Avalanche‘s native token, AVAX, is leading a significant rise among Ethereum competitors in the Layer-1 ecosystem. In the past month, blockchain ecosystems considered as rivals to Ethereum have seen gains of over 100% in their native tokens, compared to Ethereum’s 22% increase. According to CoinGecko data, AVAX has risen by approximately 130% in the last 30 days, while Solana’s price increased by 113% and Near’s native token rose by 110%.

Important Steps from Avalanche

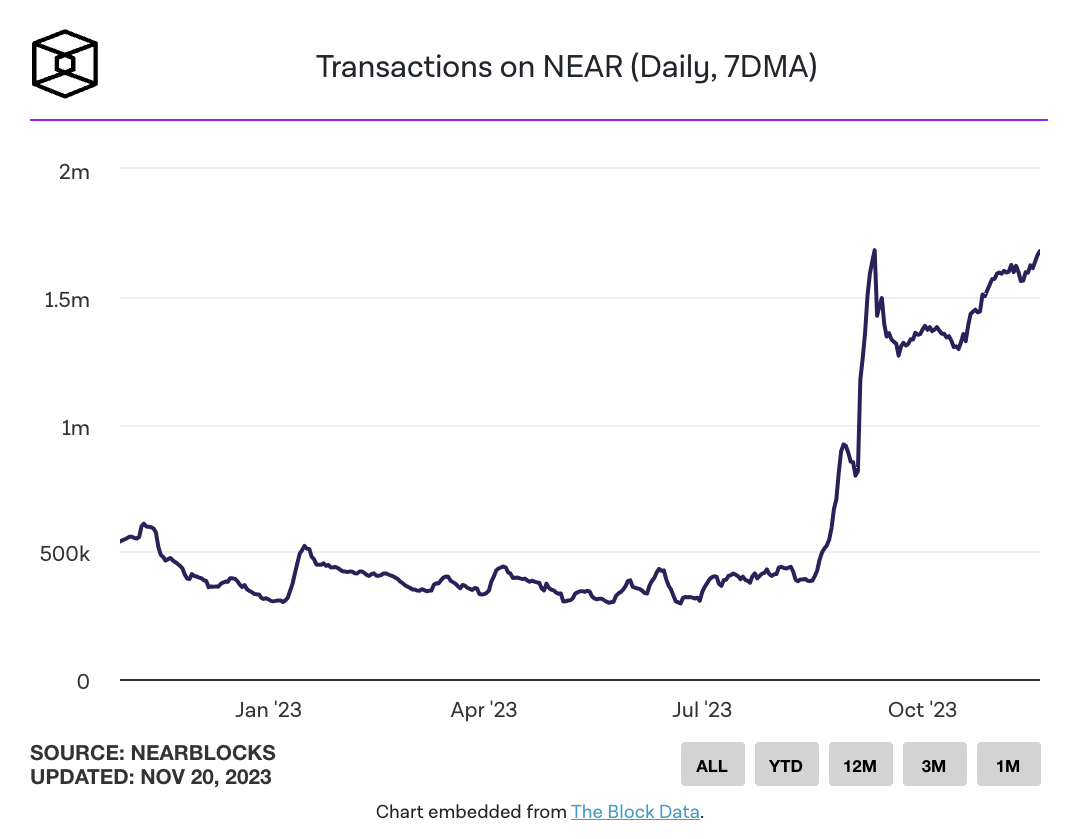

As an example of the increasing activity in these alternative Layer-1 ecosystems, data shows that the Near blockchain ecosystem reached its all-time high daily transaction count of 1.68 million.

Jeff Feng, co-founder of Sei Labs, the infrastructure provider of the Sei blockchain ecosystem, commented on Avalanche:

“The collaborations Avalanche has made with major institutions like JP Morgan and Citi are indicative of the increasing corporate inclination towards high-performance Layer-1 alternatives to Ethereum.”

Last week, JPMorgan’s Onyx Crypto Assets team announced a collaboration with Avalanche for a proof-of-concept mechanism on a blockchain network as part of the Monetary Authority of Singapore’s Project Guardian initiative. Feng commented on the matter:

“In this evolving environment, Avalanche stands out with its high transaction volume and low transaction costs.”

What’s Happening in the AVAX Front?

Feng also added that the benefits provided by the Avalanche ecosystem are expressed through corporate applications ranging from asset tokenization to payment processing, highlighting that these developments underline the financial sector’s active search for scalable blockchain solutions.

Feng also emphasized that the Avalanche network has unique design options and technical developments that efficiently handle high-volume, high-speed trading activities, addressing critical scalability and efficiency challenges in the blockchain sector.

According to data from blockchain data analysis platform CryptoQuant, AVAX’s Relative Strength Index (RSI) dropping into the overbought level indicates an increased likelihood of a trend reversal. The RSI data shows that 75% of AVAX’s price movement in the past two weeks has been upward. Investors buying into the rapid upward trend may have pushed the token to a higher level than what the market conditions would have allowed.

Türkçe

Türkçe Español

Español