The largest cryptocurrency, Bitcoin (BTC), made a strong trend reversal on November 15th with a surprising price movement, reaching up to $38,000. With this surge, the price of the crypto king reached its highest level in the past 18 months, since May 2022.

The price increase occurred despite the US Securities and Exchange Commission’s (SEC) decision to delay the approval of the latest spot Bitcoin ETF. The SEC announced that it has postponed its decision regarding Hashdex’s application to convert its existing Bitcoin futures ETF into a spot ETF. It was expected that this delay would have a negative impact on the prices of BTC and altcoins, as the introduction of ETFs is considered to facilitate access to Bitcoin for both institutional and individual investors. However, the outcome was different than expected.

Bitcoin has gained about 6% in the past 24 hours and is currently trading at $37,569 at the time of writing this article. The increase in the value of the crypto king after the major downturn in 2022 has reached 129%. Similarly, Ethereum (ETH), the second largest cryptocurrency and the largest altcoin, along with other altcoins, are showing a similar upward trend.

Market observers believe that the rise in prices despite the SEC’s decision to delay the latest spot Bitcoin ETF is due to the belief that the Federal Reserve’s (Fed) interest rate hike cycle is nearing completion. Zach Pandl, research director at crypto fund provider Grayscale Investments, said in a note to investors, “If real interest rates have peaked and progress towards approval of spot ETFs in the US market continues, the recovery in cryptocurrencies may continue.”

One of the unanswered questions for investors is whether the increase in Bitcoin’s price throughout the year is priced in according to the expected effects of spot ETFs. Many market analysts believe that the approval of ETFs may already be priced in, but the size of the subsequent inflows of money is what really matters.

What’s Next for BTC?

After facing strong selling pressure that brought it down to $35,000 earlier this week, Bitcoin is showing signs of a strong recovery. Analysts expect the price to reach $43,000 and above in the coming weeks, based on the fact that it is currently above the important support level of $36,000.

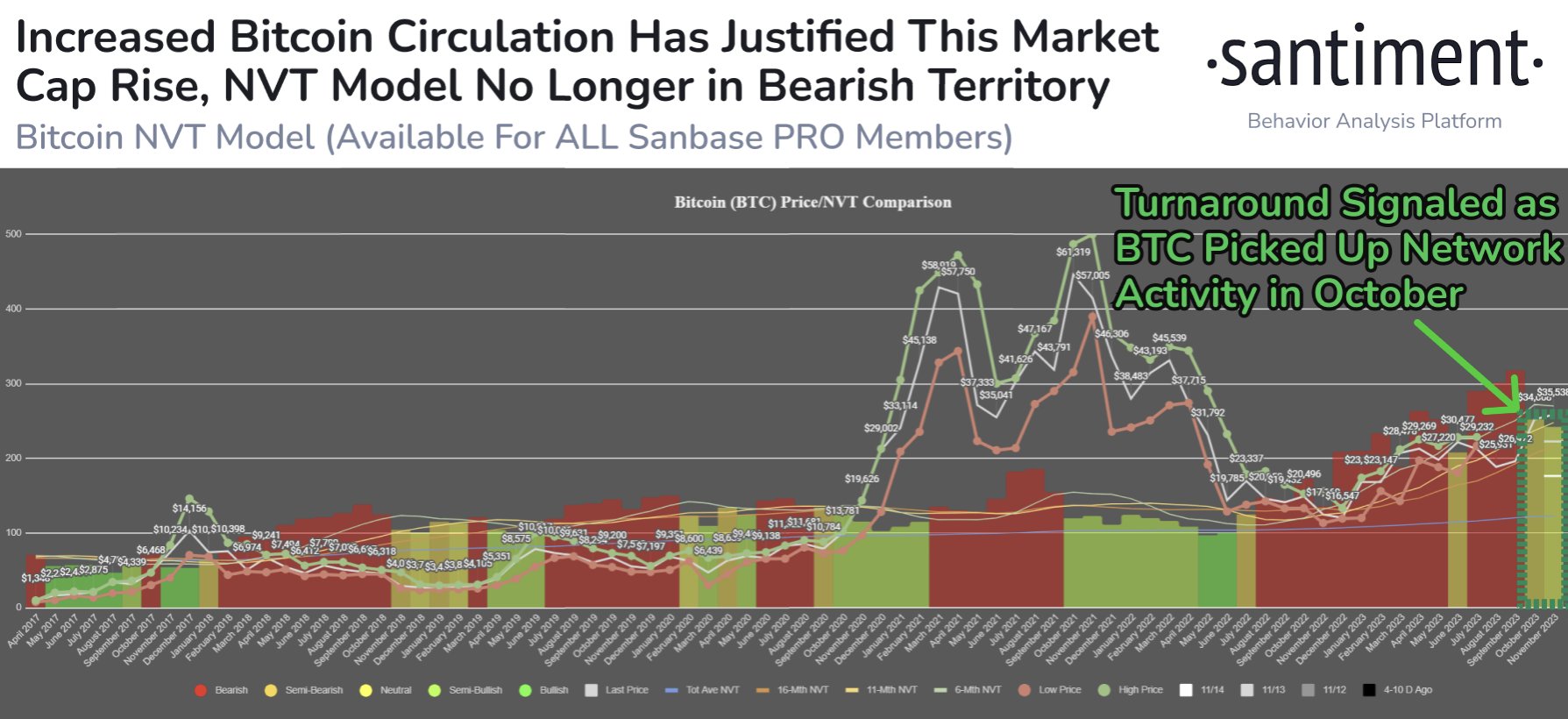

Furthermore, on-chain data reveals a significant recovery in activity on the Bitcoin network. According to on-chain data provider Santiment, Bitcoin’s NVT (Network Value to Transactions) Ratio has seen a notable improvement. This metric provides an output by evaluating the health of the circulating unique BTC amount relative to the current market value levels, and it is an important indicator for investors.

Türkçe

Türkçe Español

Español