Grayscale, the world’s largest digital asset manager, is continuing its efforts to gain approval for a spot Bitcoin ETF. On Tuesday, November 21, Grayscale announced that it has begun discussions with the SEC and signed a Transfer Agency and Service Agreement with BNY Mellon for the spot Bitcoin ETF.

Grayscale and SEC Meeting

A statement from the SEC on November 20 revealed that Grayscale executives, including CEO Michael Sonnenshein, have been in communication with the SEC’s Division of Trading and Markets. The focus of the meeting was the proposed rule change by NYSE Arca, Inc. to list and trade shares of Grayscale Bitcoin Trust (BTC) under NYSE Arca Rule 8.201-E.

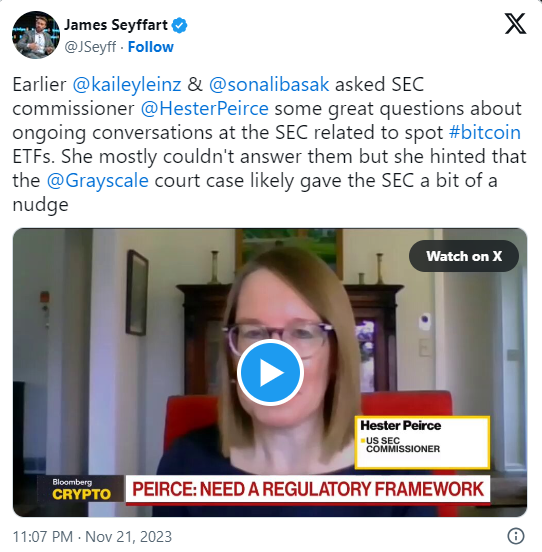

According to Bloomberg ETF analyst James Seyffart, a filing shared in the statement disclosed the signing of a Transfer Agency and Service Agreement with BNY Mellon. BNY Mellon will act as the agent for Grayscale Bitcoin Trust (GBTC), monitoring the issuance and redemption of shares and conducting audits of shareholder accounts.

Seyffart stated in a Twitter post on November 21 that the Division of Trading and Markets is responsible for approving or denying Form 19b-4s.

He also added that the agreement with BNY Mellon likely came as a result of a requirement and does not indicate an imminent conversion of GBTC. The meeting with the SEC took place within a week of the securities regulator further delaying its decision on a spot Bitcoin ETF, which did not go unnoticed.

When Will the Bitcoin ETF Arrive?

James Seyffart, along with Eric Balchunas, commented on the recent events and stated that despite the ongoing investigations, the probabilities have not changed and the 90% likelihood remains until January 10.

SEC Commissioner Hester Pierce, a prominent figure in the world of cryptocurrencies, also shared her thoughts on future developments. Speaking with Bloomberg TV reporter Sonali Basak, Pierce said:

There is no reason for us to stand in the way of a Bitcoin ETF.

She added that Grayscale’s victory in converting their GBTC product to a spot Bitcoin ETF has made them optimistic about the future. However, she refrained from commenting on whether the SEC intends to approve all Bitcoin ETF applications simultaneously.

According to ETF Store President Nate Geraci, when combined with a strategy focused on competing on fees, this could position Grayscale for dominance.

Türkçe

Türkçe Español

Español