fed fund futures imply a 66.5% chance that the central bank will not change interest rates at the March meeting.

The probability of staying at current levels is 95.4% for the December meeting and 89.4% for January 2024. While the probability of interest rate cuts is zero in both meetings, the probability of interest rate hikes in January is 10.3%. Charlie Ripley, senior investment strategist at Allianz Investment Management, said in his comment on the current outlook, “The employment data in general may indicate a turning point in the US economy, but more importantly, the data showed that the policy is working and will cause less debate about whether the policy is sufficiently restrictive for the Fed.”

A Major Price Rally Could Start in Bitcoin Soon

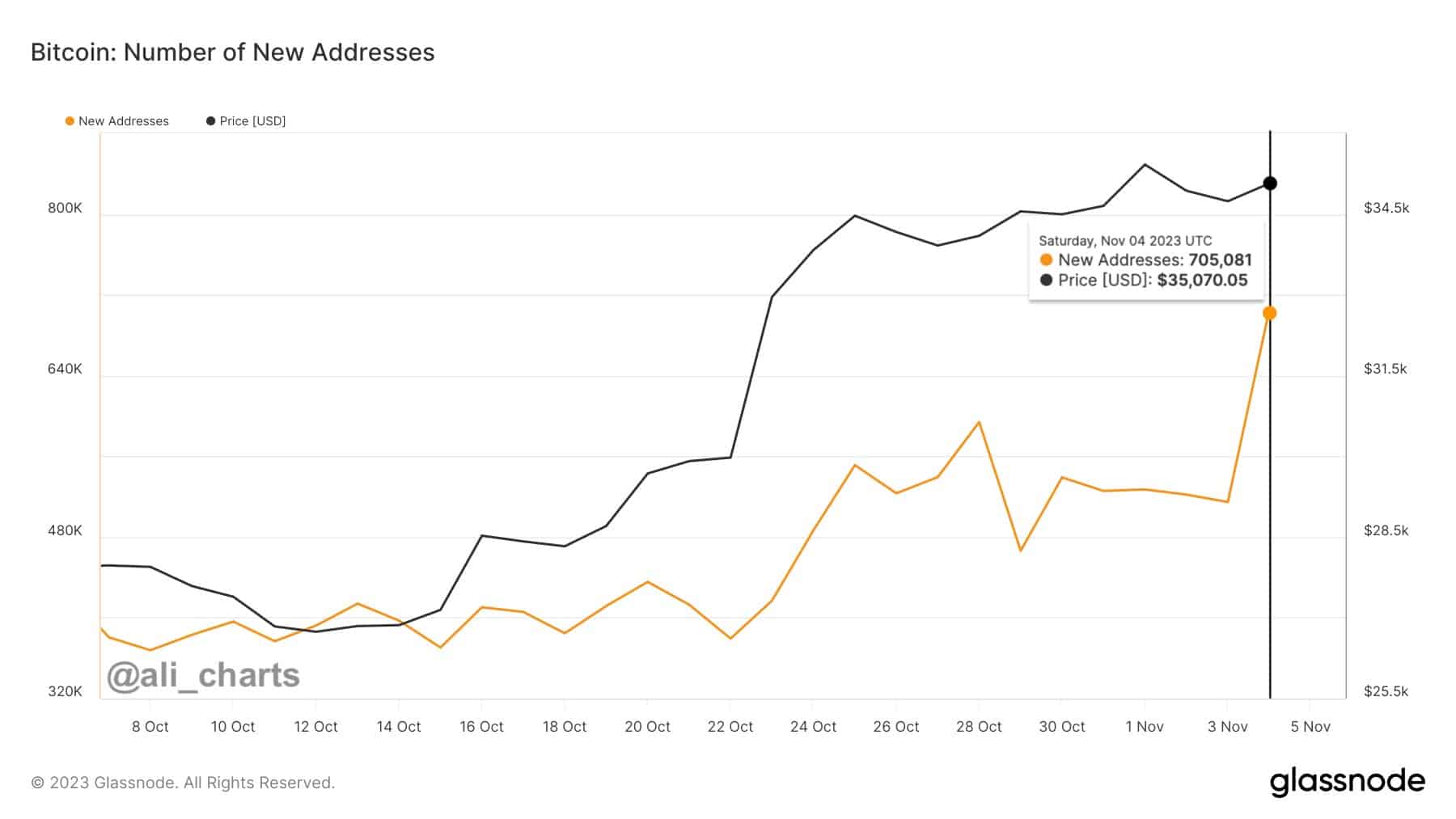

Bitcoin has been consolidating around the $35,000 level for a while, which may mean calm before the storm for the next mega price rally. Experienced crypto analyst Ali Martinez reported that over 700,000 new BTC addresses were created in a single day at a significant milestone. This growth in the Bitcoin network is generally considered one of the most reliable indicators for price predictions.

Another crypto analyst, CrediBull Crypto, also made an optimistic comment that Bitcoin could continue to gain positive momentum in the short term and continue to accelerate until it reaches the psychologically important threshold of $40,000. If this happens, the analyst predicts that a potential journey towards a new record level could begin. On the other hand, the inflow of capital into the cryptocurrency market, which exceeded $10 billion last month, supports the expectation of a rally by indicating strong investor confidence.