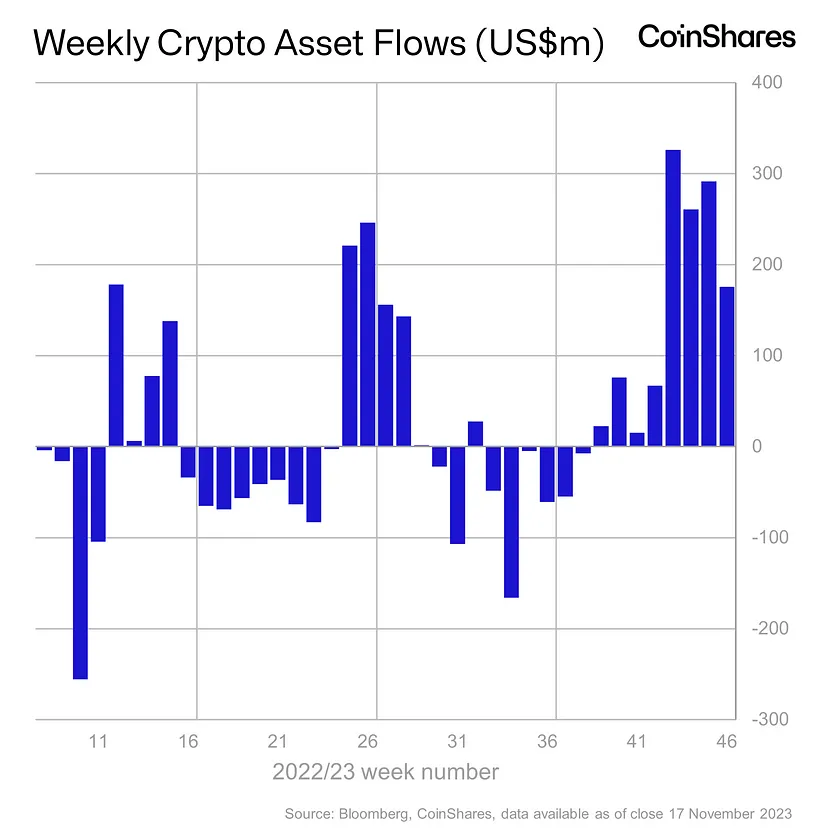

The interest of institutional investors in the crypto world continues without slowing down. Accordingly, the weekly inflow of $176 million has caused excitement in the cryptocurrency market. This indicates consecutive eight-week inflows. It is also an indicator of the optimism of institutional investors towards the cryptocurrency market.

Institutions Flock to Bitcoin and Altcoins

With the influx of institutional investors, the ETP share in the crypto volumes has also increased. Accordingly, it indicated a rise with an average of 11% compared to the long-term historical average of 3.4%. Therefore, it should be noted that this percentage is well above the averages seen in the 2020/21 bull market.

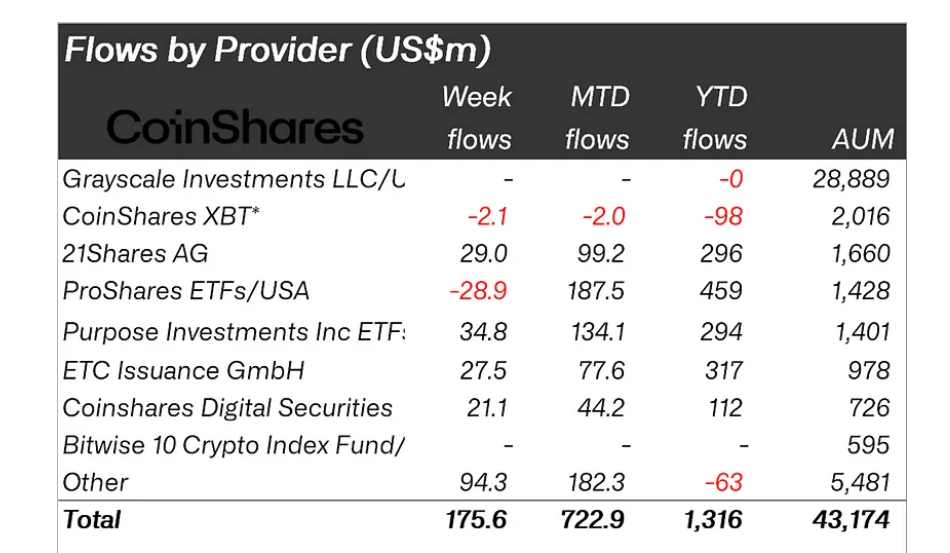

Crypto asset investment products saw a total inflow of $176 million last week, as a continuation of the weekly inflows that have been ongoing for eight weeks. Therefore, the inflows have reached $1.32 billion since the beginning of the year. However, this figure is significantly lower than the $10.7 billion in 2021 and $6.6 billion in 2020. Transaction volumes in ETPs have reached twice the average of this year, which is $3 billion per week, compared to the average of $1.5 billion.

How Did the Flow to Altcoins Shape Up?

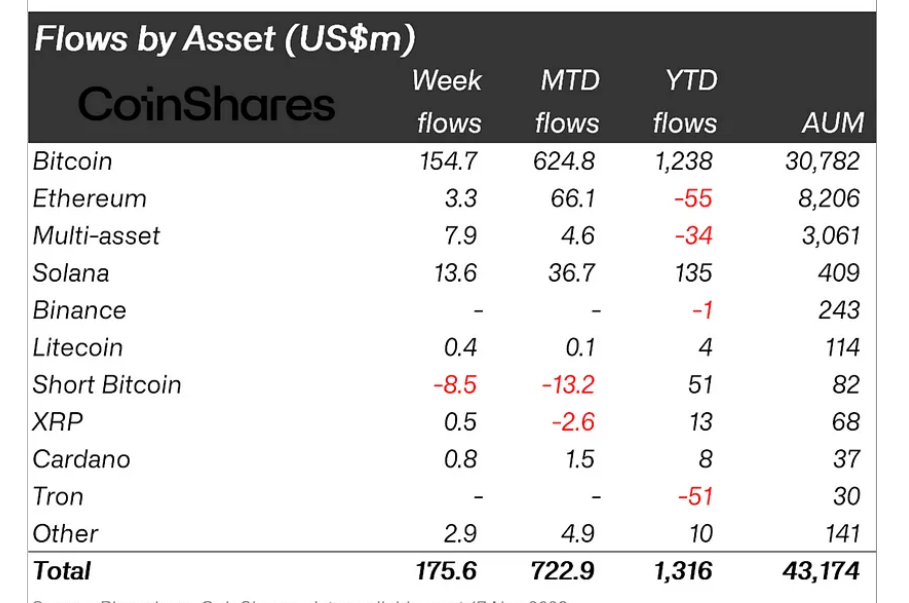

Apart from Bitcoin, there are surprising results in terms of institutional interest in altcoin projects this week. Accordingly, Solana attracted $13.6 million in investments and remained the focus of institutional interest this week, just like the previous week. On the other hand, Ethereum received $3.3 million, and Avalanche, which has seen significant increases in recent days, received institutional inflows of $1.8 million. There are minor outflows in Uniswap and Polygon, with outflows of $550,000 and $860,000, respectively. There are also outflows in the short-focused Bitcoin investment product, with an exit of $8.5 million.

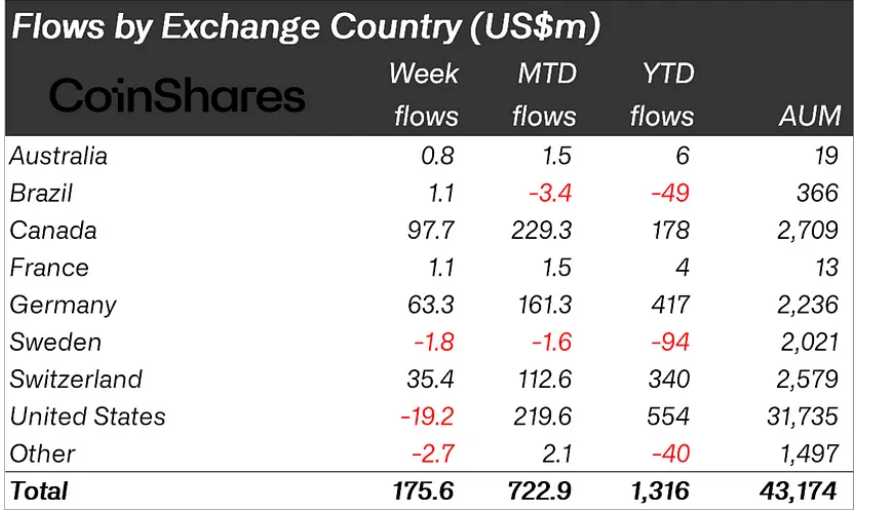

Finally, looking at the regional basis, Canada led the way with institutional inflows of $98 million, followed by Germany with $63 million, and Switzerland with $35 million. On the other hand, there was a total outflow of $19 million from futures-based products in the United States.

Türkçe

Türkçe Español

Español