Bitcoin tried to reach its highest levels in 18 months on November 21st, as the volatility in the futures market reminded an analyst of past price movements. According to data from TradingView, the momentum in Bitcoin’s price reached as high as $37,770 the day before. At the time of writing, Bitcoin was trading at $37,400, maintaining its position in an interesting territory for the second week of the month.

Key Data on BTC/USDT Pair

For the cryptocurrency market, the first quarter of this year seems more similar to the period when Bitcoin started to rise from its lowest levels after the FTX bankruptcy, according to on-chain data monitoring platform Material Indicators.

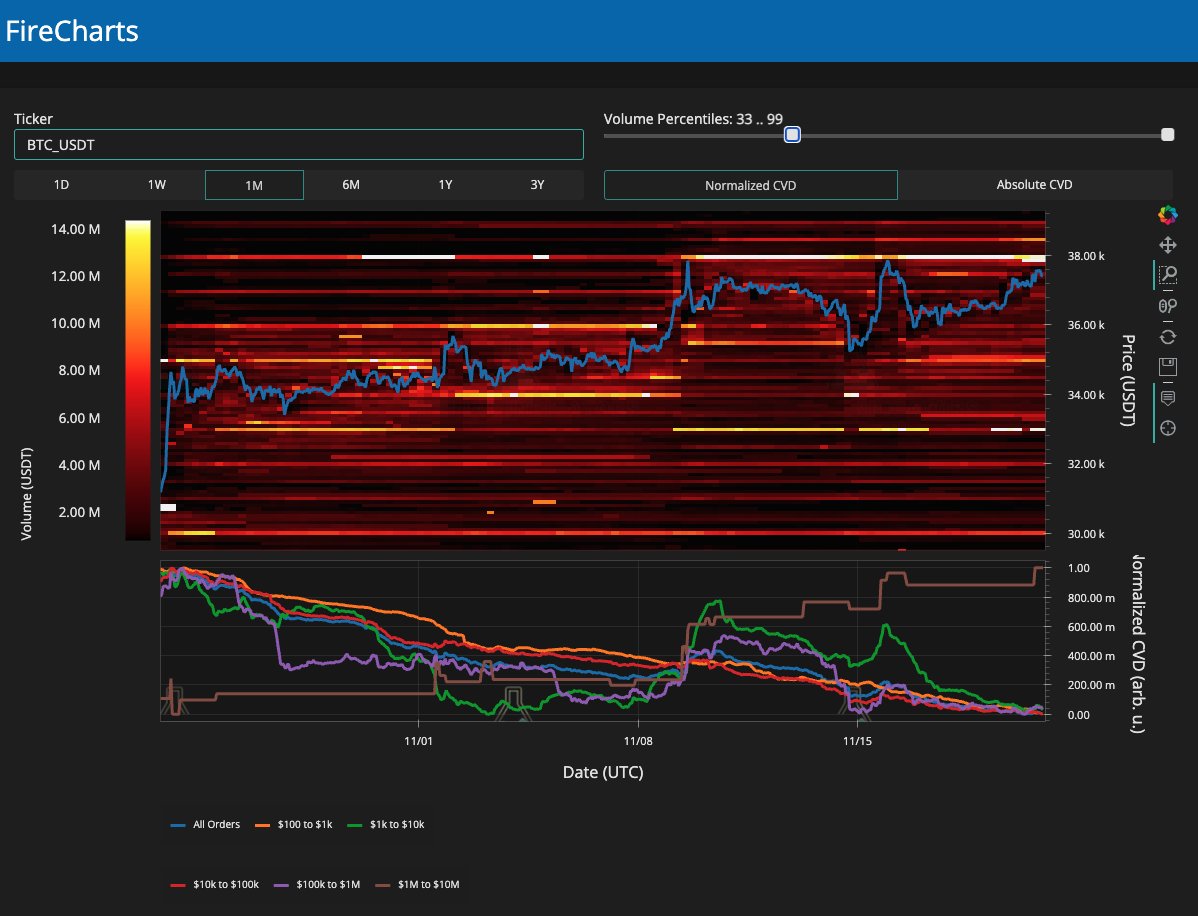

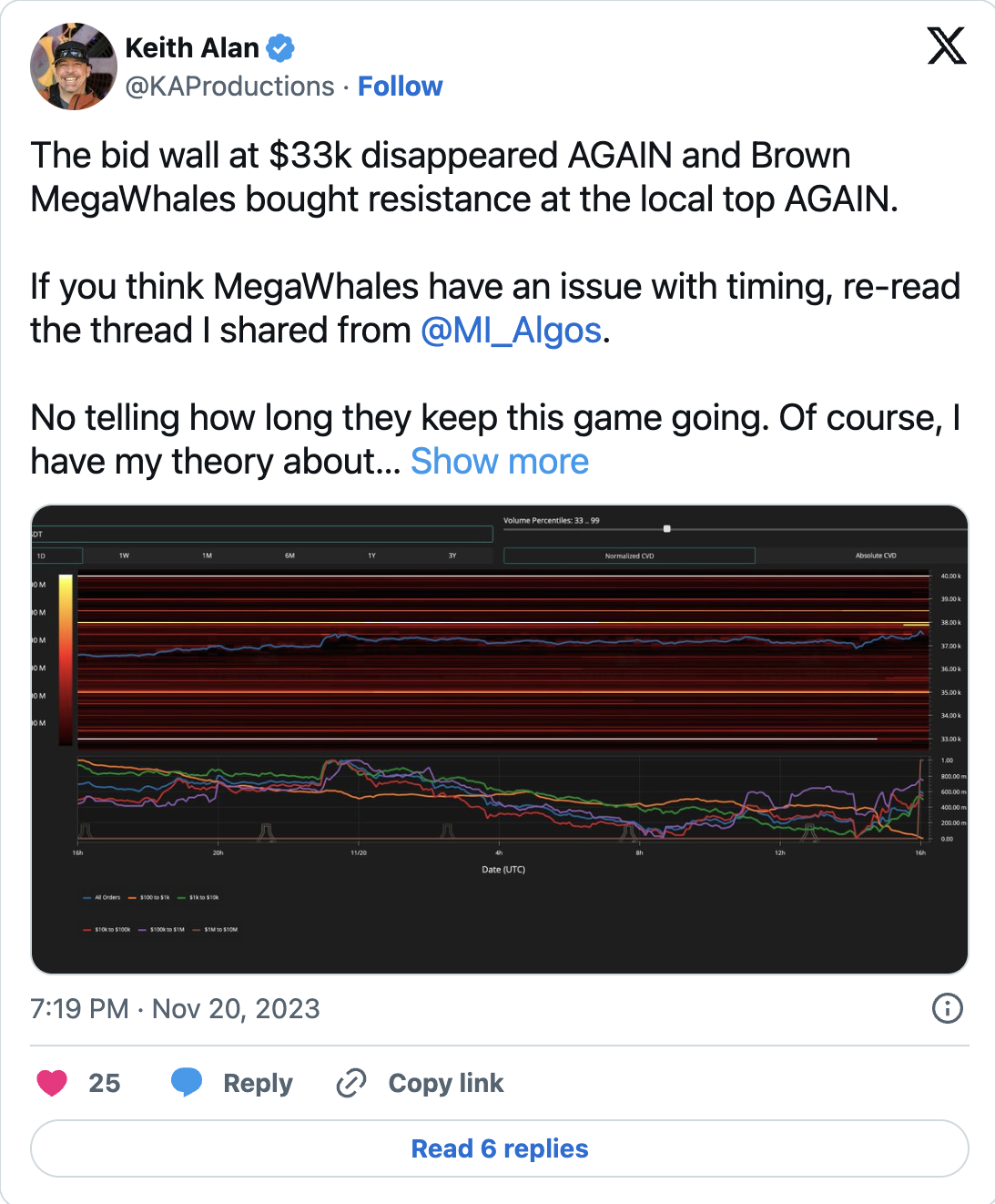

Analysts analyzing the order book data on the BTC/USDT pair pointed out that a major liquidity provider, unofficially referred to as the “Notorious B.I.D.,” may be reshaping its bid support once again. According to a post on Material Indicators’ official page, bid liquidity has reached the $33,000 level seven times in the past 30 days:

“We cannot confirm if this is the same entity we called Notorious B.I.D. in the first quarter, but we have seen this game being played before.”

A data snapshot accompanying the liquidity process on the BTC/USDT pair also reveals that sellers have lined up around the $38,000 level and just below it. The largest order class among whales, the active group with holdings between $1 million and $10 million, stood out in this regard, while other investors reduced their positions throughout the week.

Keith Alan, co-founder of Material Indicators, explained that the assets behind buy orders may be more organized than just large-volume speculators.

Noteworthy BTC Analysis by Popular Analysts

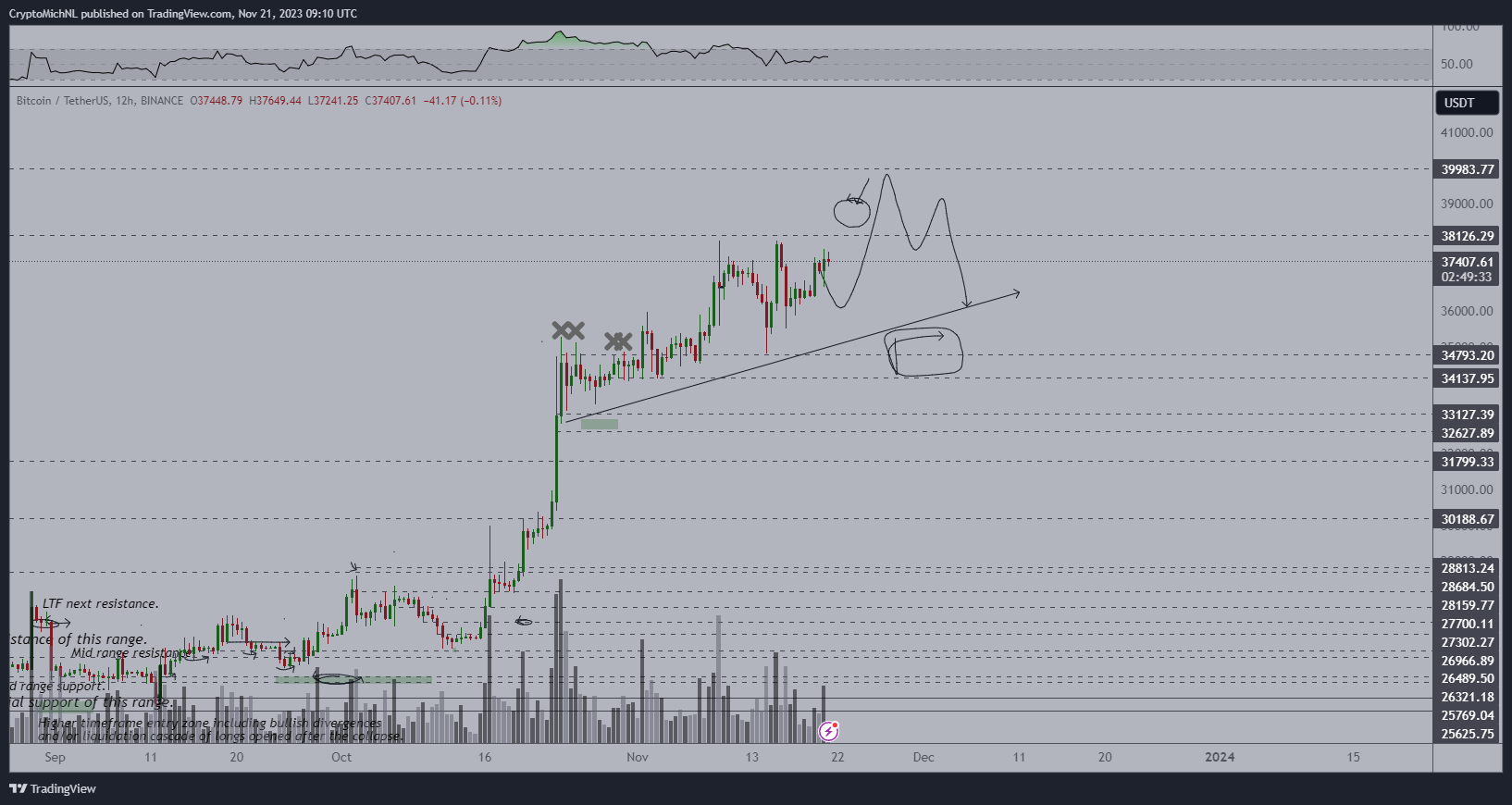

Considering all these developments, Michaël van de Poppe, the founder and CEO of trading firm Eight, pointed to the $40,000 level as the target price in the coming period:

“Bitcoin keeps rising as it rises. It makes higher lows and attacks resistance for the fourth time. A breakthrough towards $40,000 followed by a rapid drop would not be surprising. Keep buying the dips!”

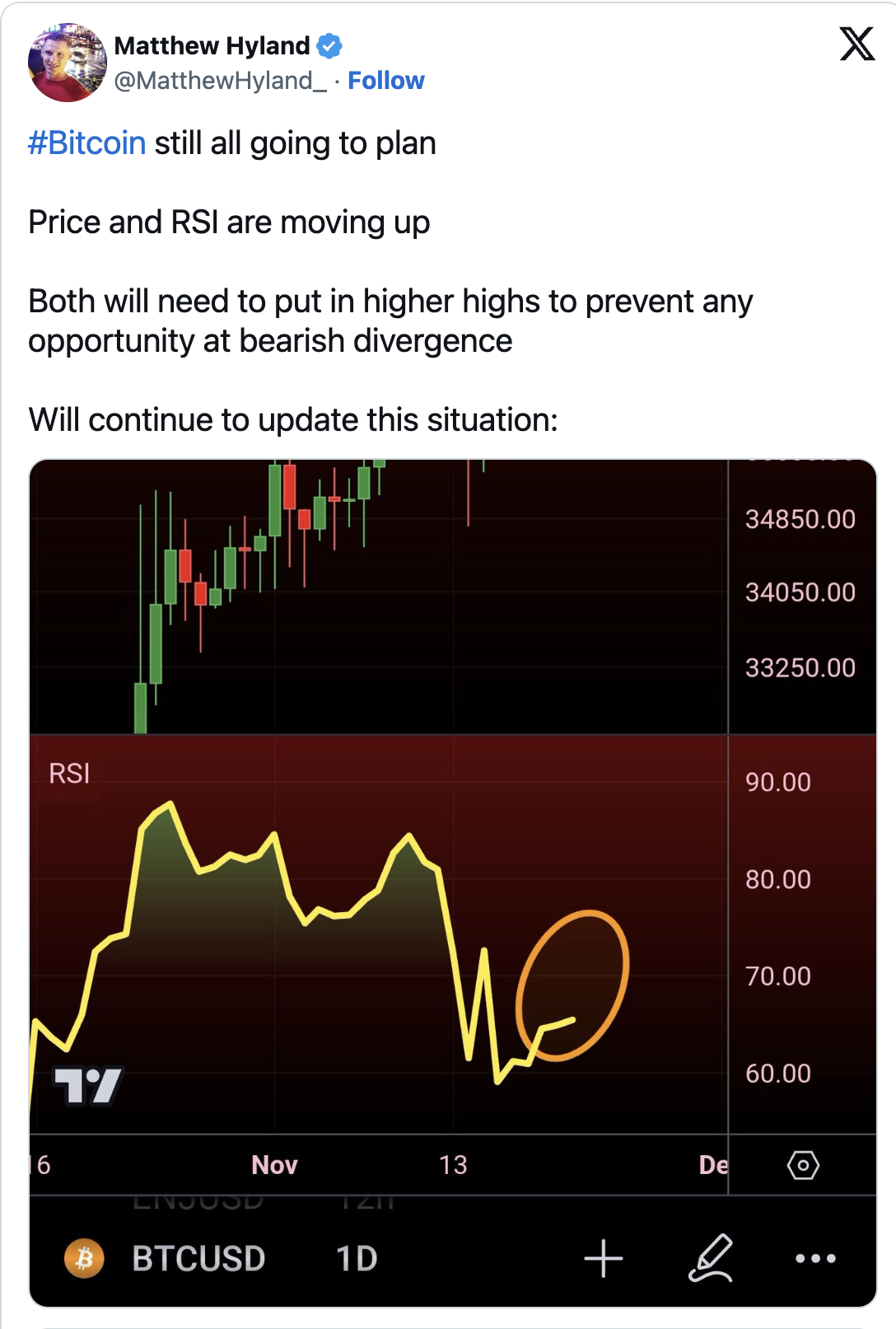

According to popular analyst Matthew Hyland, if the relative strength index (RSI) fails to break the 18-month high levels just below $38,000, there is a risk of a downward trend in price.