Bitcoin has managed to emerge victorious in the recent battle, reaching the level of $35,000 and making a surprising rise that has astonished investors. Accordingly, Bitcoin approached $37,000 on November 9th, leading to a significant momentum in the cryptocurrency market. The positive news expected from the United States is further accelerating the momentum as time goes on.

Why is Bitcoin Rising?

According to data from TradingView, the BTC/USD pair exceeded $36,000 after the daily closing. Bitcoin reached $36,864 on centralized cryptocurrency exchanges, marking its highest level since the beginning of May 2022.

On November 8th, concerns among investors had focused on the potential scenario of a retest of the $34,000 level due to a decrease in price liquidity. However, this scenario did not come true, and there was an upward trend in Bitcoin price during the trading hours of the United States.

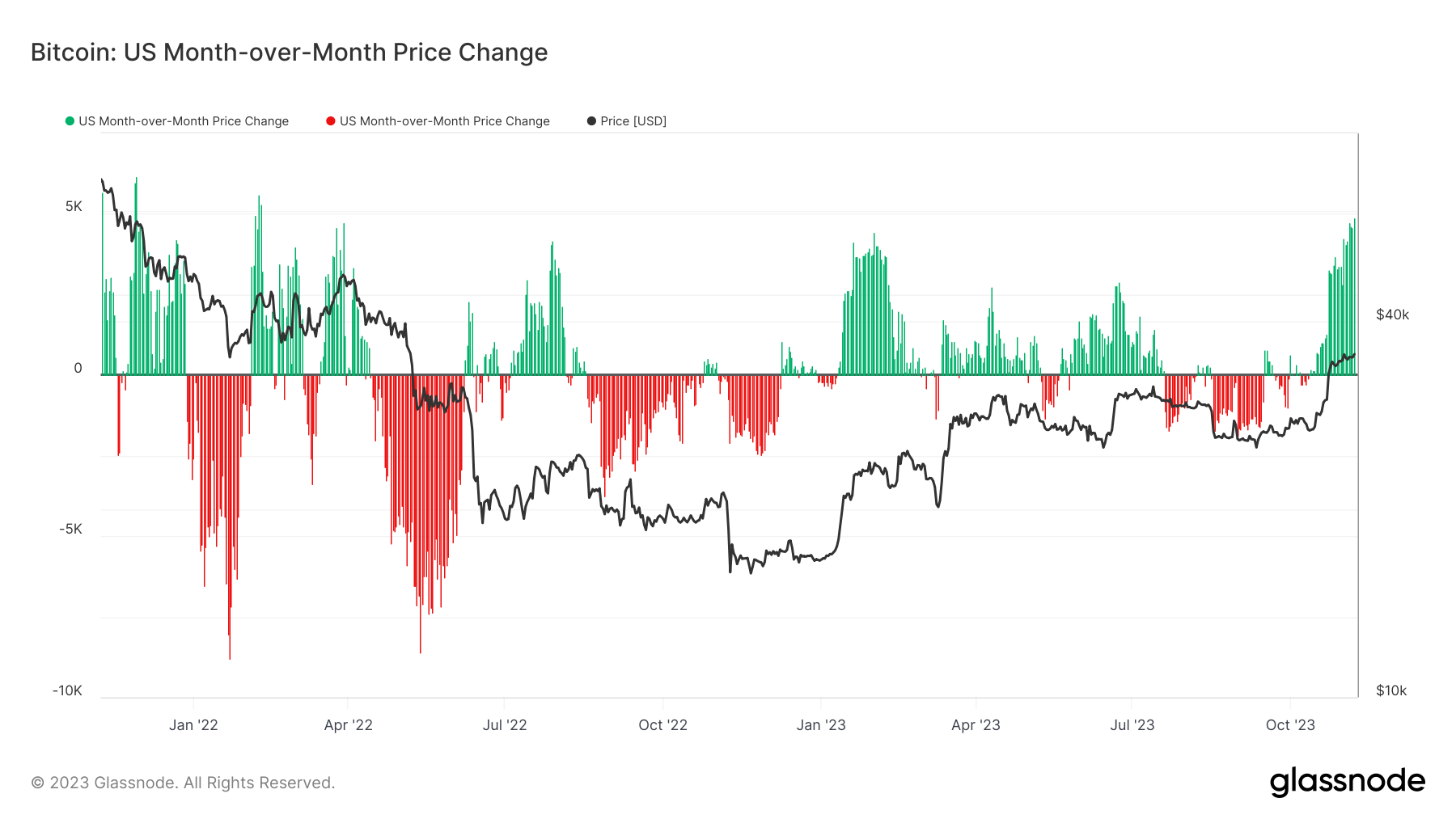

James Van Straten, a research and data analyst at CryptoSlate, shared in a section of his recent research that the price change in the Asian market has started to rise again since October 2021. Van Straten also utilized data from Glassnode, an on-chain analytics firm that demonstrates that US investors are continuing the rally.

However, some investors warned that the renewed upward momentum could be tied to the potential approval of a US Bitcoin spot price exchange-traded fund (ETF). Although it is not expected by investors until 2024, November 9th draws attention to the beginning of the period when the long-awaited announcement from the regulatory agency could theoretically arrive. James Seyffart, a research analyst at Bloomberg Intelligence, commented on the matter:

“We believe there is still a 90% chance of spot Bitcoin ETF approvals by January 10th. But if it comes earlier, we are entering a window where there will be an approval wave for all existing applicants.”

Notable Comments on Bitcoin Data

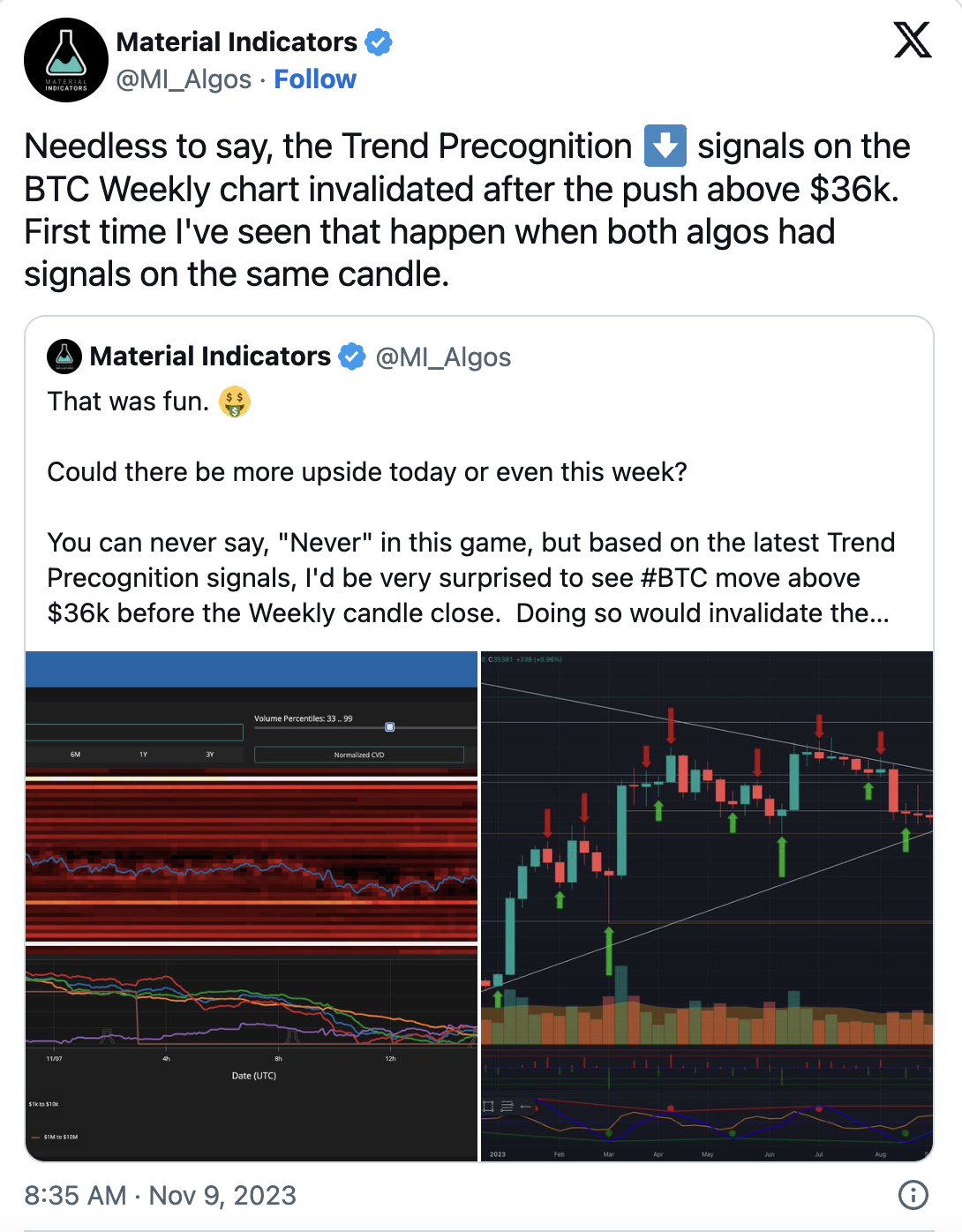

When examining market risks, there continues to be a moderate atmosphere among analysts who have been observing for a long time. Material Indicators, an on-chain data analysis platform, shared with its followers that as an unprecedented development, Bitcoin nullified signals of overnight gains in two licensed trading instruments.

Skew, a popular investor who recently warned about volatility, likened the current period of Bitcoin price movement to the end of January when Bitcoin’s bull run at the beginning of the year began to lose momentum.

Skew shared with his followers that the low timeframe upward trend is still robust, thanks to the consecutive high dip levels and healthy relative strength index values on the 15-minute chart.